As I wrote in a previous note Banks will win in Payment: But which ones? Banks are very well positioned to execute. They have the consumer relationship, the merchant relationship, the IT infrastructure, and have always taken a key role in “commerce”. However, Banks have tended to operate in a slow “evolutionary” model.. and are now in a very dangerous position. Their network is complex and brittle, their value proposition and brands diminished, and the value equation has shifted.

If you are a bank and looking to “optimize” your approach to mobile payments, what are your key assets and constraints?

- Control of Network (vs. Visa, Telecos, Google, Apple, )

- Leverage existing assets

- Massive proliferation of consumer information and account numbers

- Risk Management

- Consumer Relationship

- Margin/Fees

- Value to consumer

- Value to retailer

- Regulatory issues

As a bank, would you invest in NFC? A standard owned by the card groups, and telecos and despised by retailers? Of course not.. it does nothing to help banks, merchants or consumers…

The centerpiece of any Retail Bank strategy should be to protect the consumer relationship. If you “blew up” payments today and started from scratch, how would you redesign it? I agree with Ross Anderson (See KC Fed) Ross Anderson “If you solve the authentication problem.. everything else is just accounting ..” . Why should I pass my credentials to a merchant, processor, acquirer, network, .. all just to give them to my (issuing/originating) bank? Why on earth would I pass around real account numbers (ex Checks)? Why do all these entities get to see me? What if I could interact with the originating bank directly to instruct them to send the payment?

We have seen “credit push” attempted globally with Sofort, SMS Pay, NACHA Credit Push, SEPA Credit Transfers, UK Direct Credits, US Trials with Padiant,…etc. All have a “mixed” record of success, with the biggest issue being consumer adoption and margin/bank incentives. Given US Bank recognition of the innovation problem with 4 party networks, and the need to consolidate debit processing, it would seem there is some movement in furthering this model in the US.

Unfortunately, the trials with Padiant have been a flop. A specialized payment terminal creates unique QR code which is captured by a payors phone camera. Phone sends to code to acquiring bank. Processor looks up consumers bank in directory and sends to originating bank for consumer auth/approval. Funds are then PUSHED directly to merchant and terminal gets auth. Top issue is consumer phone data connectivity, and a rather complex user process. Of course this is a starting point, and can be improved.. retailers just needs to get the buyer a few critical pieces of info:

- TID (terminal ID)

- MID (Merchant ID)

- Transaction ID

- Bank

- Amount

I like this “Push model” MUCH.. After all I can push the payment from either a debit or credit account. The merchant need not know, and consumers remain anonymous throughout the transaction. Push takes almost all fraud out of the system and keeps authentication with the entity that KYC’d the consumer (the originating Bank). It gives the Banks tremendous flexibility in constructing new focused solutions at POS, eCom and mCom. Heck, its also aligned with Apple’s QR code wallet. The perspective will feed my update on Part 2 of Directory Battle.

For investors, impact is as follows

- Loss of debit volume

- Further chaos in mobile payments

- Need for better auth on phone (Iris, bio, …)

- POS/ECR expansion to deliver info to User phone (QR Code, BT, WiFi, …)

- …

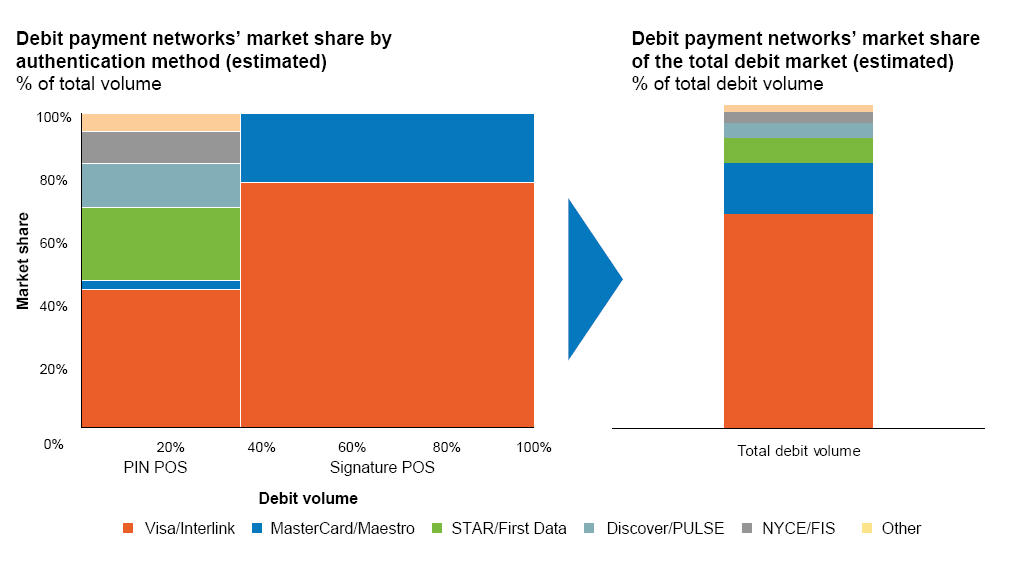

As a side note, I recommend the reading of Visa’s Debit Defense Strategy

www.digitaltransactions.net/public/frontend/files/0207net.doc

Pingback: 2013: Payment Predictions – Updated « FinVentures

Pingback: Tokens: Merchant Options | FinVentures

Pingback: CEO View – Battle of the Cloud Part 5 | FinVentures

Pingback: How to Deregulate Payments (like Telecom) | FinVentures

Pingback: Payments Part of OS: What does that mean? | FinVentures

Pingback: Divide and Conquer: Commerce Battlefield | FinVentures

Pingback: Perfect Authentication… A Nightmare? | FinVentures

Pingback: Another Bank Consortium? Paydient | FinVentures

Pingback: Structural Changes in Payments - Starpoint Blog - Finventures

Pingback: Tilting the Networks… a MASSIVE Change - Starpoint Blog - Finventures