23 June 2012

From the Window’s Team Blog

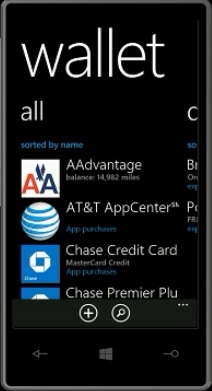

Wallet: Windows Phone 8’s new digital Wallet feature does two great things. It can keep debit and credit cards, coupons, boarding passes, and other important info right at your fingertips. And when paired with a secure SIM from your carrier, you can also pay for things with a tap of your phone at compatible checkout counters.

From PC Magazine

Microsoft is taking a somewhat unusual approach to a digital wallet by introducing a Wallet hub app and APIs that let third-party developers build applications to process transactions. What makes this so unusual is its use of “Secure SIM” cards.

Microsoft has some very interesting assets and experience (see Wikipedia on wallet, passport, liveID).

- Microsoft has 3 POS systems (see overview) with Dynamics as their “go to”.

- Passport “experience”

- Phone OS

- Developers (will leverage core Win 8)

- Cash to compete

- Skype

- aQuantive (digital advertising)

- MSN Money

- Global sales/distribution

- Patents

MSFT Hurdles (Wallet focus)

- No phone OS adoption

- Brand

- Consumer Demographics of Phone 8 buyer

- No “killer” apps/capability compared to Android/IOS

- Minimal credit cards stored w/ LiveID

- Current phone “app” footprint

- Handset manufacturer commitment (See HTC article)

- Time for Nokia to support

- How on earth are they going to Sync a card in the NFC SWP SIM with the Wallet Hub?

- US MNO Support

- Time to complete large scale pilot

- Subscale digital Advertising platform

Why announce at the developers summit? My guess is it has to do more with MSFT’s desire to turn on a developer community for the digital goods. MSFT is in control of the platform here, while the POS and NFC is far in the future. So this announcement is really aimed at competing with Apple’s Passbook in areas such as in app billing and mcommerce purchases.

I will be very impressed if MSFT can get 100k handsets active w/ Orange, and over 20k a month using NFC in a SWP SIM.

MSFT.. are you doing something unique this time? My recommendation: build a Platform team that crosses your organization. Task them to build end-end reference architecture(s) from phone to POS from mobile advertising to redemption, … etc. Then give it away… Take a look at what Square Register has done and reinvent the POS experience. Be original.. again.