31 January 2012

http://www.mastercard.us/mchip-emv.html

Yesterday MA followed lead and announced plans to support US rollout of EMV. Many of you are probably wondering what this all means in light of mandates and deadlines. The politics and business drivers behind this push are quite complex, but it is important to note that neither large US issuers nor retailers are enthused about this push for one primary reason: there is no business case for the change (on either side). Historically, networks do not change without sound financial incentives ( or there is some sort of regulatory mandate).

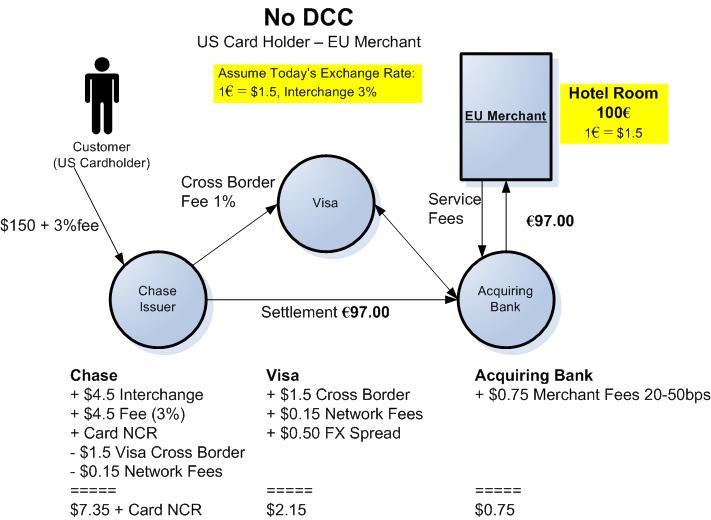

A Bank makes money by managing risk. Within the payments space large banks have invested billions of dollars in custom fraud infrastructure. The effect (if not the goal) of bank investment in custom fraud infrastructure is to push fraud into the weakest link (or bank) in the network. Smaller banks must seek partners like FIS, FirstData and the Networks to help them keep up. The EMV standard is used by card issuers in just about every market globally, except the US. EMV is effective in addressing certain kinds of fraud such as counterfeit and skimming. Within an EMV environment, international issuers and acquires thus could relax in maintaining related fraud controls IF cards existing in an EMV only environment. However international travelers to the US and US travelers abroad lead to fraud “leakage”. US issuers did not suffer, due to their fraud infrastructure, but the other banks have.

Thus the “true” benefits of EMV cannot occur until there is 100% adoption at POS (10M in US), complete elimination of the mag stripe in the plastic that we all carry (approximately 1.5 billion in US). This is the conundrum facing any new technology here: New Plastic must completely replace the old. In other words there is no “Incremental” fraud savings to an incremental rollout, nor is there a business case for either issuer or retailer to implement. Take this on top of the fact the EMV is 20 year old technology and we have a very challenging environment.

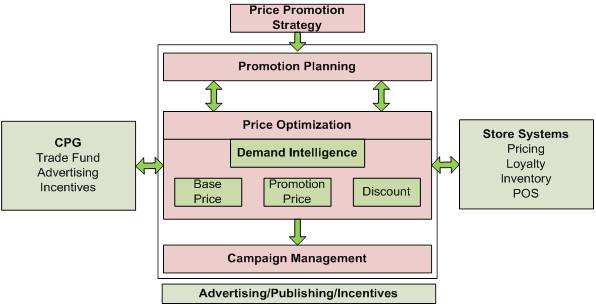

What are the benefits in retail? Both Visa and MA have established a carrot and stick approach. Given only the issuer can reduce interchange, the carrot is reduced PCI compliance costs and some terminal subsidy. The stick is a liability shift for to the merchant if a consumer presents an EMV capable card and the merchant terminal does not accept it. Given that the big issuers have no plans to reissue cards, the merchant risk is fraudulent EMV cards (starting in Oct 2015 for Visa). Perhaps if retailers see an EMV card, they should request an ID. For issuers, the compliance dates are longer and the stick which Visa and MA have constructed is weaker given that US issuers already bear costs of card present fraud.

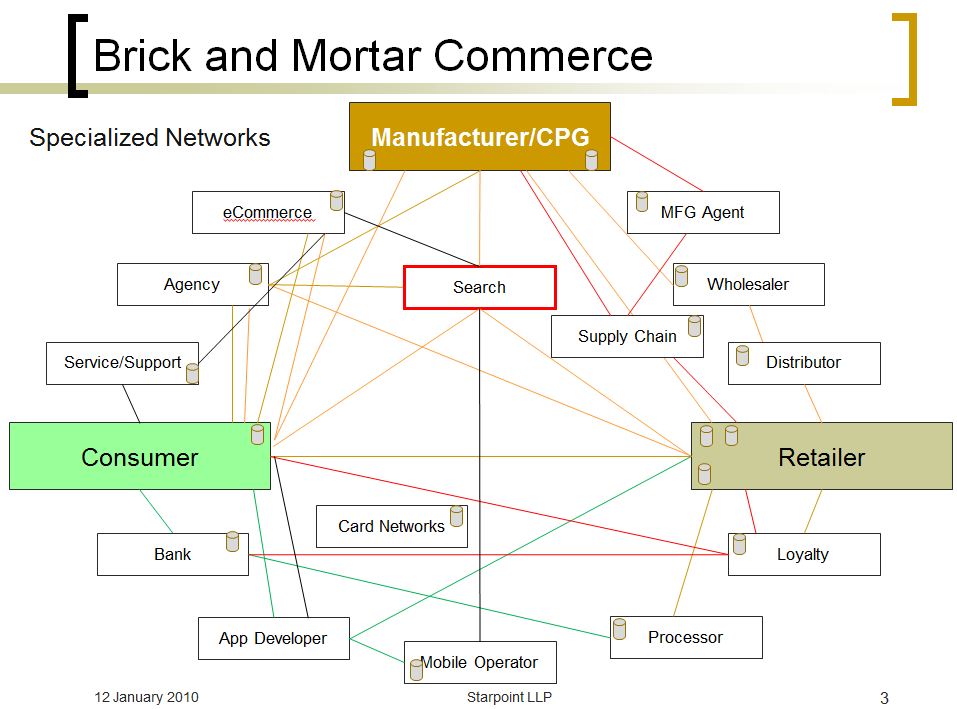

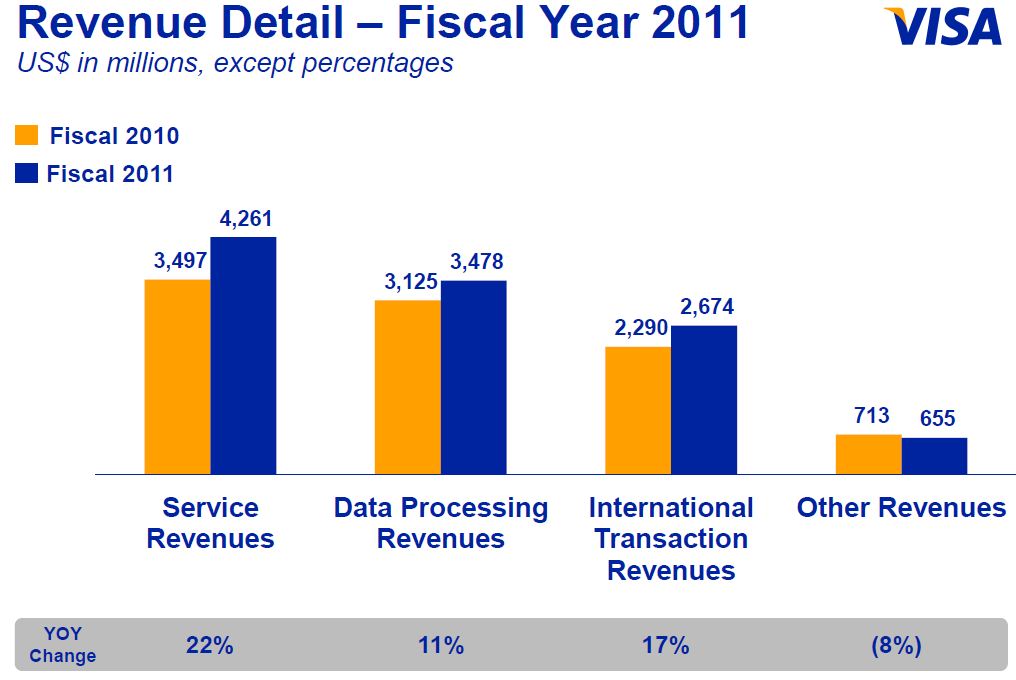

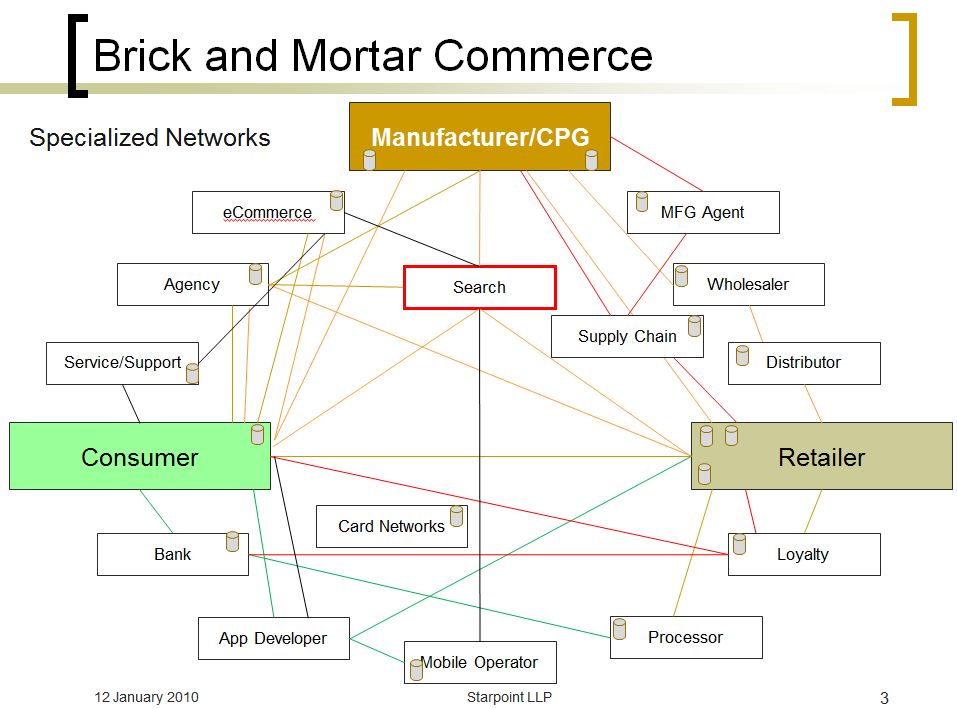

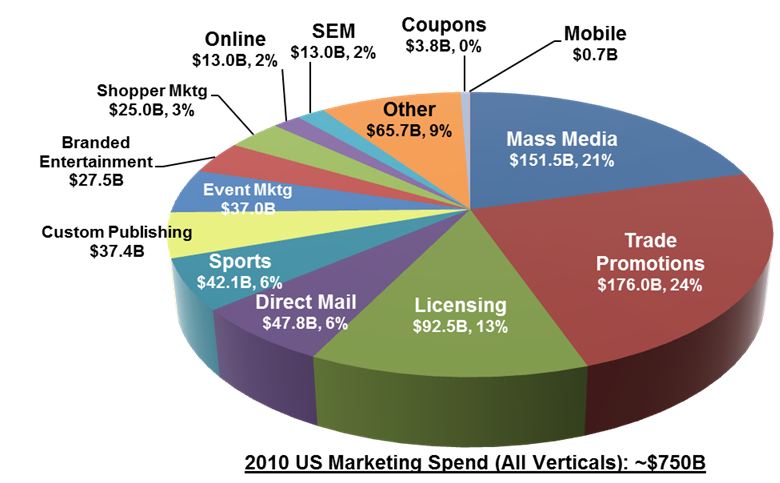

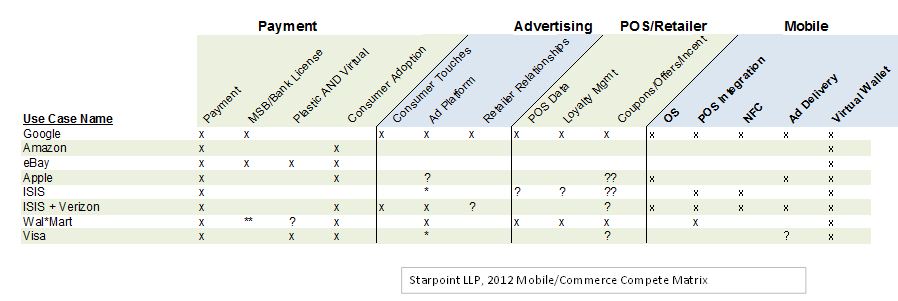

So what are Visa and Mastercard trying to accomplish? From a political standpoint they must address the international issuer concerns and be viewed as supportive of the EMV standard. But more importantly Visa and MA want to cement their control of the network, particularly in two areas: mobile and US debit cards. In mobile, Visa and Mastercard are aggressively trying to make mobile POS payments a “premium” service used exclusively by credit cards. A key to success in mobile is POS readiness to support contactless payment. The EMV mandate certainly helps provide another incentive to merchants. With respect to the Debit, the Durbin Amendment has impacted the incentives for US banks to continue support of Signature Debit. In the US, PIN Debit enjoys a slightly higher growth rate (15.6% vs 14.3%), consumer preference (48% vs 34%), lower fraud rate (2009: Signature $1.12B, $181M PIN debit card), and obvious merchant preferences (96% of PIN fraud losses assumed by issuers, vs 56% in Signature). PIN debit transactions do not need to be routed through Visa and MA, and PIN only cards do not require their logo. EMV debit cards may be a tool for Visa to maintain a US debit business (MA US debit penetration is low).

What to expect?

Note that in virtually every geography, EMV was a regulatory driven initiative. In the US this is not the case, as the large banks have proven capable of managing fraud. Large issuers are thus reluctant to undertake any mass reissuance of cards, and US regulators are reluctant to have US Banks pay for a system that will primarily benefit issuers outside of the US. My guess is that we will start to see a trickle of new cards being issued on EMV starting in 2014 or so.

Retailers will have a similar adoption dynamic as they assess cards being used at their stores, and what future payment networks may offer not only in terms of compliance and interchange, but also in delivering customers through incentives and advertising. I’m certain that the retail “first movers” in NFC must be pulling their hair out as they discover that their new NFC payment terminals are not equipped to accept the mandated EMV card. These retail CEOs will discover that the “stutter” in reterminalization was intentional and it will be a cost they will bear twice in 2 years.

In this dynamic environment, there will be high demand for companies that can help retailers develop a plan and navigate this chaotic environment. Oddly enough, start ups like Square and Payfone may have a tremendous advantage in simplifying the checkout process. In other words, EMV could actually provide the impetus for new payment networks to gain a foothold.