![]()

22 Dec 2010

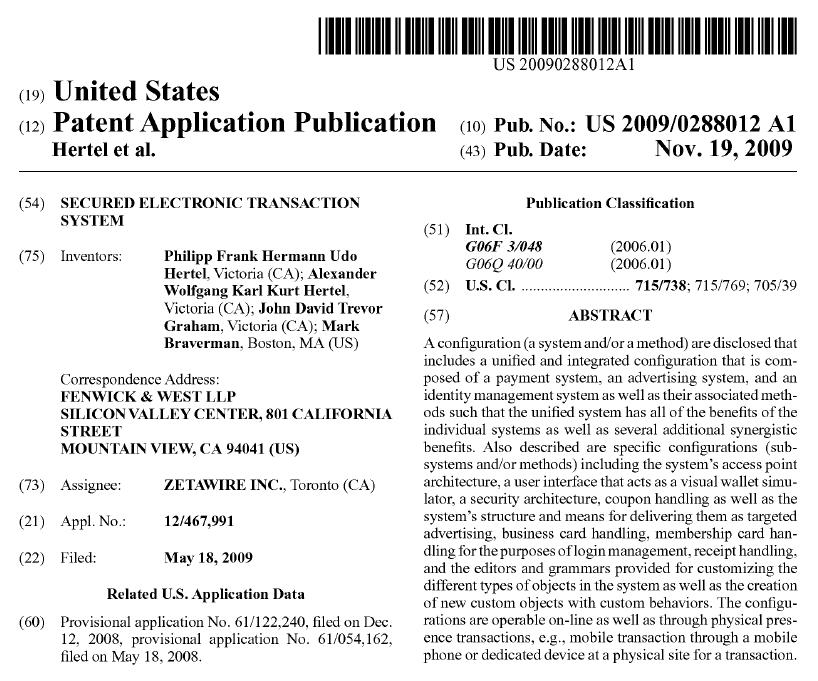

TechCrunch – Google Acquires ZetaWire

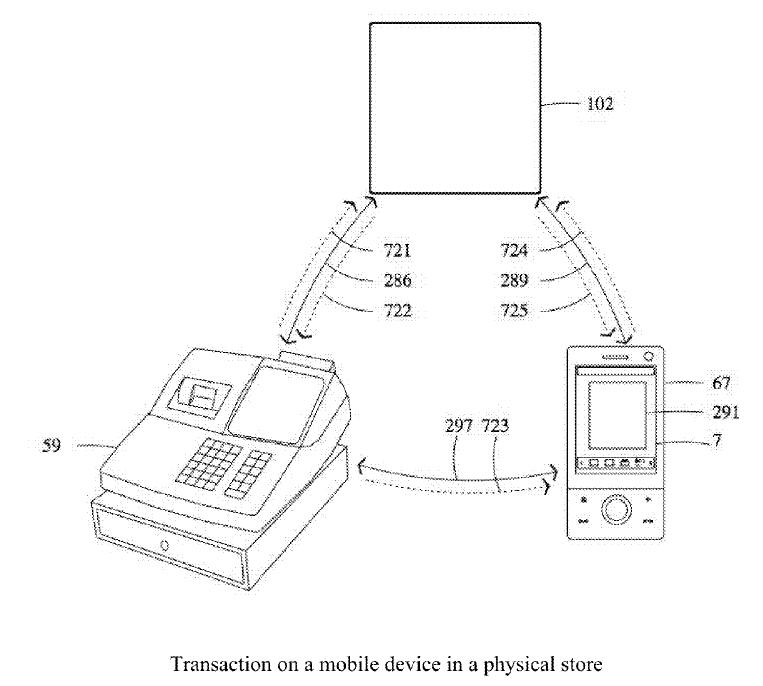

Why did Google acquire a 3-4 person Canadian company with no customers? The answer seems to lie in its patent application

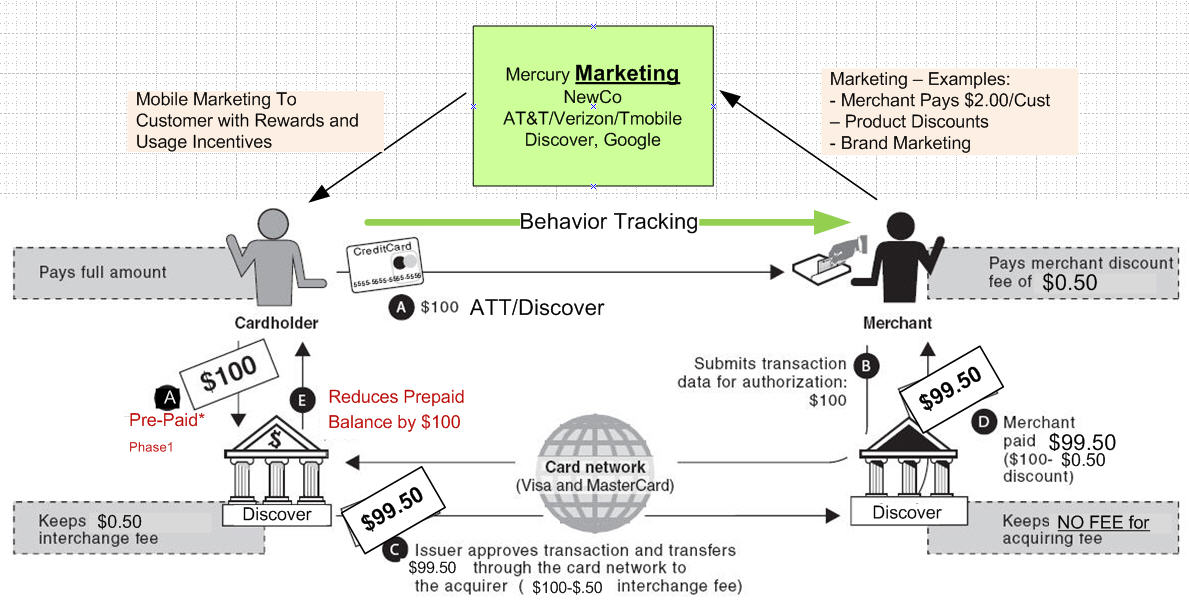

… quite an interesting read. A ubiquitous wallet, online and mobile that provides for direct communication (bluetooth, Wi-Fi, NFC, …) to other wallets and POS terminals. Interesting vision.. google as center of the mobile universe…. who would have ever imagined.

From a payment perspective, I thought paragraph 271 was rather interesting

[0271] Because the coupon and advertising system is integrated with the payment system, it is able to target and deliver advertising on an individual basis rather than on a demographic basis. The payment system has a complete record of all the purchases ever made by a user, and because the payment system is also integrated with a social network, it can also know the purchases made by all of the user’s friends. In addition, it has access to many other streams of data providing information about a user such as the user explicitly entered preferences and wish lists, which coupons the user’s friends have shared, which coupons the user currently has, etc. The system is therefore able to build a much more accurate user profile than standard advertising techniques, and this user profile can in turn be used to deliver advertising which is customized on an individual basis.

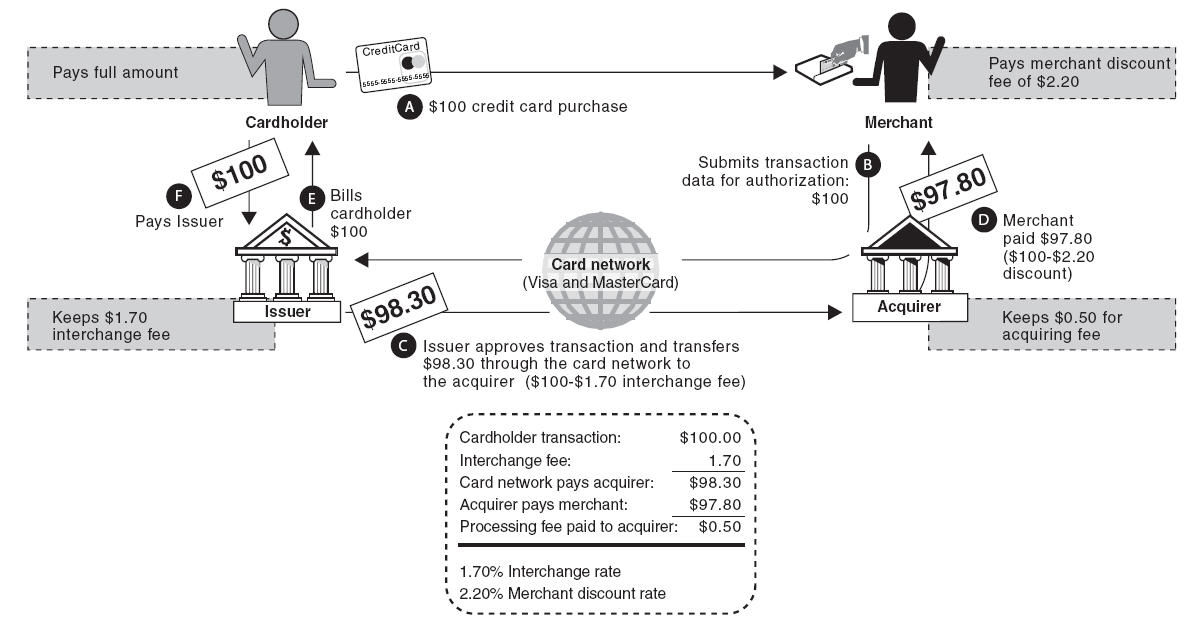

This seems to indicate a significant gap in the understanding of the applicants surrounding financial transactions (and data). Merchants hold on to item detail information, the payment network receives merchant level data.. but does not get item information. ZetaWire attempts to address this gap by inventing a “coupon authority” entity in Paragraph 264.

All information related to coupons and their definitions is managed by a coupon authority, which can be an integrated subsystem of the transaction authority 102. All instances based on the coupon definitions are minted by the coupon authority. Whether coupons have been applied to transactions is recorded by the coupon authority, as are coupons’ chains of custody from the time they are minted to the time they are spent, including all data related to how and when they were share

For those of you unaware, merchants are rather stingy with their store data. The Visa’s team best effort here is with Monitise and the new iPhone application “Visa Offers” (link is my related blog). It results in a coupon with a bar code and you show your iPhone to the cashier. How does google intend to integrate to merchants and receive store level data? I can’t imagine Amazon being excited about this.. or Wal-Mart in that matter.