Yes I am behind on the blogging…. I started putting this one together 2 weeks ago and it seems like ancient history.

PayPal + GSI Commerce

31 March 2011

Business Week Article: Why eBay wants GSI

GSI Commerce – Investor Presentation – Business Overview

eBay Presentation on Acquisition

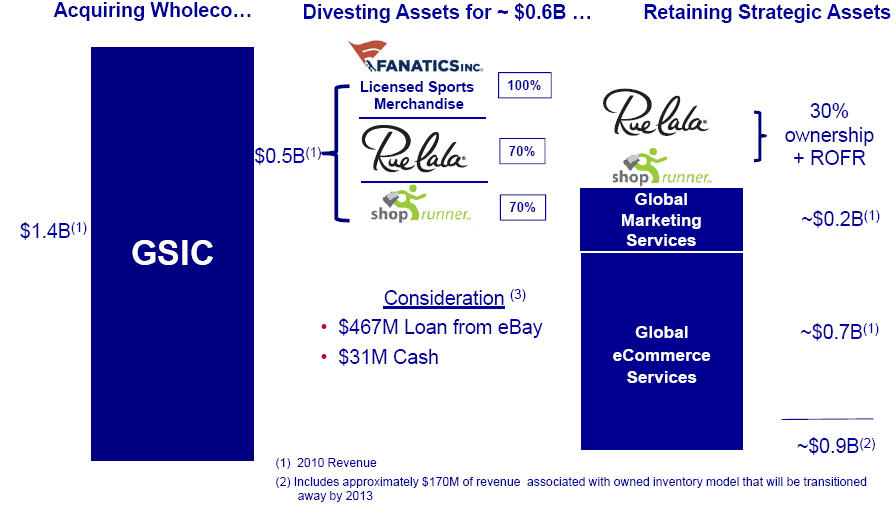

This week has seen quite a few major announcements, with eBay’s $2.4B GSI (NASDAQ:GSIC) acquisition leading the pack. M&A activity in payments, advertising and Commerce (both online and mobile) is really heating up. I’m seeing substantial deal activity and active shopping.

Independent of price paid, I like eBay’s move here. GSI is a fantastic company providing turn key services to bring key brands online. GSI was the largest retail customer of my old company 41st Parameter. As you can see from footprint slide below, their capabilities are much advanced from Cybersource.. from hosting your site to selling and shipping your goods. Brands like NFL.com depend on GSI for everything and they solid customer satisfaction.

From eBay’s presentation:

- Extends eBay Inc.’s reach with large brands/retailers …

- Brings together complementary capabilities in a manner which strengthens GSI and helps our existing core businesses

- Extends our open commerce platform capabilities

With this move I see a three (and a half) horse race for global eCommerce “turn key”: Amazon, eBay and Rakutan (buy.com). Visa is the other half horse with the CYBS acquisition (primarily focused on payment). Amazon is far ahead in hosting (EC2), distribution, product selection, merchant services (large merchants), digital goods (books, music, apps, ..), consumer share of wallet, … etc. eBay/PayPal has a few advantages in payment and small merchant services.

http://tomnoyes.wordpress.com/2011/03/10/paypal-to-drive-growth-at-pos/

Did anyone read John Donahoe’s Harvard Business Review Interview? He did a great job providing an overview of their strategy. GSI is increasing services to existing customers, and enabling faster expansion of fixed price goods. The POS initiative is an attempt to expand scope beyond the virtual world into the highly competitive merchant acquisition business. In 2010, US ecommerce was roughly $165B w/ 12% CAGR, while POS represents about $4.2Trillion.