26 Jan 2011

Today’s Article in TechCrunch: Apple Aims to take NFC Mainstream

Previous Blogs

- Apple’s NFC Patent

- Who Owns the Secure Element

- ISIS: Moving Payments from Rail to Air

- Mobile Advertising Battle

- Durbin and Debit (Payment Profitability)

To summarize from my previous blogs (regarding Apple’s NFC moves)

- Not about payment but about advertising. The mobile device will be the top advertising platform for the next century. It provides a unique opportunity for convergence of the online and physical worlds (with the commensurate customer data). In the virtual world there is a “click” by which google can bill. There is also an “order” by which online retailers track channel advertising effectiveness. Apple’s moves in NFC represent the combination of the click and the order AT THE POS so that advertising effectiveness can be managed. It is ALSO a platform for many, many other services through which Apple SEEKs to control (and monitize).

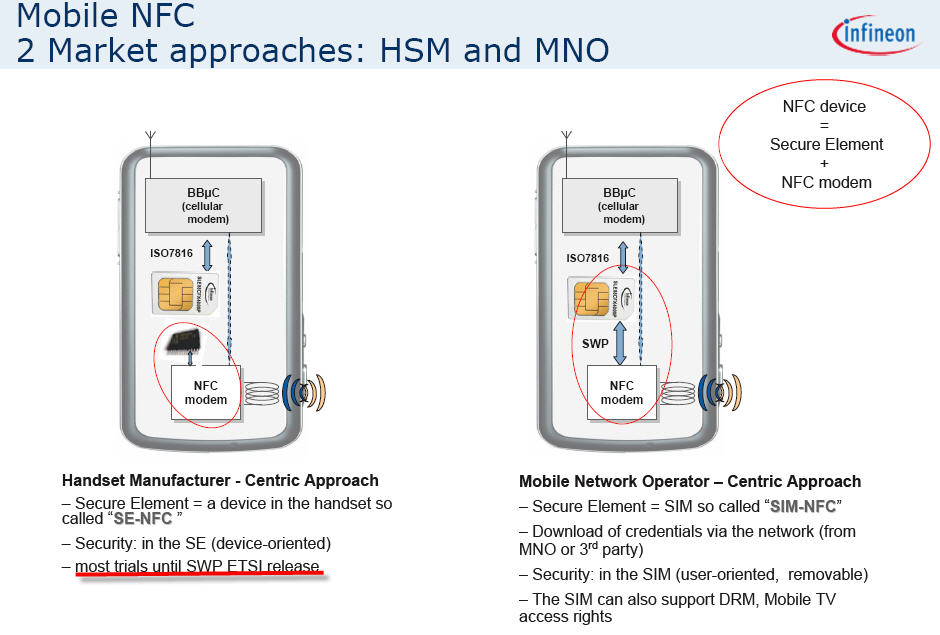

- Apple’s desire to control the secure NFC element is not aligned with carriers (in the US) or internationally. How will Apple’s NFC integrate with the SIM? Will they follow the GSMA approach? Most interesting is whether Apple will support Single Wire Protocol /UICC model or will it have a unique architecture (SE NFC) with Apple acting as TSM and managing the secure applications outside of the SIM?

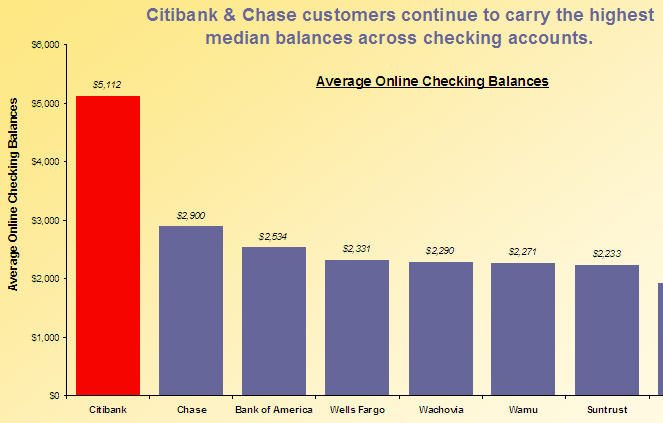

- Apple has 4 separate payment infrastructures today: Legacy Apple Store, iTunes, App Store and global treasury. They are indeed building a new payment infrastructure to support their wallet. Rumors are they are working with a big bank (?Chase?) as well as considering acquisition (ex. GlobalCollect). It seems that they are confident that they have capability to support US market rollout.

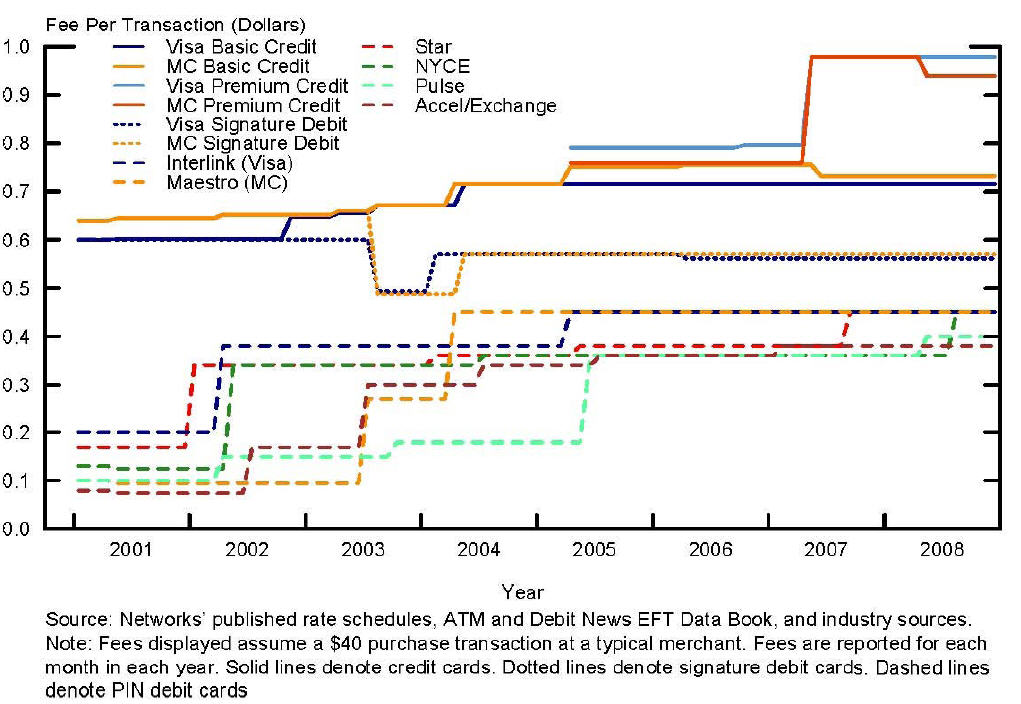

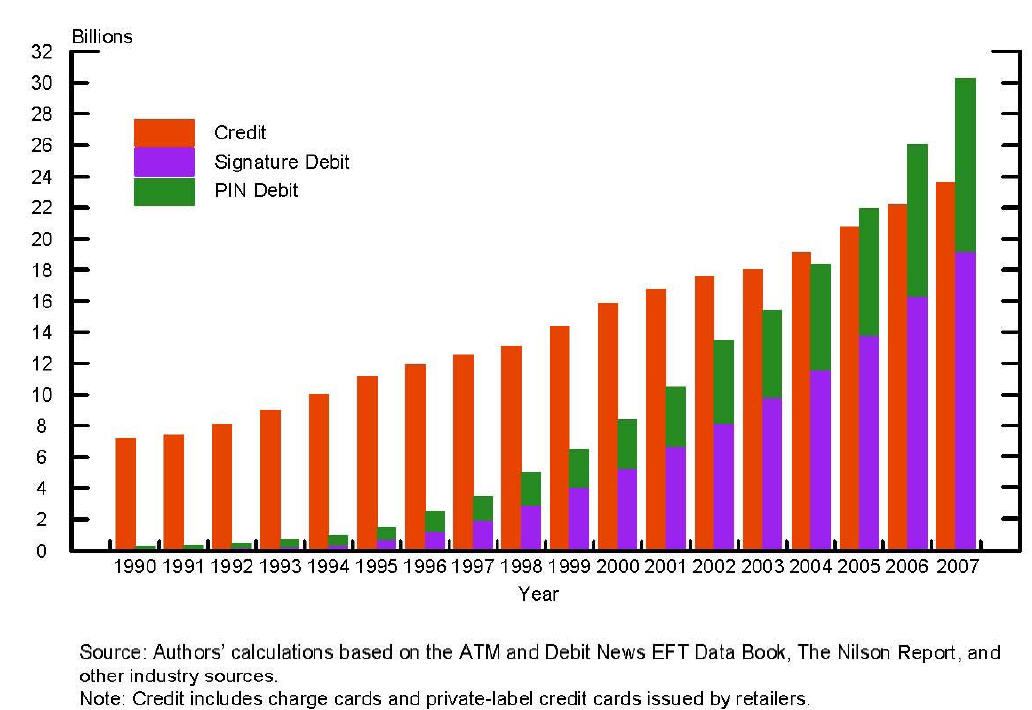

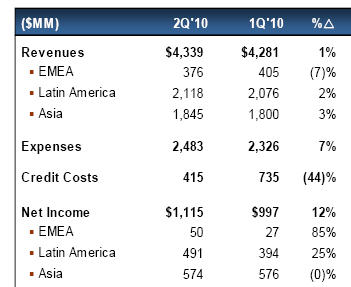

- TechCrunch is well off base in its assertion that the Debit interchange provides an opportunity for Apple. Actually, the reverse is true (in US Market). As discussed in the ISIS blog above, the key for NFC adoption is merchant POS infrastructure investment. ISIS is working with several large retailers to subsidize POS infrastructure. ISIS is doing much heavy lifting in its payment system incentives. Discover/Barclays relationship allows ISIS to build a merchant friendly value proposition and gives ISIS a unique ability to “control” the NFC/PCI certification process. Given that Apple is currently outside of ISIS, it must have another payment network to support it at the POS. Apple has typically partnered with Visa (given that MA has partnered with RIM this would make sense). In either case the merchant transaction costs for an Apple/NFC transaction will be higher (Visa controls the MDR) and Visa will control the NFC certification process. Apple may create a package of marketing incentives that will offset the merchant costs, but marketing effectiveness will be poor in the early stage (prior to NFC at POS). A classic chicken and egg problem.

Take Away for Investors/Start Ups

- Apple will be a very, very hot platform for mobile applications.

- Do not assume that there will be substantial payment volume in next 4 years

- Assume there will be iAd “advertising views” but few mechanisms to track effectiveness until payment is captured

- Important: even after payment is captured, the item detail will not be available to Apple. Apple will be able to track that customer clicked on iAd, and visited store, but NOT what item was purchased. There are a few companies addressing this… but not going to spill the beans here as I really like this space.

- Apple’s ability to capture mass media spend will be driven more by Steve Jobs and the demographic of the iPhone user base.

- Apple will have continue w/ interim CPC model on iAd until tracking through POS. They will likely attempt to develop a couponing system, but bar codes on iPhones are viewed very negatively by retailers.

- Expect to see many “four square” like start ups which try to leverage store visit check ins. But less than $2B in marketing spend shifting to platform until POS integration.

- Look for Investment hypotheses that align to Apple core services (acquisition/exit)

- Payment will take some time, DeviceFidelity spent almost 2 years in certification with Visa. In short term look to complimentary services. Examples

- NFC to Open Doors

- Physical advertising with NFC (NFC in a store display through coupon redemption)

- NFC “Four Square” like Check In (ex shopkick)

- POS Infrastructure (VivoTech, Verifone, Vending Machines, …)

- Retailer friendly applications that attempt to marry iAd data with retail POS data (think KSS Retail, DemandTec, ….)