![]()

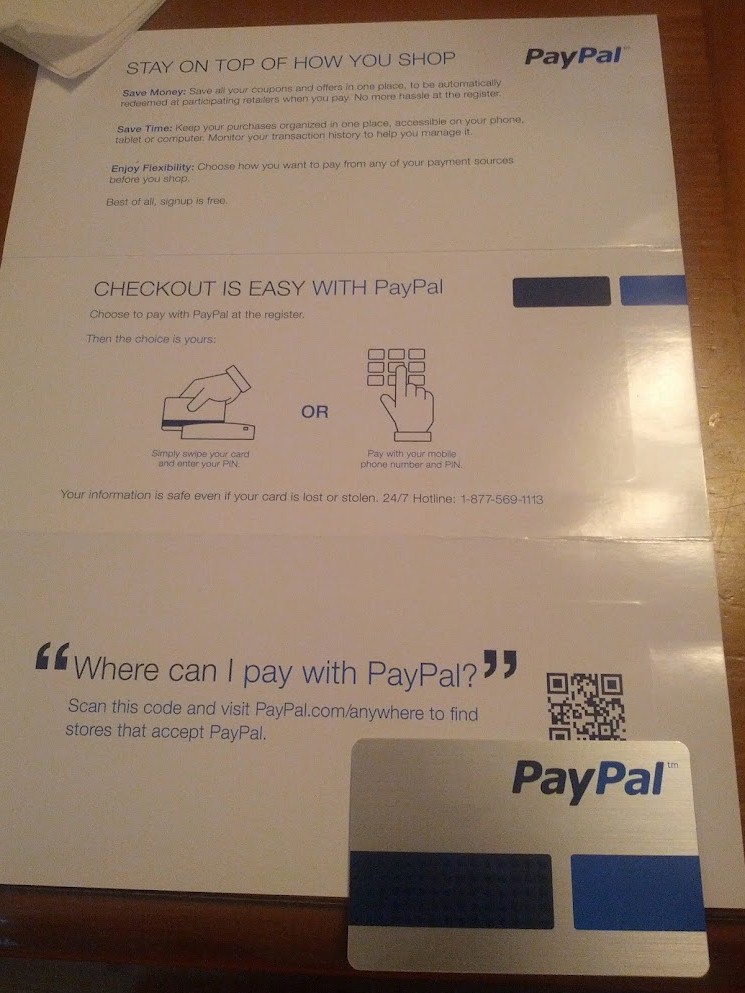

No Mastercard Logo on this one…

Quite impressed that they have pulled this together.. a new card network…

This is more than a decoupled debit.. although PayPal could choose to assume settlement risk through either ACH, stored debit card (or even ATM??). Paypal has the facilities to provide lending via BillMeLater (previous post) or to a consumer’s other preferred lender (via stored card). They are completely in control of a much larger value proposition as well.. with integrated rewards and a 3 party financial network that will compete with Discover and Amex.

I’m very, very impressed.. this is a new product that could completely disrupt traditional credit cards. Not only in rewards, coupons and incentives.. but in interest rates for every single purchase. This could be the only card you carry.. Forget about the “pay by phone number”.. the product innovation here is much more interesting than how it is delivered (plastic, phone number, bump, …).

Paypal also has a new site (beta) a few screen shots of which are below.

This new plastic is currently only accepted at Home Depot. My understanding it that Chase Payment Tech will be a lead acquirer for this new Product… I’m sure Vantive, FirstData … et.al will not be far behind. I will attempt a more thoughtful analysis later… thoughts appreciated.

Just had a funny call with a senior eBay Analyst.. he tried to do a return at HomeDepot with the card. Lets just say there were a few issues.. Including having to go online and choose to redeposit the funds in your checking account.

Paypal, if they have cash money, which I think they have a chunk of, need to embrace a business process that has nothing to do with Card Companies. Although it is not easy considering current card market volume today. However the biggest obstacle that paypal needs to clear is the ACH delay. Loading and unloading money takes wayyy too long and it’s a pity that it can only be done thru a bank or a prepaid debit card. Am not sure of how many pple would put up with prepaid debit cards-the fees are ridiculous. Combine this plastic with an ATM that acts like a payment center-withdraw, load or even send and receive money. Then Paypal will command this mobile money payment market for a number of years before the west catches up with the leaders in this business like MPESA.

Pingback: The Directory Battle PART 1 – Battle of the Cloud « FinVentures

The ACH delay can be avoided by a powerful shift in paradigm that holds good funds in pooled accounts which keeps the funds in-network of PayPal sub accounts until settled out of the PayPal network. This falls short in a Home Depot Only world, but will disrupt when multiple merchants also keep settlement funds in-network in the pooled accounts.

Thanks Crawford.. Everyone not familiar with Crawford.. he is THE man to talk to about buying and running a bank.. Utah may be the sweet spot for something quickly.

wrt/ this thread. If paypal were a bank there is no issue.. MSBs however need to manage “balances held” carefully given escheatment issues (by state/country). My understanding is that Paypal is taking a much more “risk based” payment approach depending on stored payment instrument. Instead of holding a “balance” in the MSB account, they simply run regular auth’s on the back up credit card. This circumvents MSB escheatment issues and improves customer experience by not requiring anyone to hold a balance with the service provider. Of course it increases cost.

Pingback: PayPal vs Google (at POS) « FinVentures

Pingback: Battle of the Cloud – Part 2 « FinVentures