25 July 2010 (Updated 20 Aug)

![]()

- Netbanker on Chase iPhone App

- Previous post on USAA’s Deposit@mobile

- American Banker

- ApStore – Chase iPhone App

- Chase QuickPay

- Mitek Systems Product Page

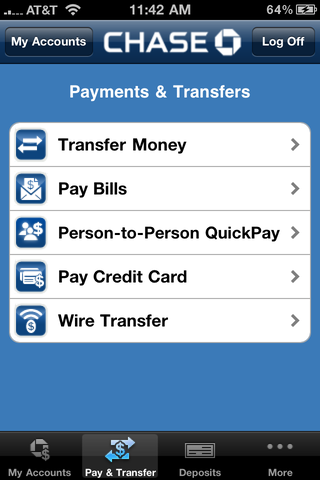

Chase has a stellar eCommerce and mobile team in both their retail and cards organization, and they are poised to deliver tremendous payment innovation across both of these business units. This innovation has been “in the works” over the last few years, and Jack Stephenson (PayPal’s former head of strategy) is fortunate to have joined at a time where both the payment platform and team is gaining traction. This month the JPM retail team has delivered new capability in its iPhone versions of QuickPay and Quick Deposit products.

QuickPay Overview:

QuickPay is a JPM’s money movement “pay anyone” service that provides  registration for both Chase and non Chase customers. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge). From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. It may have taken some time for JPM to complete the QuickPay internal build, but in the current release it has surpassed the domestic capability (and usability) of all other banks. JPM is now the leader in retail online payments.

registration for both Chase and non Chase customers. Chase was very late to the money movement game, rolling out its first QuickPay service in 2008 (whereas Bank of America and Citi have been providing this since 2002 through CashEdge). From a strategy and organizational perspective, JPM is well known for their “preference” to develop applications internally. It may have taken some time for JPM to complete the QuickPay internal build, but in the current release it has surpassed the domestic capability (and usability) of all other banks. JPM is now the leader in retail online payments.

Non-Chase customers can register for QuickPay before or after receiving funds. For non customers, registration for QuickPay is similar to PayPal (or CashEdge’s PopMoney), with the QuickPay wallet currently constrained to single linked checking account. Chase customers have a streamlined enrollment process and the QuickPay functionality is integrated into their existing online experience (demo above). This differs substantially from BAC, where the same capability to transfer funds exists but the usability is very poor. BAC is missing a substantial opportunity to capture beneficiary phone/e-mail information, an unnecessary miss since the capability exists (BAC is Cashedge’s largest US customer but has not yet signed on with CashEdge’s mobile POP money service). Beneficiary information is critical to maintaining an accurate directory.. the key element in any payment system. Chase’s QuickPay maintains e-mail, phone and other information which gives it a head start in the directory battle (subject of future blog). Given Chase Paymentech’s role in acquisition (for card, paypal, …) you can see potential for further directory synergies internally.

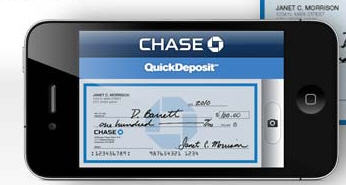

The articles above provide a great overview of the new iPhone App, with Chase following in the footsteps of USAA’s Deposit@Mobile. Application is from Mitek Systems and it is just super, and for small merchants this may become the payment method of choice (when compared to card):

Merchant benefits:

- No transaction costs (savings of 150-350bps)

- Usability and simplified enrollment

- Same day availability of funds

- Fits existing consumer behavior pattern (checks)

- Legal protections/enforceability (paper checks vs. electronic signature)

- Instant verification, risk and fraud management

- Leverages bank imaging systems and processes (regulatory and consumer receipt)

- Notification/receipt to consumers

JPM Business Case

- Check imaging (op expense)

- Small business acquisition (Customer Net Revenue for SME = $3-$5k)

- NRFF for non-customers (NIM on settlement funds held)

- Future “directory” business case, cards growth

- Prevention of DDA Account Number Breach

The JPM Quick Deposit application was reportedly built in-house, other Vendors such as EasCorp’s Depozip provide similar functionality. As for the success of this application, NetBanker reported USAA’s recent numbers for Deposit@Mobile. (update 20 Aug, my friends at BAC tell me that they have been trialing the Mitek application for almost 3 years now, fine tuning the app and the support process and are set for launch any day) .

Given that the audience for this blog (investors, start ups and innovators), you might ask why it takes 2 years for a bank to roll out this type of innovation. An excellent question! The iPhone app itself is the easy part, perhaps consisting of less then 20% of the overall budget. The “hard work” is in integrating it into existing systems and risk controls. For example, the primary value proposition, for QuickDeposit, is improving check acceptance and funds availability. At the teller line, banks have tools like DepositChek which allows the bank to determine if information on the check is correct and the account is in good standing (stopping check fraud before the check image gets into the system). These same tools must be integrated into the online and mobile process to reduce risk. I’ve picked this particular example because it is a tool unique to bank entities (not available to non-banks). In addition to the technical integration costs, banks have become very prudent in testing, and accessing impact of new functionality to call center support costs. Given the wide availability of both of these applications, it is essential that they are intuitive to JPM customers.

These applications are a great retail success. I understand that the JPM cards team is also poised for a major release in mobile soon (with multiple alliance partners). Well done JPM!

Enroll for QuickPay – www.chase.com/QuickPay

Overview of Quick Deposit – www.chase.com/quickdeposit

Thoughts appreciated

I’ve used the QuikPay service and have 3 points:

1. Chase ATMs now use the same check-image-scanners as do the tellers. Chase no longer has envelopes at the ATMs and does not use deposit slips. Rather, you insert the deposit checks directly into the reader and the ATM will print check images on the paper receipt. My point is that the iPhone Quick Deposit image process is not much different from the ATM experience.

2. I love the speed-up in availablity of cash for deposits. Because ALL modes of deposits now use scanned images, I now get overnight credit on deposits within Los Angeles.

3. Chase did drop the ball on customer-training. Yes, it has “demos” and “FAQ”s BUT these are not supplementary to a clear set of instructions. There are no instructions and the FAQs are not clear. For example, there are some unclear references to a “$1,000 limit” and a QickPay-Non-Chase payer must verify his account to Chase or else be allowed only a one-time payment of $q50 max.

Question: If a check is deposited using an iPhone, what will keep the payee of that check from being able to cash the paper item elsewhere? How can a market or check cashing store tell that this item is already being processed by Chase for deposit?

Note: After about 5 calls and countless transfers, a person at a Chase branch was both surprised by my question and by the fact that he couldn’t get an answer for me.

The paper check turned into a Check 21 item is identified by printing on it. The iPhone deposit is different, obviously, because it will not be identifiable in such a manner. It’s a completely different thing.

Pingback: Page not found « FinVentures

Pingback: Citi goes live with POP MONEY « FinVentures

Pingback: Obopay Update – 3Q10 « FinVentures

Beneficiary information is critical to maintaining an accurate directory.. the key element in any payment system. Chase’s QuickPay maintains e-mail, phone and other information which gives it a head start in the directory battle (subject of future blog).

Tom – any thoughts on the ‘directory battle’ and how banks should be looking at directories as launching points for innovation?

Excellent question. Think every bank is making plans here.. as we have all learned from our Visa/MA experience to keep this in our control. Most banks are focused in expanding the functionality of the “on us” network. There is some logic to this focus, particularly for banks with merchant services. Margin in the payments business is driven by risk management and least cost routing. There are few existing consortium teams capable of both routing and risk management. Individual banks are reluctant to give away the routing (to say The Clearing House), because some transactions may be “better” processed on an alternate network. This “network of networks” dynamic has always existed.. as a rule change within individual bank networks must come before changes within the inter-bank switch. Fortunately (for banks) there is no successful P2P service outside of the bank environment as existing products and cash meet the needs. What alarms me is that there is no coordinated effort among banks to protect this position.

Directories are a key competitive advantage for banks, particularly when coupled with integrated risk management, and clearing/settlement. Consumers want banks to control payment information as banks have a unique regulatory responsibility around payments and protection of customer information. Why are banks letting 3rd parties “ride their rails”? The answer probably has to do more with lack of a common cause for action.. there is nothing at risk that the banks currently want to protect.

Pingback: Clearxchange « FinVentures

Chase Quick Deposit makes it extremely easy to steal checks and commit fraud.

Here’s an example:

An employee works for a company and handles cash and check transactions. This could be a cashier, store manager, etc., or a bookkeeper like me.

If the dishonest employee has the Quick Deposit app installed on their phone, all it takes is for someone to turn their back for a minute, and they can snap a photo of the check, instantly depositing the money into their account. They can void the ticket out of the POS, or not tender it at all and just delete the items. The problem is that the theft must be realized within the same day to prevent the loss. Otherwise, the money becomes available for use the next business day, and by then the employee has had more than enough time to wire the funds out of the Chase checking account and leave town. You might never hear from that employee again. Then you will have to go through the trouble of trying to recover the funds, stopping payment on the checks, filing police reports, tracking down the thief, etc.

Or if it’s me the bookkeeper stealing, I can simply modify the daily journal entry to remove the checks from the deposit. If the owner trusts you enough, he/she rarely checks up on your work. No one will notice the missing funds for a very long time, if ever.

Chase claims that the system has risk and fraud management, but their system is very easy to manipulate. I tested the above scenario for myself, hoping that it would reject the deposit. With permission from the owner, I took 17 checks written to the business by regular customers and used my checking account to make “Quick Deposits”, in effect stealing from the company. I got immediate confirmation from Chase that my deposits had been accepted. The funds were available for use the next day. I wired the money out of my account, except that I put the funds back into the business’s checking account. But I could have wired it anywhere.

I went a step further and deposited a blank check, with just the dollar amounts written. Within minutes, I got the confirmation that the deposit had been accepted. The payee is not verified, and it doesn’t check the endorsement, signature, or date. It appears that the only thing the software reads is the MICR line and the amount. I deposited a completely blank check. Where’s the Risk/Fraud department?! Two weeks went by and no one from Chase contacted me about my mysterious blank check deposit.

Steve, thanks for taking the time to post. Most fraud scenarios have both a merchant and bank view. From a retailer view, it would seem there is a substantial issue with the integrity of the accounting controls within the scenarios you outline. Most stores have electronic cash registers to address controls and improve reporting and reconciliation process. What role did the Chase QuikDeposit service have in facilitating this fraud? Pay to validation? My guess is that you have written this note within last 30 days of your test. Remember, Chase has a record of check capture volumes by phone type, and by user account. I would bet your activity has been picked up, and is being researched at the moment. ACH transactions can be reversed in 60 days.

I hope you can convince Chase of your altruistic intent. Processing actual customer checks into your account without their knowledge is an issue.

lol Not turned in to check 21 so the original check gets deposited for second time. Just happend to me, they have posted the same check 6 months apart! Now I have to go to my bank to fight check fraud. So watch your bank account for this type of CHASE quick deposit check fraud

hmmmm.. so they stop it across different banks.. (You can’t take same check and deposit at 2 different banks)… Not clear if you are the depositor using QuickDeposit, or if you are the writer of the check and a beneficiary used quickpay to deposit same item twice.

It would be good to do an experiment.. my guess is that you will see reversal in 5 days.

There are several complex rules in the background here.. like what is the frequency of fraud on your account, and whether you are a “premium customer”. Don’t feel bad, Jamie Dimon’s mother had her card declined in the UK..

Pingback: Chase Quickpay Limit – giroz.net

As usual, really fascinating and practical blog post Chase

QuickPay and Quick Deposit