2 February 2011

The actual scoring is probably a little more complicated. This blog is focused on investors and business heads that are not deep in the trenches with mobile payments. There is much written on the technology, standards, pilots and who is doing what.. this is an attempt to understand the business incentives within the ecosystem(s) and WHY key actors are pursuing/supporting different strategies. Getting NFC in a mobile handset was no “obvious” decision for MNOs or Handset manufactures, in fact just 18 months ago Apple told a major bank “we have enough radios in the phone, can’t we just use one of the existing ones?” The point shouldn’t be missed, there are many, many ways which a consumer can store information and transmit it to another device (like a POS). As an example: the US State department (in its infinite wisdom) decided to put an unencrypted RFID tag that contains your name and passport #… Another wacky example is Google Zetawire Patent.

Why NFC? Technically it operates on the same ISO/IEC 14443 protocol as both RFID and MiFare so how is it different? I’m not going to get into the depth of the technology (see Wikipedia), but the biggest driver was GSMA/NFC Forum’s technical definition (UICC/SWP) that ENABLED CARRIERS to control the smart card (NFC element). This in turn enabled carriers to create a business model through which they could justify investment (See NFC Forum White Paper).

(Sorry for the pedantic nature of this, but since blog readership is going up.. I’m taking some license in assuming that the style is not irritating too many people.. and besides getting right use of terminology is important. )

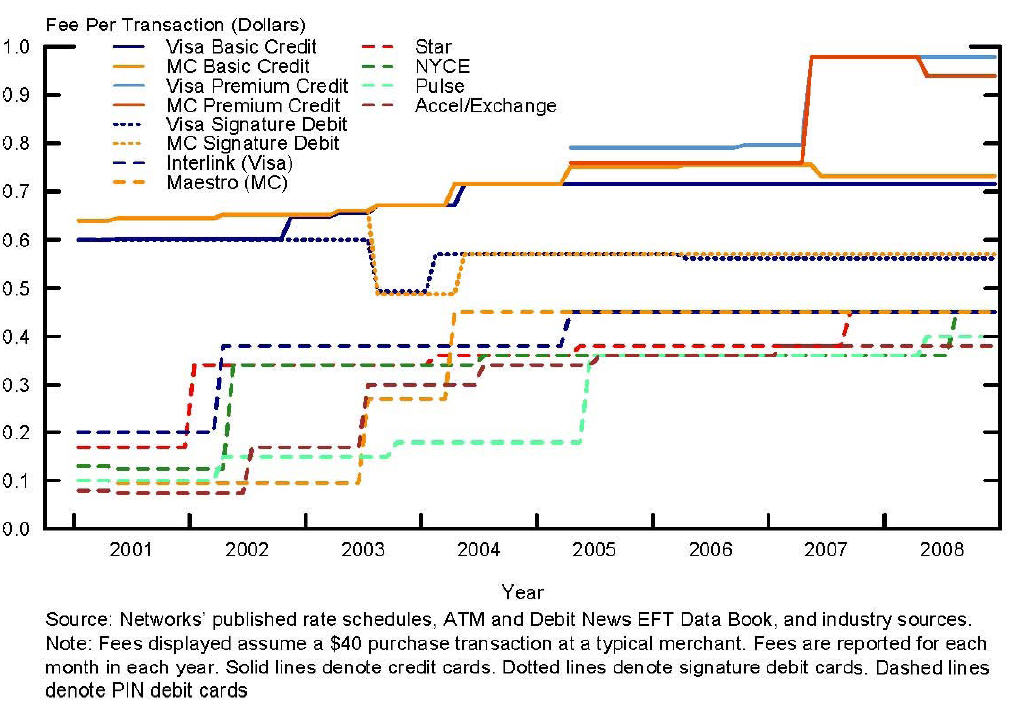

Banks and card networks have been circling mobile/contactless payments for sometime. Mastercard’s PayPass (2003) led the way for many of the current bank contactless initiatives. Visa later followed (and still trails) with PayWave in 2007, and Discover with Zip in 2008. All card initiatives operate on the same ISO/IEC 14443 protocol as NFC, most with numerous “successful” pilots. The issues with contactless card platforms are not technology, but business model.

As with any new “platform” it must support a business model for some… preferably for many … participants. Card focused models focused on either cash replacement (ex. Transit, Vending, P2P, …etc.) or “premium” convenience play (see Best Buy NFC Pilot). For those of you not in the card or retail business… there is little love loss between the 2 groups. Retailers are not about to invest in anything that helps either banks or card networks unless it improves sales or margins (see Banks will win in Credit). The NFC model allowed carriers to control the radio, and integrate it into the SIM (UICC) for management of secure applications and data (see Apple and NFC).

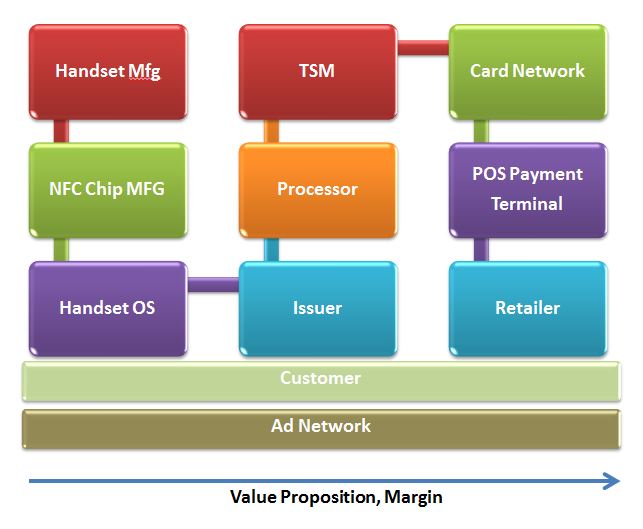

Prior to NFC, the “control” for contactless payment was with each contactless network. Visa and Mastercard took 12-18 months to certify every new device. That meant every single new POS Reader, handset, … had to go through multiple certification processes. What manufacturer would want to invest in this contactless model? Alternatively, NFC contains standards and specifications operating within ISO 14443 with an independent certification process. The NFC specification does provide for an independent entity, called the Trusted Service Manager (TSM), to assume the role of gatekeeper (See Dutch Example). But MNOs are not likely to give up the keys prematurely. In the US ISIS model, this TSM will be run by Gemalto (for the MNO consortium).

What does this mean? Q: Can Visa develop a PayWave application on an NFC certified phone? Yes.. can Mastercard develop a PayPass Application? Yes.. that have already. Can TFL develop an Oyster Application? Yes. Vendors like Zenius design secure applications that do just that. NFC enables the phone to host multiple applications that can use the “radio” in different ways (example open secure doors). These mobile applications are secure and can be provisioned and updated remotely. This is the “beauty” of the NFC ecosystem. Investors note: In all of these examples, it takes the MNO and/or TSM to approve your application. In the case of Visa and MA… they are not approved. This means your start up can build the slickest app in the world.. but someone else owns the keys to consumer use. For Visa and Mastercard: their PayPass and PayWave brands are mere NFC applications that can be denied within the NFC enabled phone.

Another important control point (for NFC payment) is POS infrastructure. A new NFC payment instrument must be supported by both the POS (certfication) and the processor(s). POS terminals typically support multiple standards, protocols and payment insturments (see VivoPay 5000M). For each payment method (PayWave, PayPass, Zip, Bling, ..) the POS terminal must undergo a proprietary certification process. POS terminals connect to one or more processors (ex. FirstData, FIS, …) and in addition to processing the transaction, the terminals can receive and process updates (example ISIS/Zip protocol which is still in definition). A recent example of POS payment upgrade: Verifone’s efforts to include Bling/PayPal acceptance at POS, a very big story that has received little attention.

The “downside” of NFC for many stakeholders is that they are no longer in control. In the NFC model, the “keys” to the NFC platform sit with the MNO who controls the UICC. This control is necessary, as it is the MNO who fulfills the KYC (Know your customer) requirement linking a real person to a SIM (and hence to a transaction). In the NFC model, Visa will still need to certify their own NFC software application to be PayWave compliant.. but will NOT necessarily need to certify the chipset/OS and device in which the application runs. Of course the details are a little sketchy here because Visa has not tested their own application for this environment, as handset manufactures are still in flight with their designs (focused on ISIS compatibility). I believe the ISIS dynamic is also the driver of why the latest Android Nexus S had write functions disabled..

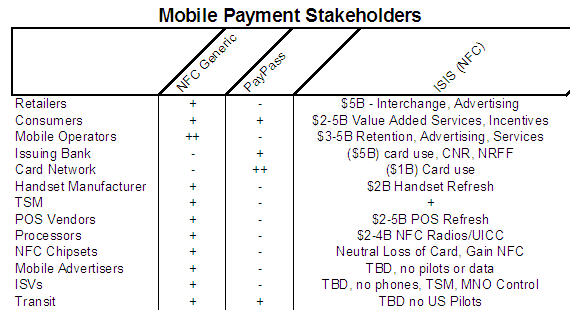

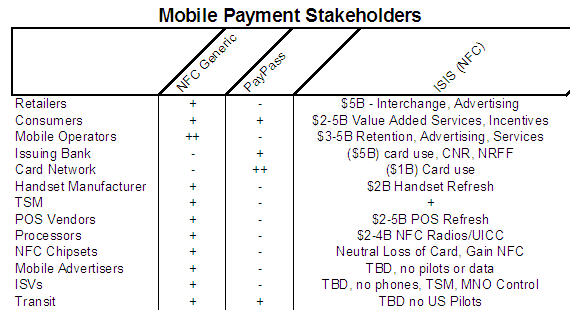

Stakeholders

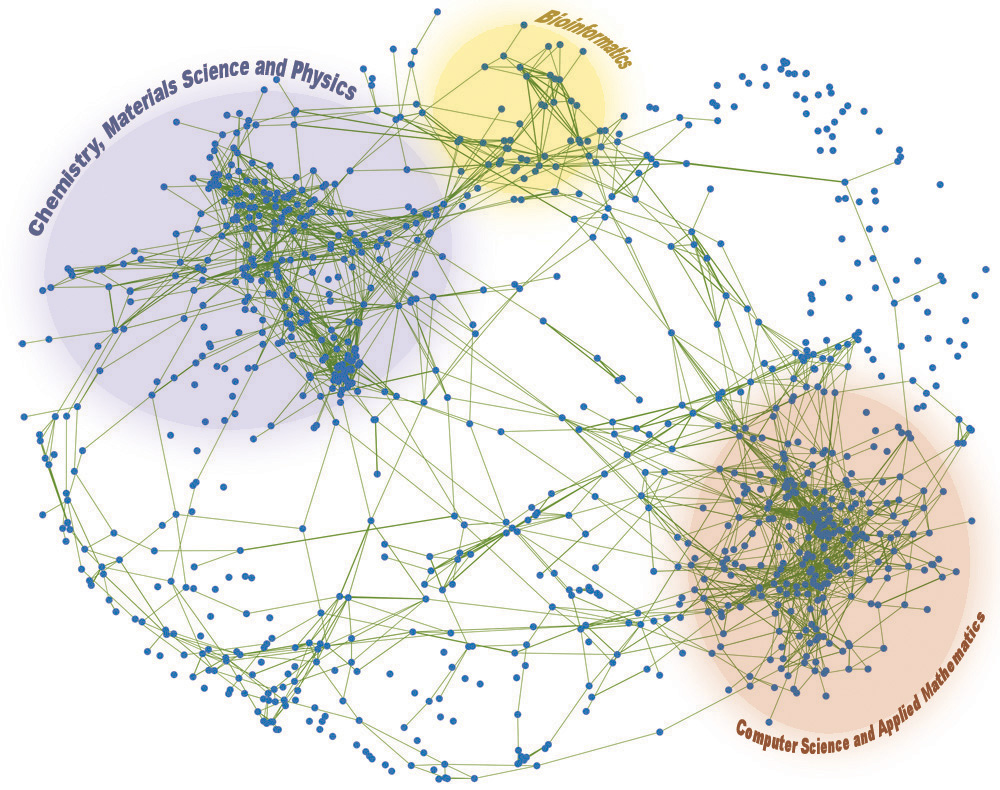

In analyzing the Total Addressable Market (TAM) for any investment I always look at who are the existing stakeholders and their realative markets. Within the NFC Ecosystem I see the following:

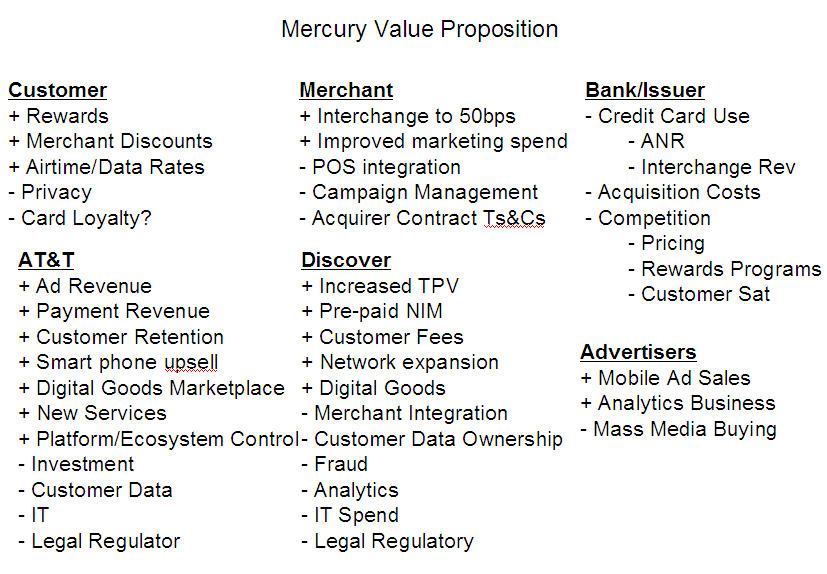

MNOs have had very little experience in running a software platform ecosystem, or a payment network.. or a TSM. Closed systems usually precede open systems, and I would expect this trend to follow within NFC. The vendor most able to coordinate a value proposition which spans payments, software, mobile platform, advertising, … ? Apple. Say what you want about Apple’s penchant for control.. they are one of the few companies with the skills and experience to address all of the issues surrounding a new mobile platform.

Banks and card networks are the only group not to score in NFC because of their inability to create a new value proposition with MNOs and retailers, as such they loose. Banks hold out hope that existing card loyalty programs hold, and consumers refuse to use payment instruments that are not currently in their pocket. History demonstrates that telecom operators have ability to sell and market cards (see AT&T Universal) to create compelling incentives…. Banks will likely begin pushing the benefits of Credit cards (Reg Z consumer protections). Will carriers respond by expanding their consumer credit risk through carrier billing initiatives (Boku, Bango, billtomobile)?

Message to banks.. stop depending on Visa and Mastercard for this.. develop your own payment network, with a unique POS integration.

Thoughts appreciated