Monthly Archives: January 2013

Random Management Thoughts: IPOs and Innovation

Gemalto QR Codes.. One Giant Leap _________ ?

10 Jan 2013

NFC is a beautiful technology with uses far beyond payment. In the payment use case however, it is not the technology, but rather a business battle over control and ownership (a 12 Party NFC Supply Chain Mess) which has conspired to create many forces against NFC’s payment success.

As I stated yesterday, latest news is that MCX has chosen QR code based approach from Gemalto (following Starbucks success). My guess is that Gemalto has developed a one time use QR code that is derived from device information (it will change for every transaction… ). You can safely assume that ACH will be the primary funding mechanism (just as in Target’s Redcard and Safeway’s FastForward). The banks had some idea of MCX’s plans are thus moving aggressively to create a directory service to “protect” customer DDA information via tokenization. My guess is that this protection will come at a price….

Here is my best guess of the transaction flow (assuming the rumor is true).

Registration

- Customer downloads Gemalto’s wallet

- Account is created unique to the phone

- Consumer registers phone, DDA, loyalty cards, backup funding instrument

- Bank account is validated, consumer risk scored, back up payment instrument run for auth

- Wallet is activated on first use at a participating merchant after ID is validated

Usage

- Customer opens wallet at checkout

- Unique QR code is generated based upon phone information (ex IMEI, time, network, phone #, …)

- Cashier selects “check” or “loyalty card”

- QR code is presented to register and scanned. Note MCX merchants are large multi lane merchants with POS development teams.. there will be some work to be done here

- Authorization – ECR passes QR code to MCX. Example via store controller routed much the same way coupons are done today.

- MCX validates code, performs fraud screen, authorizes payment (performed by FIS).

- Individual stores also will be able to leverage code as key for consumer “cloud wallet” access where coupons are stored and redemption is paperless.

- Coupons are applied

- Loyalty price/promotions are applied

- Payment is applied

- Zero balance

- Consumer gets electronic receipt and paper one.

I like QR codes for their ubiquity and established consumer behavior (thank Starbucks in the US). Stores don’t need to buy any new hardware for this to work, there is a zero cost of issuance, and it will work on a broad spectrum of phones. Development cycles for Store POS software are normally 18 months… so it could be some time before we see something come out.

QR codes may not be rocket science, but NFC has demonstrated the downside of tech heavy solutions. We may not need a $400M F22 when a simple bicycle will do. Carriers face a future as dumb pipes, a future share by banks, as both work to control their market positions instead of delivering value. MNOs and Banks (in the US) have proven themselves equally incapable of succeeding with new walled garden strategies. Commerce will find the path of least resistance, like a mighty river…

The big challenge for MCX will NOT be in technology, but rather a consumer value proposition. Retailers stated goal is to bring death to merchant funded bank card reward programs. What will convince me to part with my Amex card at the POS?… it will need to be something substantial.

Another often asked question is can MCX keep a bunch of fierce competitors working together in the same tent? This approach seems broad enough to insulate MCX from retail competitive forces and align them in fighting a common enemy. Per Sun Tzu “the enemy of my enemy is my friend”. Retailers are looking to turn the tables on the 2% “payment tax” on their business. There is serious enterprise commitment to making MCX work, banks will do well to treat them with respect.

Who will lose in this approach?

- Payment Terminal Manufactures

- Anyone dependent on NFC

- Existing Payment Networks – Debit Volume primarily (if MCX can create a value proposition)

- Retail banks. The primary payment relationship is a strong “daily use”… there are many downside for banks if they loose it.. for example retailers could offer instant credit based upon your history and network reputation.

- Start ups building case for value around bank cards or payment networks

- Consumers that want anonymity.

Other Related Blogs

Reputation – Commerce Implications

9 January 2013

I’m sitting in NYC waiting on my plane.. thinking about reputation, not only explaining the importance of a “good one” to my 12 and 8 yr old boys, but also thinking about its broader importance in commerce. Where do I have reputations today?

- Commercial: Bank, Credit Bureaus, Card Issuers, Local Merchants, Employers, Customers, Suppliers, Amazon, Linkedin, eBay, Blog, Google, …

- Community: Friends, Neighbors, Schools, Church, Organizations,

- Personal: Hospital, Government, Police, Government, Friends, Colleagues

Throughout history reputations were 100% dependent on relationships. These personal networks were the primary conduit of reputation information. Financial services have benefited greatly, over the last century, from improvements made to reputation portability and standardization.

In this modern era, eBay offers many lessons in relevance of reputation, demonstrating what great things can happen when tools exist to manage it. There are also many negative lessons here. For example in 2004, eBay launched into China. Prior to launch eBay’s risk organization wanted to keep the China community separate from the US. Community separation was a logical recommendation given that reputations take time to build, and dependent on community context. In the US buyers and sellers work for years to build trust and “confidence”. Reputations forged by self-dealing, or other fraudulent practices, were ferreted out. Unfortunately Meg didn’t want this community separation… she wanted one big community. Within weeks Meg saw the downside of operating these 2 together, as fraud shot through the roof.. thus separating the communities and opening the doors for other competitors (See this Stanford University Case Study).

Reputation has a very strong societal and community context. I told my sons that a Chef with a great reputation in New York or Paris means something completely different than a great Chef in a community of cannibals (… well it made them laugh). Markets hold people and money accountable, and the ability to measure and convey a commerce reputation is critical for network growth and efficacy. Banks have long held a central intermediary role in commerce as both a “reputation authority” and a manager of the corresponding risk. For example, letters of credit (LOC) are an instrument extended to a supplier receiving an order from an unknown buyer. After all, receiving an order for 100,000 widgets from a known buyer carries a far different weight that one from one that is unknown. Thus an LOC reduces the risk to the supplier by allowing money to be held by a 3rd party bank while the order if fulfilled.

Another excellent reputation example is in serving the poor at the base of the pyramid. In 1976, Muhammad Yunus created the concept which led to Grameen Bank, a success which resulted in the 2006 Nobel Peace prize (see Wikipedia). Muhammad recognized that lending must be tied to a reputation which is critical to maintain: that within the local community. The Grameen model lends money to a community group, whose individual members are mutually responsible for the loan. This is a fantastic model. What further opportunities could exist if participating individuals could expand their reputation outside of the community?

Modern markets have demonstrated that improving the portability of reputation expands the capital attracted to that market. For example financial markets expanded by specialists operating in a securitized model where risks could be aligned to capital. In retail banking, local markets evolved from local banks to national. Each bank could make rational decisions on where to participate and specialize in this market.

In business-business commerce reputation is a critical factor in the success of JIT inventory, virtual supply chains and vendor managed inventory. Few companies would be willing to let an unknown participant into their network. In the online world, eBay and Alibaba have done a tremendous job building communities around reputation. Wouldn’t it be nice if you could take your reputation with you? For example if Prosper or Zopa could get through regulatory hurdles (see here on their issues), lending could be done in an ad hoc community of investors without a banking license. Commerce would be done based upon your community reputation (eBay/Amazon), and risk would be managed through non financial data from retailers, facebook, MNOs, …

Unfortunately few of the holders of your reputation are incented to share it (in a positive sense). Few people know that there are roughly 4 times the number of negative credit bureaus as there are positive. In other words, every bank and supplier are willing to share their negative customer information (ie didn’t pay their bill), very few are willing to share their positive customer information. In most OECD 20 countries, positive bureaus are not the result of commercial initiative, but rather a legal or regulatory one (Wikipedia Equifax).

In the US we have more of an aggregation problem.. how do we manage multiple reputations. In emerging markets the problem is much different: How do you build any kind of reputation? One of the first problems to crack is identity. How do you assign an ID that sticks? We see many government initiatives around National ID, but this takes time. Is there another number or ID that we could use in the interim? It certainly seems that a cell phone number makes the most sense given its global penetration of 5.3B consumers (75%+ of the worlds population). Could emerging market carriers enable an opt in “reputation” consumer service?

I’d love to see a few companies work toward this end.

In the US, I’d love to see a consumer service that just measures my reputation in all of these places (beyond banking).

Sorry for not finishing this blog cleanly…

MCX Wallet – QR Codes and Gemalto?

Rumor is MCX is going with a “Starbucks model” QR code payment mechanism. Gemalto is rumored to have won the wallet (… arghh why another one?).

There are many Merchant benefits to this approach, primarily it skips the entire bank owned payment network as QR codes are read directly by the ECR (IBM, Micros, Aloha, NCR, ..) with minimal hardware changes. MCX members with Loyalty cards (ex CVS) would be able to skip the phone based wallet and leverage common MCX infrastructure (cloud) to enable payment on loyalty cards.

Fraud infrastructure will be critical to the success of this approach. Retailers have tremendous historical data for loyalty card customers… but they really don’t know who their customers are. Banks are certainly able to help solve this fraud, identity and reputation problem. MNOs may also be able to add value here IF they move quickly (example Payfone would be perfect here).

Another story I heard was the Starbucks was a founding member of MCX, but then left. If this QR code approach is accurate, their departure makes sense.. as they are the team that paved the way for the success of this approach. Why would they throw their technology and standards away for something exactly the same?

The payment mechanics of all this certainly look good. However what will be the consumer value proposition? I hope this QR code can be ported to other wallets (let the customer decide).

2013: Payment Predictions – Updated

2 January 2013 (updated typos and added content on kyc, cloud, and push payments)

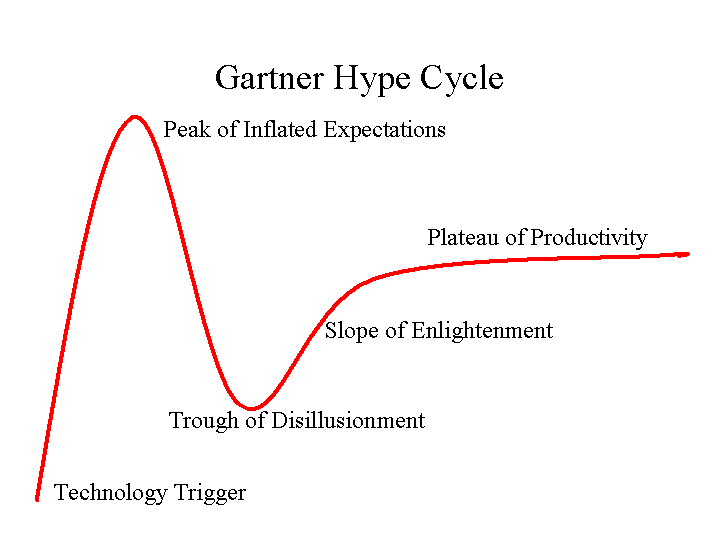

Looking back to my first “prediction” installment 2 years ago, 2011: Rough Start for Mobile Payments, not much has changed. Although I am personally approaching the “trough of disillusionment”. Lessons below are not exclusively payment (ie mobile, commerce, advertising) but seem relevant .. so I mashed them together. Key lessons learned for the industry this year:

- Payment is NOT the key component of commerce, but rather just the easiest part of a very long marketing, targeting, shopping, incentive, selection, checkout, loyalty … process. Payments are thus evolving to “dumb pipes”.

- Value proposition is key to any success for mobile at the POS. There are no payment “problems” today. None of us ever leave the store without our goods because the merchant did not accept our payment. There are however many, many problems in advertising, loyalty, shopping, selection, …

- There is no value proposition for the merchant or the consumer in NFC. NFC as a payment mechanism is completely dead in the US, with some hope in emerging markets (ie transit).

- 4 Party Networks (Visa/MA) can’t innovate at pace of 3 party networks (Amex/Discover). See Yesterday’s blog.

- Visa is in a virtual war with key issuers, their relationship is fundamentally broken. This is driving large US banks to form “new structures” for control of payments and ACH. Control is not a value proposition.

- US Retailers have organized themselves in MCX. They will protect their data and ensure consumer behavior evolves in a way which benefits them. Key issues they are looking to address include bank loyalty programs, consumer data use, consumer behavior in payment (they like chip and PIN but refuse to support contactless).

- Card Linked Offers (CLO) are a house of cards and the wind is blowing. Retailers don’t want banks in control of acquisition, in fact retailers don’t spend much of their own money on marketing in the first place. Basket level statement credits don’t allow retailers to target specific products and it also dilutes their brand without delivering loyalty. Businesses want loyalty… Companies like Fishbowl and LevelUp are delivering.

- Execution. This may be subject of a future blog… Fortune 50 organizations, Consortiums, Networks, Regulated Companies all share a common trait: they are challenged to execute. Put all of these groups together (

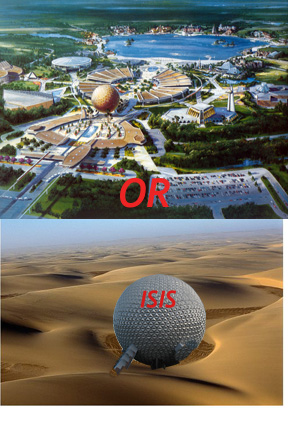

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus.

without a compelling value proposition…) and we have our current state (see my Disney in a desert pic). Take a look at who is executing today and you will see product focus around a defined value proposition. My leaders: Square, Amex, Amazon, Sofort, Samsung, Apple, SKT, Docomo and Google. Organizations can’t continue to stick with leaders that are focused solely on strategy, or technology, or corporate development… You should be able to lock any 3 people in a room for a week and see a prototype product. The lack of depth in most organizations is just astounding. Executives need to bring focus. - In a NETWORKED BUSINESS, it’s not enough to get the product right. You must also get retailers, consumers, advertisers, platform providers, …etc. incented to operate together. Today we see broken products and established players throwing sand in the gears of everyone else in order to protect yesterday’s network. Fortune 50 companies have shown poor partnership capabilities. Their strategies are myopic and self interested. For example Banks DO NOT DRIVE commerce, but support it. Their “innovation” today is self serving and built around their “ownership” of the customer. Commerce acts like a river and will flow through the path of least resistance. There can only be so many damns… and they will be regulated.

- The Valley and “enterprise” startups. There are billions of dollars to be unlocked at the intersection of mobile, retail, advertising, social. Most of the value requires enterprise relationships. Most investment dollars have flowed to direct to consumer services. I expect this to change.

- Consumer Behavior is hard to change, particularly in payments, it normally follows a 20 yr path to adoption. For example, in every NFC pilots through 7 countries we saw a “novelty” adoption cycle where consumer uses for first 2 months then never uses again. My guess is that there are fewer than 1-2 thousand phone based NFC transactions a week in the entire US. (So much for that Javelin market estimate of $60B in payments).

- Consumer Attention. Who can get it? They don’t read e-mails, watch TV adverts, click on banner ads. My view is that the lack of attention is due to a vicious cycle relating to relevant content and relevant incentives.

- Hyperlocal is hard. The Groupon model is broken, CLO is broken.. Large retailers have a targeting problem AND a loyalty problem. Small retailers have a larger problem as the have no dedicated marketing staff. Their pain is thus bigger, but selling into this space requires either a tremendous sales team or a tremendous brand (self service).

- My favorite quote of the year, from Ross Anderson and KC Federal Reserve. [With respect to payment systems].. if you solve the authentication problem everything else is just accounting.

Predictions

Here are mine, would greatly appreciate any comments or additions.

- Retailer friendly value propositions will get traction (MCX, Square, Levelup, Fishbowl, Google, Facebook, …)

- MCX will not deliver any service for 2 years, but individual retailers will create services that “align” with principals outlined by MCX (Target Redcard, Safeway Fastforward, …etc). The service which MCX should build is a Least Cost Routing Switch to enable the most efficient transaction across payment “dumb pipes”. This will enable merchants who want to take risk on any given customer the ability to do so..

- Banks will build yet another consortium in an attempt to control payments. They will work to “protect consumers” by hiding their account information and issue “payment tokens”. I agree with all of this, yet this is a very poorly formed value proposition and Banks will find it hard to influence consumer behavior.

- We will see more than one bank start a pilot around Push Payments (see blog).

- Facebook and Google will gain significant traction in mobile ad targeting…. following on to targeted incentives… which will lead to mobile success. Bankers, please read this again.. success in mobile will begin with ad targeting and incentives. Payments are an afterthought…

- Retailers at the leading edge will begin to see that their consumer data asset is of greater value than their core business.

- Banks will follow Amex’s lead in creating dedicated data businesses. What is CLO today will morph into retailer analytics, offers and loyalty.

- Apple will put NFC in their iPhone.. but usage is focused on device-device communication… not payment. NFC will be just another radio in the handset, there will be multiple SEs with the carriers owning a SWP/SIM based one.. and the platform provider managing the other. Which will succeed? A: the group that can best ORCHESTRATE value across 1000s of companies.

- Visa will lose a top 5 issuer to MA, and they will see a future where their debit revenue is gone (in the US) as MCX and bank consortiums take ownership of ACH and PIN debit.

- We will see 100s of new companies work to create new physical commerce experiences that include marketing, incentives, shopping, selection. Amazon is the driving force for many, as retailers work to create a better consumer experience at competitive price.

- Chaos in executive ranks. Amex, Citi, MCX, PayPal, Visa all have new CEOs.. all will be shaking up their payment teams.

- Retail banking is going through fundamental change. Bank brands, fee income and NRFF are declining, big dedicated branches will be replaced by more self service. Mass market retail will see significant leakage into products like pre-paid. Retailers and Mobile Operators are better able to profitably deliver basic financial services, to the mass market, than banks…. see my Blog Future of Retail: Prepaid.

- Unlocking the Cloud… and Authentication. KYC is a $5B business. Look for mobile operators to build consumer registration services that will tie biometrics with phone. Digital Signatures on contracts, payment through biometrics, .. all will be possible in a world without plastic. Forget NFC… See previous Blog on KYC and Cloud Wallets.

American Express: Innovation Leader

Happy New Year! Football is on my plate today so this blog will be short.

American Express is cranking out innovation at a tremendous pace. I’m very impressed at what Ken and Dan have done here in last 3 years. For example I just received a note in the mail yesterday that all of my Amex transaction receipts will be in my Apple passbook (don’t know why they used the USPS to tell me). Here are a few other innovations

- Facebook – Link Like Love

- Foursquare

- Loyalty Partners

- BlueBird prepaid with WMT (my Blog on prepaid)

- Amex DataInsights (good article here)

Retailers don’t like the costs of Amex… but they love Amex customers. Amex has a very heavy bias toward business and T&E spend. Although Amex has only 12% of global card payment volume, each Amex customer spends more than 4x the amount of a typical V/MA holder. In full disclosure I own Amex stock, and I’m an Amex points junkie.

Amex is working to expand its consumer base (into mass) through Bluebird and Serve, but I won’t go into that here.. What I’m most impressed with is that they are the first card network that is beginning to deliver value to advertisers and retailers…. Yes, through its massive trove of consumer insight, Amex is beginning to show signs that it can deliver value to retailers.

Following on from my Nov Blog: Retail CRM Enabled by Payments, Amex’s recent loyalty partners acquisition is showing signs of success in coupling merchant transaction data with its DataInsights business. Through this, merchants have new mechanisms to identify customers, incent loyalty and market specific products.

In my view, Amex is at least 5 years ahead of any other issuer/network. Of course they have the benefit of operating as a 3 party network and regulated bank. This allows them to own: the consumer, the merchant and the rules of the network. As such they have many “innovation” advantages over the V/MA networks and issuers; Amex’s network is much more pliable, where the 4 party networks are very hard to change.

This same dynamic is why Discover is the “dance partner” of choice for anyone working to do something unique at the POS. It is also why I see a 3 party network as the winner of MCX (?a NEW 3 party network?). As I stated previously, innovations at the POS will be less about payments and more about data and re-orchestrating commerce to create new experiences. There are 3-4 entities that each have unique data, none of which have shown interest in pulling it together: retailers, bank, advertiser, telecom.

Amex is the first to start breaking down this data “log jam” with willing participation from retailers. Although their consumer segment is very narrow, margins are tremendous in this top tier.. which means Amex could be in a position to further accelerate its affluent value proposition without mainline retailer participation (ex focus on T&E).

Random thoughts for Investors

- Data business revenue, enough to move the needle?

- Affluent card – Net new customers

- New 3 party network for MCX. Will it kill 40-60% of Visa’s debit revenue (in 10 yrs)

- Why did Amex buy Serve again? It seems it can justify higher margins through data…

- Bluebird growth. Can Amex manage value proposition for affluent and a lower mass segment?

Sorry for typos and short blog