16 Sept 2012

Quote of the week

It’s not clear that NFC is the solution to any current problem…

Apple Senior VP Marketing – Phil Schiller

A few months ago I was in Hong Kong speaking with institutional investors at CLSA’s annual event. One of my more memorable meetings was with James, a chief investment officer with a top 5 investment bank. The heart of the discussion was on the future of telecom. Although I’m not a telecom expert, James was interested in finding “the next killer app” in mobile. Was NFC it?

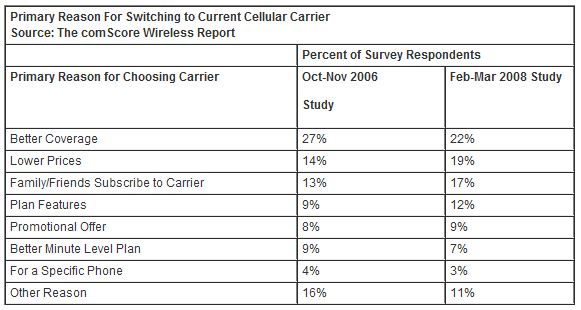

His investment thesis was that phones are starting to become commodities: screens, LTE connectivity, cameras, battery life, applications, …etc are all reaching a point of good enough. His time with me was spent drilling down into payments and NFC in order to see if I had any new data which would alter his view. I did not….

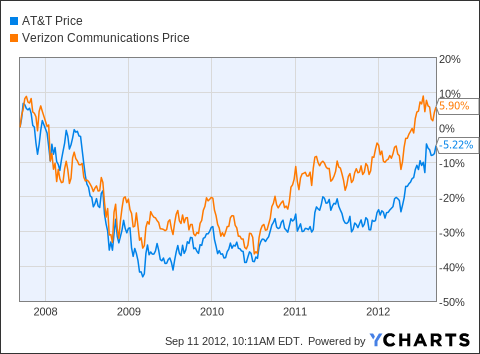

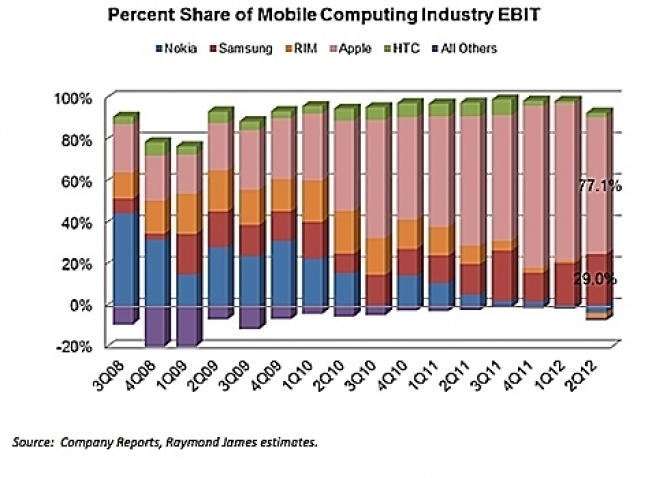

What will happen in a world where handset hardware is no longer the basis for competition? The same thing which occurs to any manufacturing area where a “good” becomes a “commodity”: margins compress for the commodity and migrate to the new area which is basis for differentiation/competition. Yesterday I outlined the implications, and investment opportunities, for the mobile operators.

This week we saw the launch of the iPhone 5.. better, brighter, bigger, lighter, clearer, faster, lasts longer, crisper, sturdier, takes better pictures, more tightly integrated to applications that Apple controls, …etc. A great new product. An Evolution… not a revolution. What Apple understands better than almost any consumer product company is: consumer experience matters. While some handsets already exceed those of Apple’s iPhone in feature/function (Samsung’s Galaxy S III)… none can match it on consumer experience. Experience is where Apple is focusing its efforts, and the major shift in iPhone capabilities is NOT in hardware features.. but on orchestrating value in ways it can control.

Apple takes a Clayton Christensen approach to the iPhone: what problems does a customer have, and how do I solve them? For example, I hate typing in my name and address on a little mobile browser to order a good from lets say Gap.com. Apple’s passbook will resolve this by allowing Gap to integrate to passbook to pull all of the “iTune’s account” information over .. so I don’t have to fill this out anymore. Apple is moving to solve real consumer problems… It is looking to orchestrate value delivery.. moving the “hub” of coordination from the phone to iCloud.

This is what I refer to as the Stage 4 Value Shift (see April Blog). Theoretically, an open innovation model (ex Google/Android, Java/Oracle, …) should be able to quickly surpass Apple, as 100s of small companies invest larger amounts (cumulatively) in expanding capabilities of a “platform” (see platform leadership). However, Apple has learned its lessons from its Mac days and has defined competition along the lines of “consumer experience”. In this model, it does NOT CARE about interoperability or standards… rather Apple is maniacally focused on delivering value to consumers with usability, reliability, intuitiveness, … being core measures. Apple’s brilliance is multi-faceted, but by defining product focus along the lines of consumer experience, the iPhone’s closed model of innovation can not only effectively compete, but win easily against open systems. In other words, while open systems compete more effectively in a feature/function war.. they loose in the qualitative measures of “experience”.

Apple will obviously monitor the environment for effective new features, to ensure that the core product hardware remains competitive. For example, the real world transaction data for NFC based payments is a complete joke. There are no phones, there are few terminals, and there is no consumer or merchant value proposition. Sure there are exceptions like Japan, but only closed systems with a monopoly leader have proven the ability to push the solution out.

Apple does see a need to improve device-device communication, as well as shrink the hardware footprint. With these drivers, and given the prototypes in market, I fully expect Apple to redefine phone hardware architecture with a new integrated chipset that would encompass functionality of: controller, radios (wi-fi, BT, 14443, …etc), secure element that would also enable the SIM to be virtualized and placed within the SE. If this is indeed Apple’s direction, it will not be a new basis for hardware competition on feature/function, but rather: battery life, footprint and control (ex. virtualized SIM).

Other players also have unique strategies and assets. For example, Google’s strategy: orchestrate value based on consumer data. In assessing investments I look for one key answer: what problems are platforms trying to solve and in what marketplace?

All about Commerce… and Entertainment

My major issue with Apple’s strategy is the degree to which other entities can participate. I see mobile phone revenue streams in 2 major buckets: Commerce and Entertainment. Entertainment is not a focus for me.. Commerce is. Businesses operating within the retail sector are undergoing fundamental transformation. For 1000s of years, local merchants survived based upon distribution and availability. Today they are left trying to sell a commodity product at a higher price to consumers in a marketplace with near perfect transparency.

What is the roll of any intermediary in commerce? Not just in the selling, and purchasing, but in marketing, product selection, distribution, service, support, … What does the new face of retail look like? This is the focus of Amazon… they are the leader here from a “virtual commerce” (e and m) perspective.

As an investor, I believe we will see a massive new wave of companies redesigning retail. Five years ago I had a camera, an iPod, a PDA, GPS, phone, … today I have one device. What will the bundling (or unbundling) of retail look like? What are the problems to be solved? In the past 15 years mobile has grown up along side of commerce, operating primarily as a replacement to fixed line and then migrating to a replacement for online. We will start to see phones leap into commerce in new ways.. but my firm position is that this leap does not start with payment (the last phase of a commerce) but with marketing (the first phase). Why? Because marketing and retail are fundamentally broken, and Payments is NOT.

It is in this context that I laugh at NFC solutions. My favorite quote on this topic was from head of strategy of top 5 retailer

“Mobile Operators know how to run dumb pipes, not create business platforms for marketing… their current wallet initiatives are akin to a toll bridge, NFC is their toll booth where they stop me before reaching my customer.. to cross their NFC bridge I have to wait in line and when I arrive at the gate they don’t want $0.50 toll.. they want 3.5% of what I’m carrying in my truck, and a copy of the shipping manifest (customers’ names). This model doesn’t work for me. “

Commerce will find another path… one of least resistance … of better “experiences”. This is what Apple is enabling in Passbook, and why Amazon is succeeding in commerce. NFC is just a radio… one who’s standards are largely controlled by banks, mobile operators and card networks. Why would retailers want to participate here at all? We should not act to enrich the complexity of payment networks, or wireless ones, but rather form new networks.

Sorry for the typos.. and re-hash of past blogs.. hope it was useful.