18 March 2010

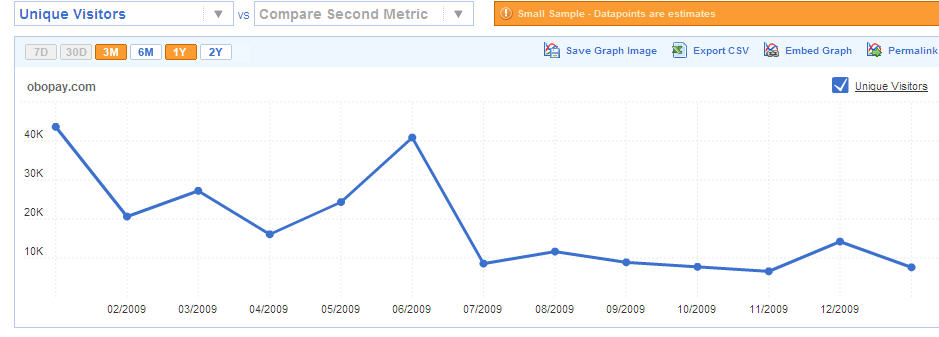

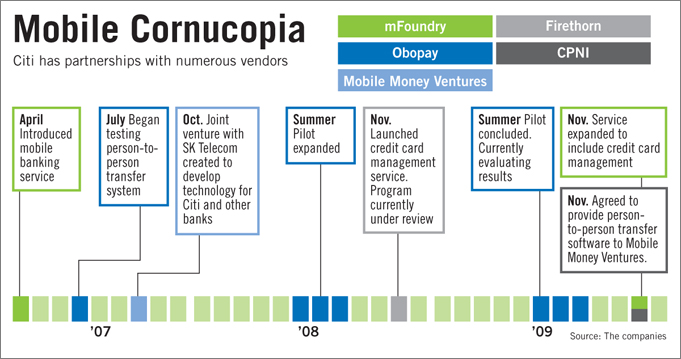

Good article.. just a little “too kind”. Citi learned that 2,000 customers found Obopay to be a neat way to give kids their allowance. Of course Citi had higher hopes.. but a sender pays model has rather poor incentives in kick starting a “new network” and consumer behavior (See Citi is out of Obopay). For those in the industry looking for lessons here, Paybox learned them the hard way in the EU. Obopay’s failure is nothing new.. changing consumer payment behavior is hard. Obopay added a few extra challenges as it attempted to execute a payments business plan with an inexperienced team.

Mobile P2P payments is firmly in the Gartner “hype cycle” stage within developed countries.. The short term future for NFC (at the POS) is quite exciting, particularly with AT&T/Visa’s pending pre-paid card. Within emerging markets, Mobile payment is a game changer for MNOs and the unbanked. The ability of any US tech companies to compete within this emerging market opportunity is TBD as NGOs and MNOs throw substantial resources at the problem.

Interesting to see Obopay start positioning as check (i.e. cash) replacement service. So would you pay $0.25+1.5% of your transaction so that you could provide convenience to a merchant? Me? I think I’ll tell the merchant to take my check.

Hey if the first business strategy doesn’t work… move on.. Jack Dorsey’s square model is focused in a good space (not too keen on his solution though). Obopay.. back to the drawing board.

Related posts

Pingback: Structuring a Bank “Start Up” 101 « FinVentures

Pingback: Structuring a Bank “Start Up” 101 « FinVentures

Pingback: Facebook P2P - Starpoint Blog - Finventures