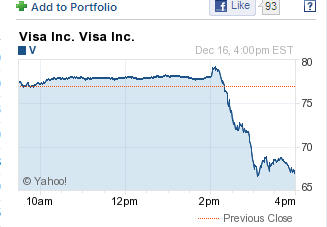

The banks knew it was coming, so don’t let anyone fool you that it was a “suprise”. The idea of a flat fee of $0.05-$0.15 has been floated for some time. As you can see from graph on right, Visa lost 10% of its value after the announcement. While Banks and Issuers are returning their Christmas presents tonight, the merchants are having a party.. particularly large ones like Wal-Mart who in 2009 had interchange costs of $1B.

As a banker, we invited Wal-Mart to come in and talk to us in 2005. They certainly did not mince words then, I remember a few quotes explicitly “what service do you provide that justifies taking 2% of my sales”?. Another memorable quote “we want to find a model where you pay us to take your card”. Something we laughed off back then, after all who on earth in the bank wanted to design that model? Banks “had it coming”… The interchange rate creep bore too many signs of a

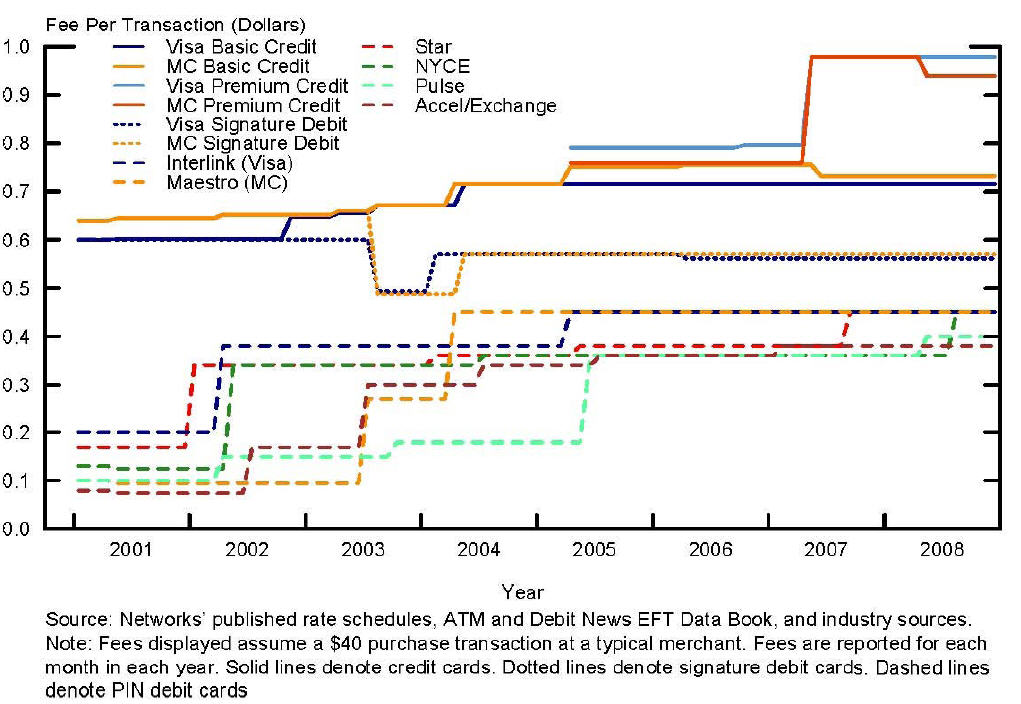

“network” run amok and NO ONE stopped the train. Banks launching campaigns like “skip the PIN and win” to incent consumers to pursue signature debit transactions (200bps+) vs PIN debit. We only need to look at the federal reserve chart on the right to see the lack of market forces here.

“network” run amok and NO ONE stopped the train. Banks launching campaigns like “skip the PIN and win” to incent consumers to pursue signature debit transactions (200bps+) vs PIN debit. We only need to look at the federal reserve chart on the right to see the lack of market forces here.

I believe this is a “tipping point” event in US cards. We will see merchants aggressively incent use of debit, and the Visa and MA logos will start to come off of our debit/ATM cards, as they do in Canada and Australia (Interac, and EFTPOS). What will the banks do about this revenue loss?

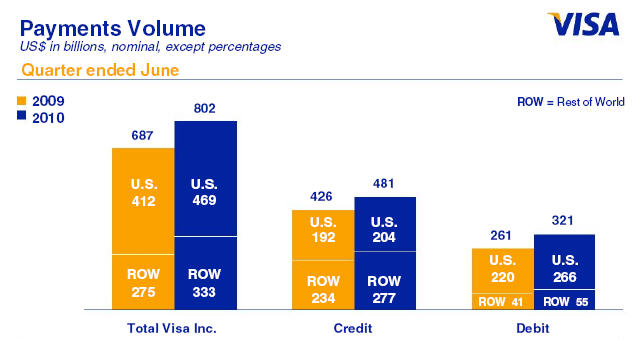

All are looking for new ways to drive other revenue streams into the payment services, particularly around marketing/advertising (see my Blog on Apple iAd). The Visa and MA relationships with the large banks was already showing signs of strain. The large banks will not wait for Visa and MA to develop an alternatives, most are assessing new networks and value channels which they can control (see Googlization of FS). I’m short on V/MA because of this dynamic.

The Federal Reserve’s proposal is open for comments, and there may be a change. But the starting point for the negotiations is quite a bit lower than what the banks were hoping for. My message to Bank CEOs: drop the fight here and find a new model for payments. Don’t let Apple and Google eat your future as well. What will it take? Well for one thing it will take a little collaboration, re-energize a few of your existing consortiums like NACHA, The Clearing House, Early-Warning to develop new models for payments and seed these team with top executives. You can’t take your eye off of this ball, retail payments is less than sexy.. but it is core to your daily interaction with customers.

WSJ – Issuers Howl

WSJ – Issuers Howl