7 June 2010

Rumor Mill

Paypal’s new virtual terminal may be just in time. Rumor is Visa is planning a slew of new product announcements in next month.. from NFC, to mobile coupons to bringing down the barriers of card acceptance. Perhaps this is the primary driver for the CYBS acquisition, there must have been a dependency given the multiple paid.

Thought for the day: What is “banking innovation”?

How many times per day do you really want to check your bank balance? From how many different devices? Is comparing yourself to others innovation?

From my perspective a “killer” customer value proposition (in any market) is making “up market” premium services available to the masses. How would you like to be treated like a client of a private bank? Your bills are paid, your lawn is mowed and your dog is walked… You have a relationship with the banker, he is invited to your children’s wedding. He actually knows your name when you walk into the office or call him on the phone…. and he also consistently delivers superior market returns to your portfolio.

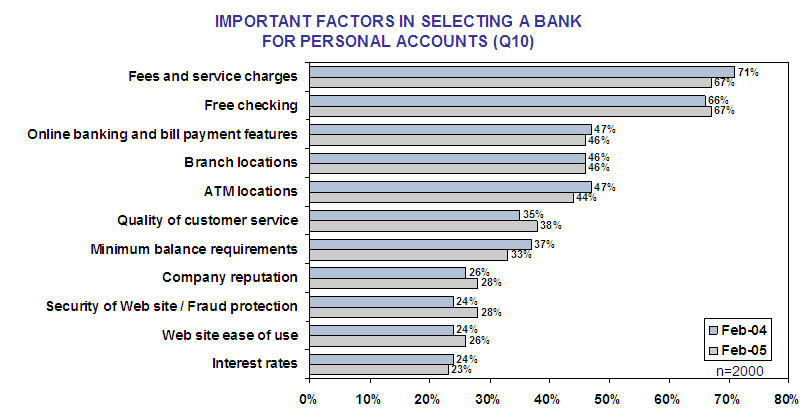

As a bank customer.. does your bank know who you are? your history with them? What your goals are? Is it any wonder that bank customers are rate driven? There is no relationship (or trust) in the average mass market portfolio of a large national bank. Why do customers select a bank today? (sorry for stale data)

Banks know that Customer Satisfaction strongly equates to profitability, and retention. Customer focused innovation starts with focusing on what your customers need… I’m surprised at the lack of effort here…. What would my top area be? That’s easy.. financial education. Banks that help educate customers stand a very good chance of building better relationships, and increasing wallet share. Today I’m left with an “apply” button on my brokerage tab for Wachovia, Citi, Chase, Wells.. the average customer doesn’t want to apply for an account until they understand how this “product” will serve them and gain insight into how BankX’s services compete.

Who will take on financial education 301? I don’t really want banking to be “fun” (aka Virgin).. I want it to be serious and thoughtful.. US retail banking is just plain backward when it comes to innovative products (Foreign currency accounts, structured products, international equities, …). Perhaps there is a “catch 22” with our collective financial literacy.. or lack thereof.

Examples

- Wells Fargo https://www.wellsfargo.com/about/csr/fin_ed/

- Bank of America http://www.bankofamerica.com/financialtools/

The banks above have obviously invested time thinking about this, however my guess is that few current customers know about (or use) any of these services.

What would a private banker do for a new relationship? He would probably try to find out my risk tolerance and develop a plan to better manage cash (ex sweep account) and investments with consideration for taxes and personal plans. Why are banks outsourcing this to a CFP? Of course the answer is that banks are product focused (as opposed to customer focused), there is great margin in that 0.25% CD that grandma buys.. also a great source of liquidity which drives Tier 1 capital and my bond rating (cost of capital). All of this seems to point to great opportunities for small banks, particularly those that cater to affluent (Aquestabank and their 1.2% CD).

It seems that the ABA and OCC are frowning on deposit competition right now, a heavy price for consumers.. take a look at rates in the UK this week (http://www.moneysupermarket.com/savings/) . The incentives for the large banks is to act as a “late follower”… after all until balance run off occurs there is little incentive to change.. US branches (and their sales teams) continue to excel in generating margin.. with consumers poorly equipped to evaluate options.

Make no mistake, the consumer market will change.. Will banks that depend on customer illiteracy for success will have adapting? US banks are very fortunate that the average consumer is not a British replica… where consumer “rate hopping” is at an extreme … perhaps Mint, bank rate, and money supermarket will get more traction and bring greater transparency..

Thoughts appreciated.