25 May (updated)

WSJ: Bank launch Clearxchange

Banks take back mobile momentum!! Everyone else.. stay away from P2P because this team will own it.

BAC, JPM and WFC launch Clearxchange .. a mobile pay anyone service. This is a very solid idea by the 3 top US retail banks… after all why should PayPal route funds between banks? Banks have always had the capacity to make this work, but have lacked the structure (and business case) to pull this together. Their real risk was banks loosing the “directory battle” (referred to in my previous blog on Chase QuickPay). The last Bank driven initiative of this scale was Spectrum in 1999 where banks decided that acting together in electronic bill payment was the right thing to do..

A short history on this initiative. WFC and BAC got together and created Pariter Solutions a few years ago for “on we” clearing of ACH and images. Pariter initially received the charter to also move toward developing “on we” clearing for mobile/online P2P transactions, but this was pulled late last year as Pariter was having challenges executing against its core mission. Subsequently BAC and WFC got together and created Clearxchange to develop a common “directory” and online/mobile application infrastructure for P2P routing (ACH processing is TBD, but likely to be handled by host organization with clearxchange as a 3rd party sender).

Chase was an early leader here.. QuickPay delivers all of the functionality of Clearxchange… plus some. At one level, I view clearxchange as building what Chase (and Cashedge) already have. Chase has agreed to participate in directory sharing, so that Chase customers can send/receive to Clearxchange customers.

I’m a very big supporter of ClearxChange’s bank led P2P model, banks must own this for this service to take off. Remember, retail payments are a money looser for banks, the WSJ article did an excellent job describing the dynamics. By taking the lead, I would hope other banks also participate directly with ClearXchange or through Cashedge’s PoPMoney service (described here in blog).

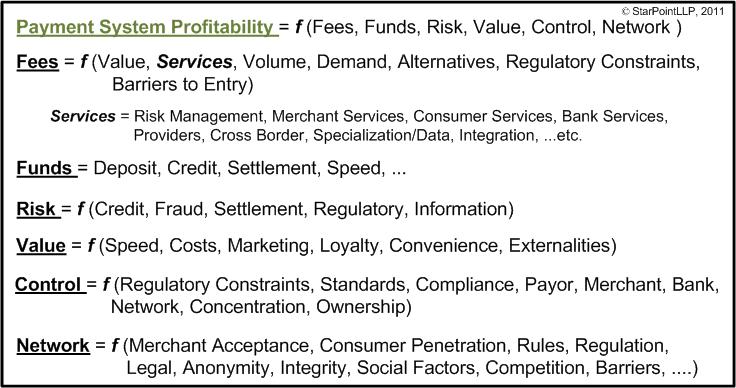

Moving money via ACH is technically simple, the real challenge is in risk/fraud management. On this level, there are only 2 organizations with substantial fraud management skills in cross bank P2P: Cashedge and PayPal. Both have 10+ years of ACH history. In the last few years banks have collaborated in developing shared fraud models (can’t really discuss specifics for obvious reasons) that now allow them to substantially reduce risk without prior transaction history. The long term objectives of CX are rather vague (bank control of ACH rails, and balance retention in DDA). Their short term plan is to move consumers to a “push” model, where funds are sent from a bank authenticated log in. Banks want to be the starting point of a transfer. This positions them as the trusted intermediary, with benefits in fraud and cementing consumer behavior. This is a significant announcement with over 3 years of planning behind it.. but scope is narrow.

The push (ACH Credit) P2P model, where customer initiates transfer from their bank, has a poor history (search on “Paybox success”). The historical issues here have nothing to do with technology, but rather business model: simple and free funds transfer is not a great business. I’m very curious to see what CX’s revenue model looks like.. At one level I do laugh.. just 5 years ago, the only top 5 Bank to allow online transfers out of the bank was BAC. I ran online and payment services at Wachovia (now part of WFC) which included all the online payment operations. The other bank retail heads were very reluctant to launch online transfers because of the risk of deposit run off.. or rate hopping. … wow have things changed.

Every year the banks delayed this service was another year that PayPal could develop a directory of mobile phone numbers, e-mail addresses and ACH information… this is the real battle… retail payments are a terrible business when viewed as a stand alone product.. but are essential to retail banking. (See Banks will win in Payments).

The only “cons” I have for ClearXchange are:

- It involves a technology build.. and clearly Chase and Cashedge have already built these functions. The banks should have gotten together and bought Cashedge.. particularly since BAC is Cashedge’s biggest customer.. they could have been running with this for 2 years

- The structure. Why not put this in The Clearing House? or Early Warning Services? another bank owned consortium does not make sense given their charter unless they plan on involving non-banks

- BAC, JPM, WFC.. will you please walk away from Visa Money Transfer.. they are attempting to walk all over what you are building here. My guess is that your Visa relationship managers are not talking to your P2P teams..