AT&T, Verizon, T-Mobile, .. create NewCo to deliver mobile payments w/ Discover

2 August 2010

In press today – Bloomberg Today – AT&T and Sprint to create prepaid venture

Previous Posts

Mainstream press has added a few additional details to what we outlined back in November. The biggest surprise to me is that Discover is the network partner (quite frankly I assumed it was Visa). Discover is an interesting partner, given its capabilities (issuer and acquirer) and reveals much about the mobile network operator (MNO) plans to bring a merchant friendly (lower interchange) strategy to market. It appears that First Data is in this alliance as well acting as the trusted service manager (TSM). NewCo represents a major investment (rumors are that the major operators are investing north of $200M) and may start a new venture wave in the valley as NewCo positions itself to be the “Google” of mobile advertising.

Don’t think about NewCo as a card business, think about this as the next Google and payments are the KEY that ties together the mobile, virtual and physical world. As I discussed in March:

Q: What will it mean when every AT&T subscriber receives a pre-paid Discover card with an NFC sticker?

Answers

- Tipping point for mobile commerce, ushering in a new era where the mobile phone can transact with a wallet that spans the virtual and physical world, aggregating every other account type and payment instrument.

- A new business for AT&T which could drive 30-60% growth in LT revenue

- Software REVOLUION. The “Next wave” for iPhone AND the entire mobile commerce ecosystem (see googlization)

- New mainstream marketing channel as couponing integrates with payment, location awareness and detailed knowledge consumer behavior/preferences

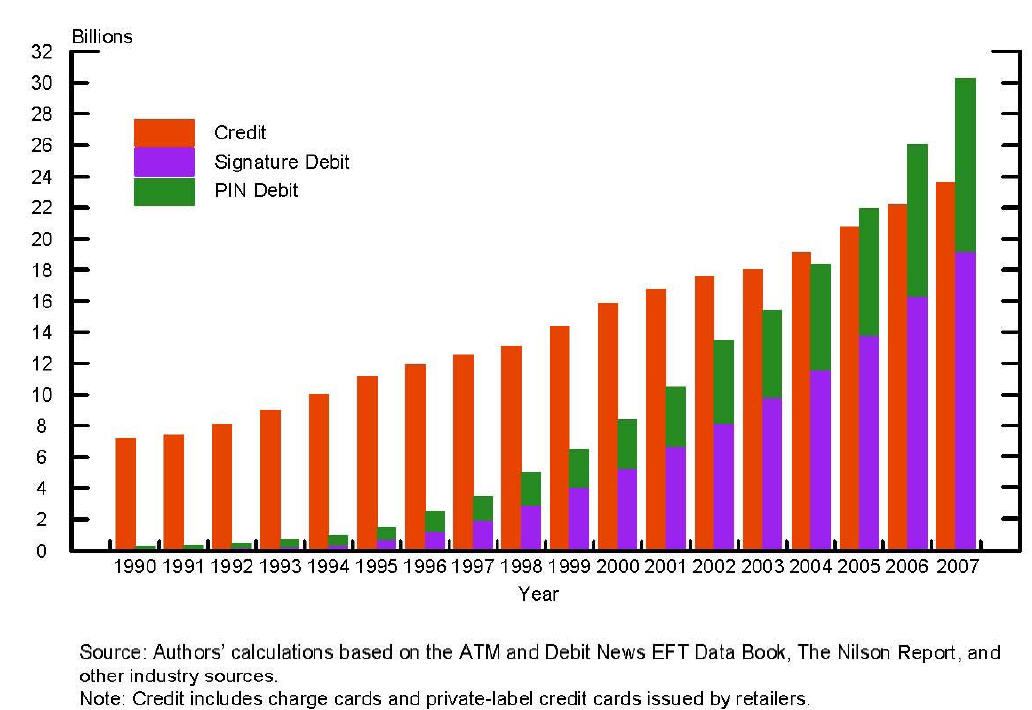

- Card business killer for Bank/Issuer revenue as MNO Pre-paid encroaches on the consumer relationship AND issuer debit/credit products (Decoupled Debit)

- Cash replacement for small value payments as merchants of all types adapt POS to accept NFC, and small merchants take out POS terminals in favor of making their phone a cash register

- .. would love to hear from you on the next 100…

There are at least 3 major elements to this announcement which warrant further discussion, as impact on the venture and payment community will be significant:

– NewCo business model: It’s all about marketing and control

– Payments shift from banks, Visa, and MA

– Mobile payment value proposition. Can NewCo make this work for consumers and merchants?

Business Model

The AT&T Universal card changed the credit card landscape in 1990. AT&T demonstrated it could both create a card business AND leverage distribution muscle as it attracted over 10M card holders in under 2 years. Citi acquired the AT&T Universal card for $3.5B+ in 1997 and it remains the largest affiliate card in Citibank’s portfolio.

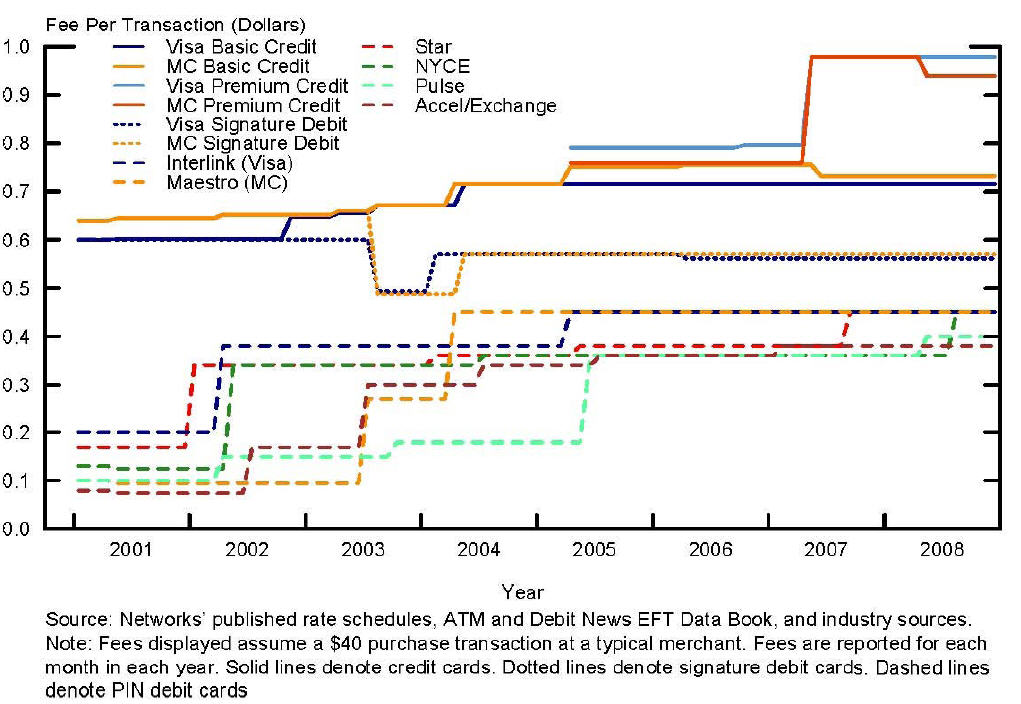

As I wrote back in November, The US market is ripe for a break from the 6 party political “fur ball” that is hampering delivery of mobile payment (Card Issuers, Acquirers, Network, Merchant, MNOs, Handset Mfg). For those outside the US, MNOs have substantial control over handset features and applications, and have been leveraging this “node control” to “influence” direction of payments. The central US MNO argument being: “it is our customer, our handset, our network we should get a cut of the transaction rev”. Unfortunately existing inter-bank mobile transfers/ payments are settled through existing payment networks that provide limited flexibility in accommodating a “new” MNO role and the network rules leave much room for improvement in: authorization, authentication and consumer “control”. The Discover partnership would appear to offer NewCo the opportunity to define new rules, rates and incentives for consumers and merchants to participate.

The key to unlocking this new business model is not interchange, but creating a new market for mobile advertising, NewCo will be to mobile advertising what Google was to online. For example, rumors are NewCo is attempting to consolidate $1-5B+ in Madison Avenue marketing spend in first year (See consumer scenario here). The MNOs are brilliant! Their collaborative efforts here are a severe threat to both banks and established payment networks. Widespread adoption of NFC will revolutionize consumer payments and may result in the next boom cycle for silicone valley. Make no mistake, NewCo will be the leader of the next great ecosystem.

More tomorrow.