Target’s 10-Q was published Friday for quarter ending 10/30/10. I’ve started following Target’s financial services performance given the US launch of their new

REDCard decoupled debit. All of this seems a little like back to the future… 40 years ago each store had their own closed loop branded card, 100 years ago small stores offered their customers store credit. Target’s innovation is creating a card that couples 0% interchange, with loyalty program that they control, in an infrastructure that already exists (Target’s card group and

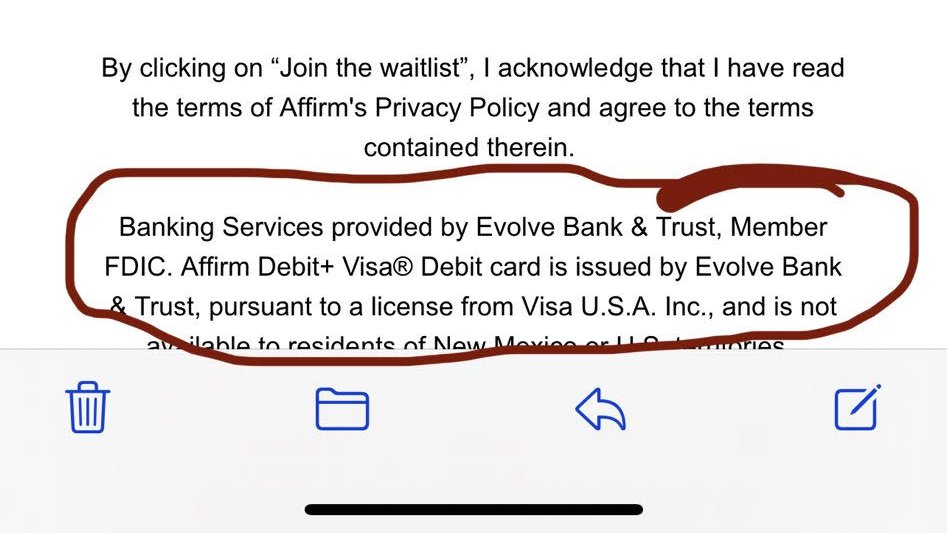

Target bank).

Financial services execs within: big banks, retailers and the payment networks are keeping a close eye on this product. Target has a very unique competency in payments through its ownership of

Target Bank and associate card processing. Historically, Target’s card portfolio has been either a millstone or a jetpack. REDCard takes out the majority of the credit risk (aka the millstone) and leverages the card processing infrastructure to provided a competitive advantage.

The REDCard launch looks like a smashing success, and through the 10-Q we can estimate the initial adoption for the 15 days within the national launch (adding a small base within the Kansas City test market). On page 14 and 17 we see that Target accounts for REDCard’s 5% rebate as reduction in sales, with the card unit reimbursing a portion of this cost (operations and marketing). In other words the “net cost” of to the card unit: REDCard’s 5% less card processing costs (ie interchange, …etc).

- Reimbursed amount: $26M

- Less 10% one coupon run off: $19M (Estimated).

- Card Net Reimbursement for REDCard: $7M

Red Card TPV (Assuming 200bps average cost of payment)

REDCard 15day TPV = $7M/(500bps-200bps) =

$233M

(out of quarterly sales of $15.2B)

Admittedly, I do not have a way to resolve the difference between this number and the market penetration number below (from 10-Q). As stated below REDCard includes Target Credit card, Target Visa Credit Card, and Target Debit Card. When will these cards recieve the 5% off? Perhaps after new terms are agreed to and deposit accounts are linked (comments appreciated).

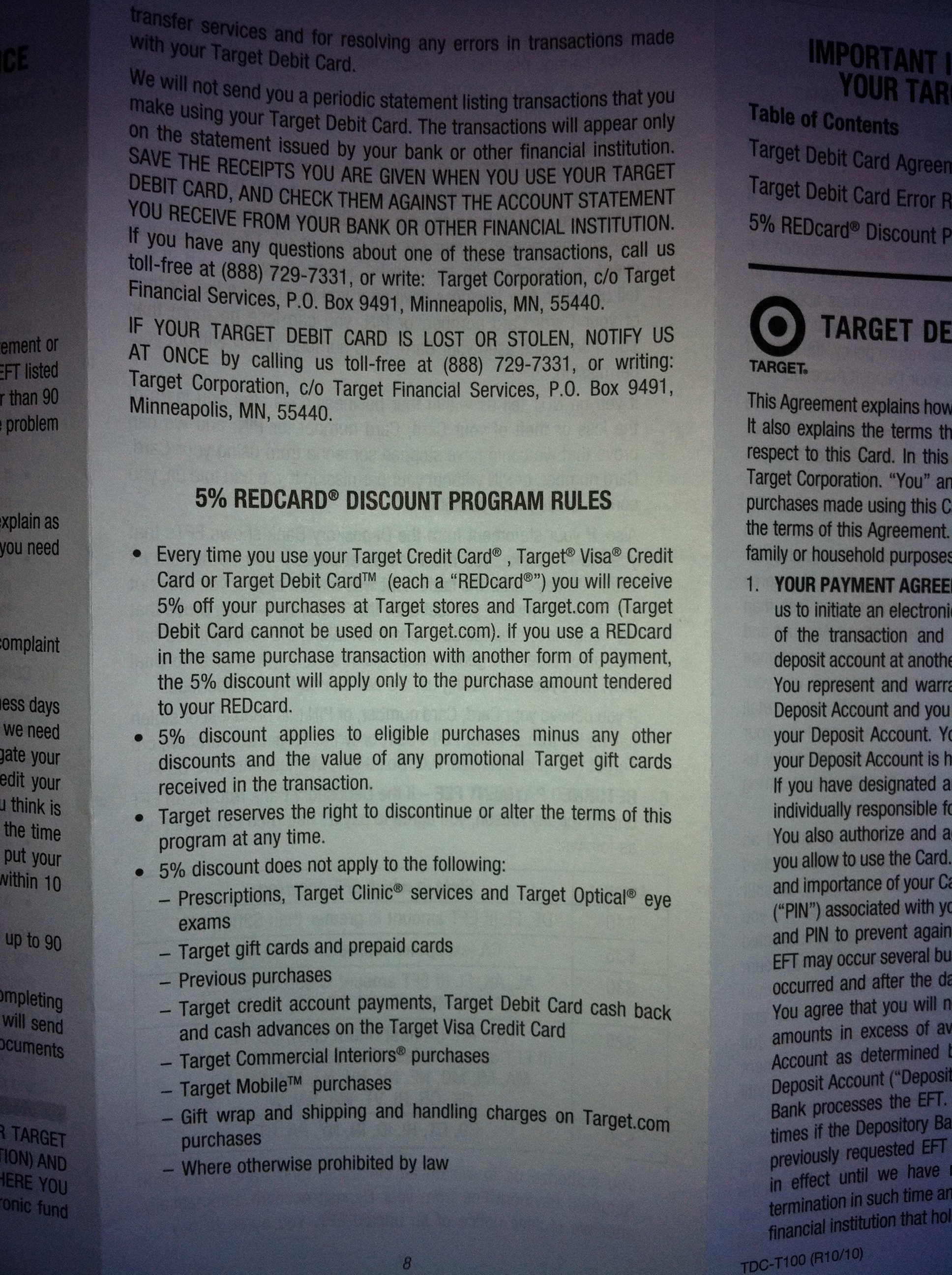

Beginning April 2010, all new qualified credit card applicants receive the Target Card, and we no longer issue the Target Visa to credit card applicants. Existing Target Visa cardholders are not affected. Beginning October 2010, guests receive a 5 percent discount on virtually all purchases at check−out every day when they use a REDcard at any Target store or on Target.com. Target’s REDcards include the Target Credit Card, Target Visa Credit Card and Target Debit Card. This new REDcard rewards program replaced the existing rewards program in which account holders received an initial 10 percent−off coupon for opening the account and earned points toward a 10 percent−off coupon on subsequent purchases. These changes are intended to simplify the program and to generate profitable incremental retail sales.

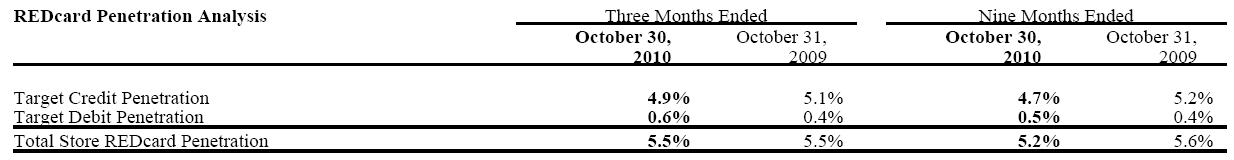

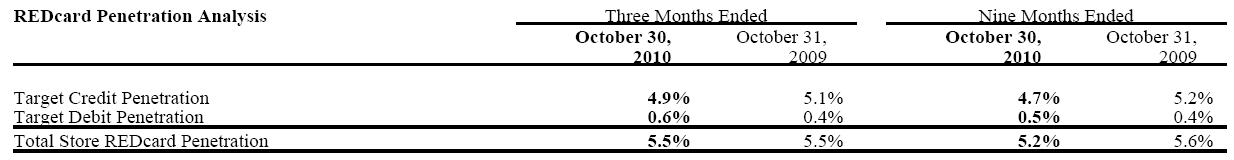

We monitor the percentage of store sales that are paid for using REDcards (REDcard Penetration), because our internal analysis has indicated that a meaningful portion of the incremental purchases on our REDcards are also incremental sales for Target, with the remainder of the incremental purchases on the REDcards representing a shift in tender type.

Note a) on Pg 17

Loyalty Program discounts are recorded as reductions to sales in our Retail Segment. Effective with the October 2010 nationwide launch of our new 5% REDcard rewards loyalty program, we changed the formula under which our Credit Card segment reimburses our Retail Segment to better align with the attributes of the new program. In the three months and nine months ended October 30, 2010, these reimbursed amounts were $26 million and $60 million, respectively, compared with $19 million and $59 million in the corresponding periods in 2009. In all periods these amounts were recorded as reductions to SG&A expenses within the Retail Segment and increases to operations and marketing expenses within the Credit Card Segment.

Congrats to Target on a great launch. Already we see some of their strategic plans to refocus the across the board 5% incentive to something more “targeted” (pardon the pun).

As reported in Mashable, ShopKick is being trialed in 242 stores. I would hope Target looks to white label this to make it their own service, unless they have an equity piece to incent them to build ShopKick’s network. Issue here is that they checkout process is still rather complex. The great thing about ShopKick is that it is focused on keeping foot traffic in the store when a prospective buyer finds a lower price somewhere else, shopKick can help generate a specialized offer to keep them. This works well for big ticked items, but for more than 1-3 items it will be a nightmare as the POS integration is not there.

Is this the beginning of more store cards? What is the “tipping point” which makes this model attractive to other retailers? Will customers take one more piece of plastic in their wallet? Can Target sustain this level of rewards, or will they look to target incentives after critical mass of acquisition? Will merchant acquirers and processors respond with new services?

The competitive barriers are high, as bank licenses and card teams are not formed overnight. How would I leapfrog Target? First tell me where I go to buy a Flux Capacitor?