27 March 2012

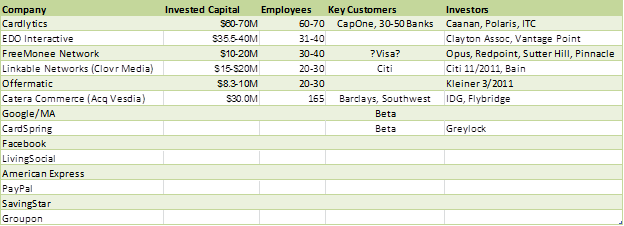

We see in the press that Google/MA have gone beta with Card Linked Offers, and Bank of America is about to go live with “BankAmeriDeals”. I last gave an overview of this space back in November in my Card Linked Offers post. For those that haven’t seen it, there is also a must read blog by Reed Hoffman in Forbes on the subject: The Card is the new App Platform.

Here is my blog from 3+ yrs ago – Googlization of Financial Services – outlining data flow. My purpose is mentioning this blog is not to show how smart I am (as an alternate view is already firmly established), but rather to highlight how much my view on the opportunity has changed over the last 3.5 years. As I tell all of the 12 start ups in the CLO space.. if Visa couldn’t get this to work what makes you think that it will be easy for anyone else.

There is a CORE business problem I didn’t realize back then.. merchants don’t like cards and are VERY reluctant to create ANY unique content (offers) where card redemption is REQUIRED. Further constraining the “capabilities” of CLO is lack of item detail information within the purchase transaction. IBM is the POS for 80% of the worlds to 30 retailers. Take a look at the 4690 overview here, notice what incentive solution is integrated? This was a 5 yr project for Zavers…

A story to illustrate my point on retailer reluctance. As most of you know POS manufactures like IBM, Micros, NCR, Aloha are implementing POS integration solutions similar to what Zavers has done. Most of the CLO companies above are paying the POS manufactures to write an “adapter” that will work within their POS and communicate basket detail information. (ISIS is rumored to have a 200 page Spec for this POS integration as well). There is a very big difference between having integration capability, and a RETAILERS agreeing to use it (ie share data). There must be a business value proposition for retailers to move… and I can tell you with a great deal of certainty.. Retailers don’t like the BANK card platform.

I emphasize BANK for a reason.. I was with the CMOs of 3 large retailers a few months ago. When asked what their payment preferences where, they answered without hesitation: Store Card. This is their most profitable product used by their most loyal customers (think private label). Do you think for a moment that a Retailer would deliver “incentives” to customers that are not in this group.. Remember, these PVL loyal customers also hold a number of other bank cards, and there is not much in the way of customer matching between data sets. I think you get my point.

As I stated previously, all offers businesses are highly dependent on targeting. Targeting is dependent on customer data, relevant content, effective distribution (SMS, e-mail, an App), campaign management (A/B testing, offer type, target audience, …). Campaign management is very dependent on feedback. There are very few companies that can effectively TARGET and DISTRIBUTE. The current group of CLOs is partnering with the banks to solve the targeting problem (example Catera/Citi, Cardlytics/BAC, …). This is further EXASERBATING the poor Retail adoption. Why? Here is what a CMO told me:

“Tom, lets say a consumer just shops at Nordstrom.. the card network and bank see that I just completed the transaction and now market to them … the advert is “go to Macy’s and save 20% on your next purchase”… Given that they can only offer basket level incentives this is how it must work… Tom do you know what will happen? The customer will return what they just bought and go to Macy’s and get it. How is this good for Retail?”

From an Ad Targeting/Distribution perspective, Mobile Operators certainly have an eye on this ball (mobile phone). But only a few companies like Placecast can actually deliver it for them. MNOs are truly messed up in this marketing space (within the US). If you had the CEOs of Verizon, ATT and ISIS in a room and asked “who owns mobile advertising”?.. ISIS would say nothing if both of the other CEOs were in the room.. They want it.. but no one will give it to them as they can’t execute with what they have in this space. Verizon would say “many partners”… Their preference would be to sell the platform akin to their $550M search sale to Microsoft in 2009. So VZ wants a $1B+ Ad platform sale… who would compete for that business? I digress.. but what is in place today looks much more like a rev share… Internationally there are carriers with their act together: Telefonica and SingTel (just bought Admobi).

Let me end this CLO diatribe with a customer experience view. Let’s assume I have 12 CLO players.. each partnered with a different bank/network. Also assume that all are heavily dependent on e-mail distribution. I have 6 different cards.. and will be getting at least 6 e-mails per week with basket level discounts. Now assuming that I can keep track of which offer was tied to which card.. and use the card. I’m still left at the POS with a receipt that shows none of these basket level discounts (as they are “credited” to my account after purchase).

Without POS integration AND Retail data sharing this will not work.. the customer experience is terrible, as is the campaign’s restriction on basket level discounts. The ubiquity of cards is attractive.. as is bank data on Consumer “Store preferences”…. But both work to the detriment of retailers. What consumers will see in CLO for some time is the generic 10-20% off your next purchase that will also be available in direct mail campaigns… Let’s just hope that someone can work the double redemption problem…

My read on this for Google is a little different. Google is positioning itself as a neutral platform.. it can do Retailer Friendly.. Bank Friendly… MNO Friendly.. Manufacturer Friendly… Each will have different adoption dynamics. Google’s objectives are likely: gain insight, be the central platform for marketing spend, be the most effective distributor of content, … . This offer beta would certainly seem to be a “bone” thrown to banks.. hey… here it is … good luck trying to make it work.

Tom,

You make some excellent points here, particularly from the retailers’ point of view. My only question is, are you comparing CLO to what is out there, or what is possible? When compared with existing offer channels like newspaper circulars and Valupak for paper coupons, or Groupon and LivingSocial for e-coupons, CLO seems to be far and away the better deal, because far less money is given away to people who (a) might have bought the product anyway or (b) are now being educated to wait for the coupon.

Of course a retailer would prefer you use their store card, for any number of reasons. However, from a consumer point of view, you generally want to concentrate your spending on one card to maximize rewards. So retailers don’t really have the option to ignore CLO, because there will always be a percentage of customers who don’t want store cards. In any case, there’s nothing stopping the retailer from doing their own CLOs, based on their own transaction history.

Distribution will be a problem until the market consolidates, but this is nothing new. Even then, I expect we will have a mixed environment of retailer-oriented, bank-oriented, and third-party offer networks, just as we do today. No sector has the power to dominate.

Great dialog Aaron. One key issue w/ CLO is basket only incentives. 20% off your next purchase of x or more. CLO companies cannot deliver item level incentives (90% of the time). There will be a few exceptions, for example Bank AmeriDeals is using SavingStar in Grocery… so you will be given item level credit in 1-15 days after purchase in grocery (great customer experience huh?).

Stores do not like giving basket level incentives.. it is not effective marketing spend for them.. PARTICULARLY if they are not the ones directing the targeting. Retailers are absolutely ignoring Card Linked Offers.. sure there is some experimentation.. but the results are very sub par. Direct Mail is better…

I agree we will have a mix for some time…. I give the lowest probability of success to anything bank friendly (offers are triggered by shopping with another store). I give the highest probability of success to anything retailer friendly.

Tom,

Can you explain why, if stores don’t like giving basket level incentives, they appear to do it all the time? For example, how is a basket-level incentive any different from a coupon offering 20% off your next purchase, which I get via e-mail and snail mail all the time, especially around Christmas? It seems that the goal is to get me in the store, which a CLO could do just as well, and targeted towards people who shop at my competitor.

As for the results of CLO, at the NRF show, Cardlytics released some statistics that seemed fairly impressive to my untrained eye (http://www.cardlytics.com/News/Press/JanuaryPerformanceRelease.aspx). Is there some way they’re twisting the results that I can’t detect? I admit my expertise is in payments, not retail marketing.

If any retailers want to jump in here, that would be great; I’ll pass the link along to my Retail Insights colleagues, and see if they care to comment.

Aaron, thanks for the thoughtful question. I would also love to hear an answer directly from a retailer. I’m going to be intentionally obtuse here (not talking about solution), but rather about the business problem.

1) Discounts are a tool in an overall price promotion strategy. For you, how many basket level discounts drove you to a store last year? For me there were three: Office Depot, Dicks Sporting Goods and CVS. All three of these have rich loyalty programs. In this model discounts work as an incentive within the loyalty program to generate a visit and increase basket size. They are highly targeted. Discounts also work in a customer acquisition model (the Macy’s/Norstrom example above). Overall the margin in retail is very, very low. Globally, across categories, gross margin has gone from 4.2% in 2006 to 2.4% in 2010. Given this margin compression, and the fact that retailers spend very little of their own money on marketing, you can see why basket discounts are not widely used, but rather targeted. There are exceptions: jewelry, furniture, apparel, … But never in electronics

2) The Cardlytics press release is carefully worded. A) 20-50x of other channels.. this is translated basket level discounts offered in other channels. This is NOT comparing incentive types (Pre-paid offers, item coupons, loyalty programs, …). My first hand experience shows that the cost performance of CLO is very poor related to other incentive programs. That said, it does well in certain areas like new customer acquisition. But this is where existing market leaders are “flipping out” at the prospect of banks using a customer transaction to deliver an incentive. It is a long term Faustian bargain. Cardlytics B) The Bank of America AmeriDeals is an interesting example.. their goal is to create a new form of merchant funded rewards behind debit card (now that Durbin killed the interchange). This is a great strategy by BAC…. it assets are consumers, data, cards and distribution. Problem is that there is substantial conflict in reach (customer sets) and targeting. CardSpring seems to be taking an approach to let the retailers target across cards.. but this only addresses part of the problem.

Pingback: Offermatic: Is offermatic dead? - Quora

Pingback: Groupon Cash Register? « FinVentures

Pingback: BAC – Offers Success? « FinVentures

Tom, you have CardSpring listed in your Excel spreadsheet, but you don’t discuss them here. I think they are solving a lot of the problems that you highlight with Cardlytics and others, what is your take on them? Also, what is your take on Swipely?

CardSpring is another animal…. a retailer/acquirer friendly shop. The primary issue I see is that consumers must first register their card as an offer vehicle with the merchant (or the FirstData service). I would like to hear a success story here. The top 20 retailers are not moving this direction… is it getting traction with the smaller retailers?

If I were a small retailer, why would I do this vs create my own loyalty program? Why cardspring vs. Square’s new register?

Pingback: Battle of the Cloud – Part 2 « FinVentures

Pingback: 2013: Payment Predictions « FinVentures

Pingback: CLOs where is your content? « FinVentures

Pingback: Private Label.. “New” Competitive Environment? | FinVentures

Pingback: Other Drivers of Debit Consolidation | FinVentures

Pingback: Payment News for May.. What a Month! | FinVentures

Pingback: Tokens: Merchant Options | FinVentures

Pingback: Perfect Authentication… A Nightmare? | FinVentures

Pingback: Payments - June 2015 Current State/Updates - Starpoint Blog - Finventures

Pingback: Transformation of Commercial Networks: Unlocking $2T in Value – Noyes Payments Blog