22 November 2010 (updated 15 Dec, sorry for previous typos)

SUMMARY: VMT may by “Mandatory” but no one cares and is not acting on it.. As one bank told Visa “do you want my attorneys or yours to draw up the waiver”.

Correction (11 March) Chase and Bank of America are committing to it in next 6 months.

Visa Money Transfer Overview – Issuer presentation

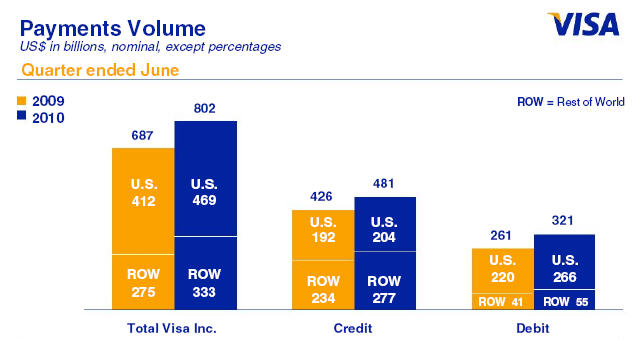

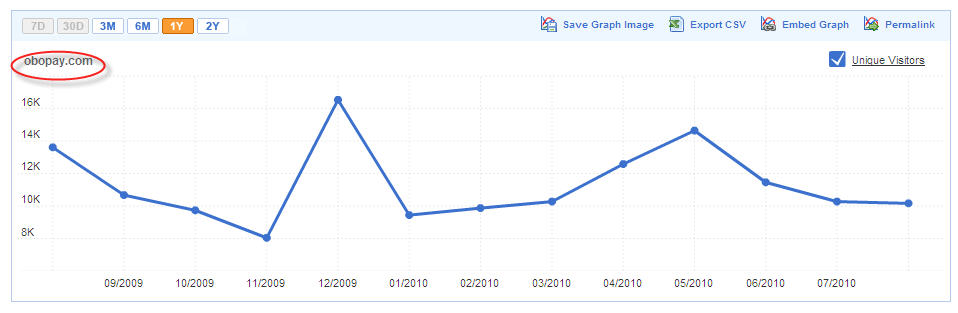

I’ve been on the phone this month with several folks focusing on the unbanked and emerging markets. A clear theme has emerged: card based money transfer will not be successful except in very limited circumstances. This is true for both (pre-paid) cards tied to mobile phone plans and network initiatives (Visa Money Transfer, Mastercard Moneysend/Obopay). Visa and Mastercard both have grand designs for taking part in the tremendous growth within emerging markets, but it looks like the growth will be at the top end (which is still substantial) rather than with the unbanked in areas like G2P payments.

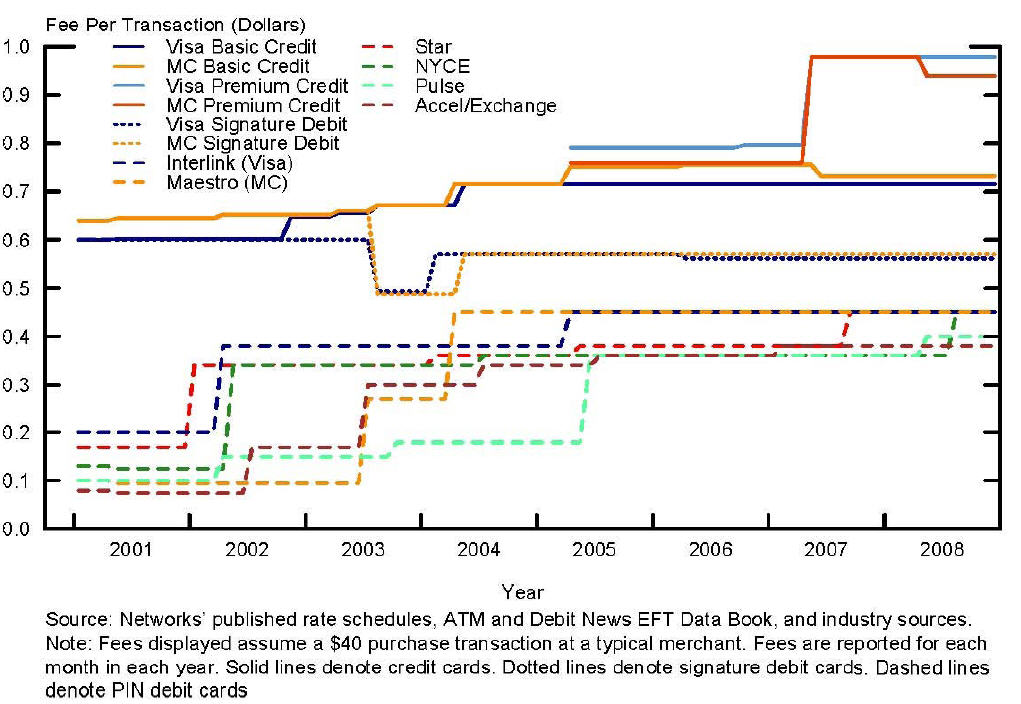

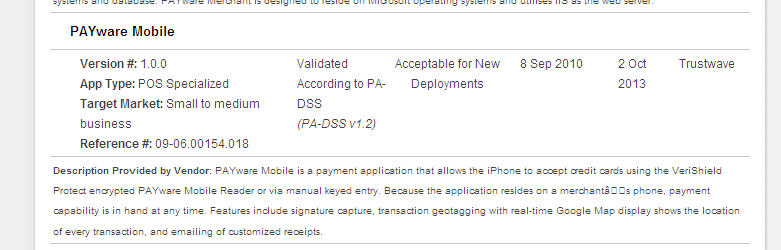

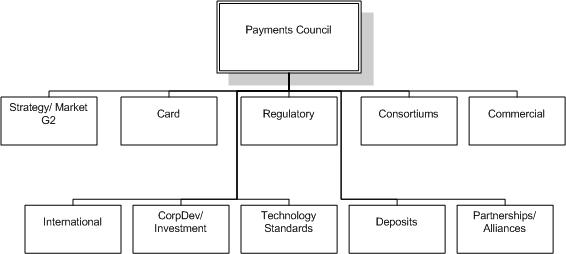

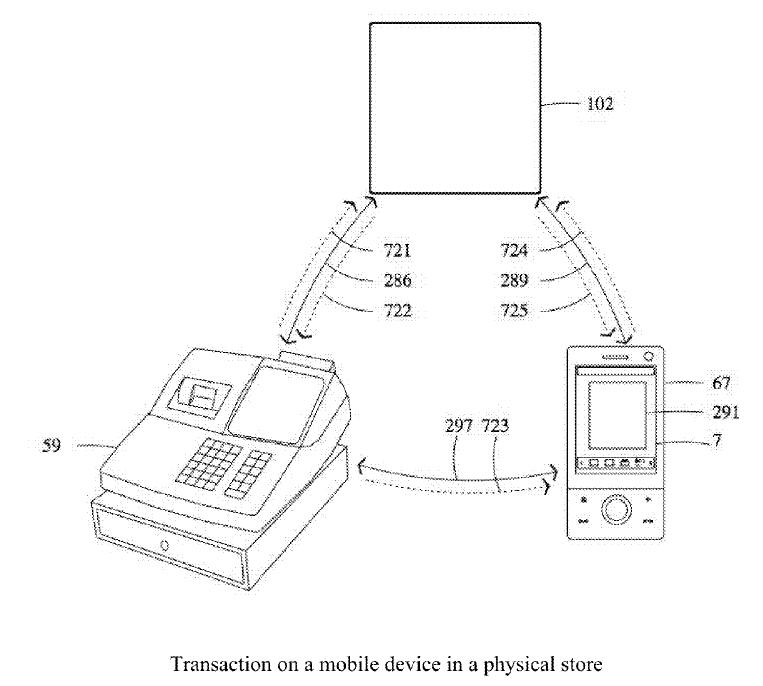

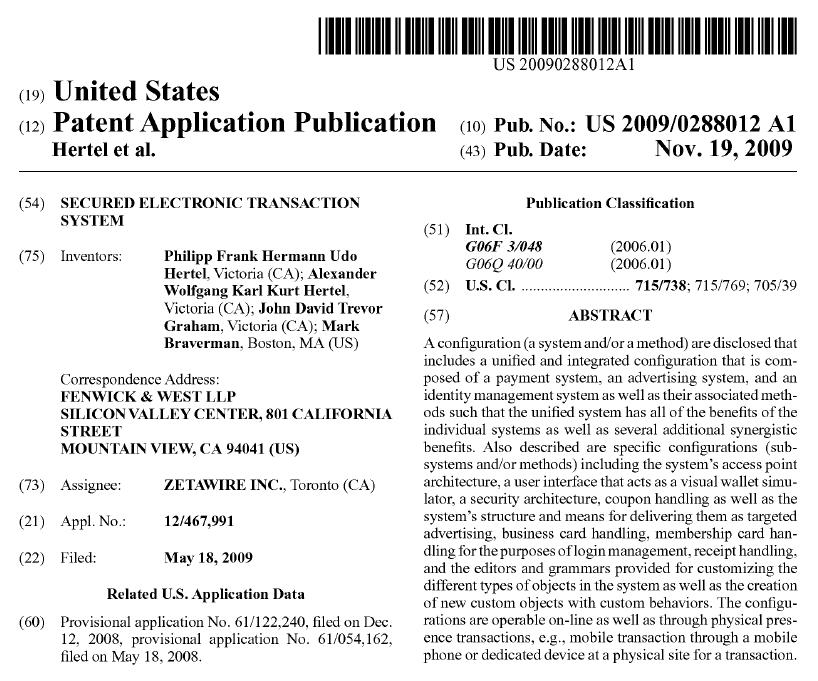

In my previous blogs, I’ve certainly shared my views on Obopay/Mastercard. This blog focused a little attention on the Visa Money Transfer (VMT) service. In both the Mastercard MoneySend (MMS) and VMT models the networks own the switch of card/bin/mobile#/service provider/issuing bank. MasterCard’s MoneySend service attempted to focus Obopay in “mobile acquiring” of both senders AND beneficiaries (come pick up your money). VMT’s AFT/OCT transaction set (see Patent) attempted to bypass this “registration” intermediary and go directly to issuers. Technically, the solution is excellent and the comments below are not meant to detract on Visa’s substantial lead on MA in developing this service. The problem with VMT is the business model. Unfortunately for Visa, global card issuers (particularly in OECD 20 countries) are taking a pass. The adoption challenges are particularly acute on Debit and within Western Europe (business case, conflicting services, pricing, fraud, customer support, agreements, Visa Europe and bank control… ).

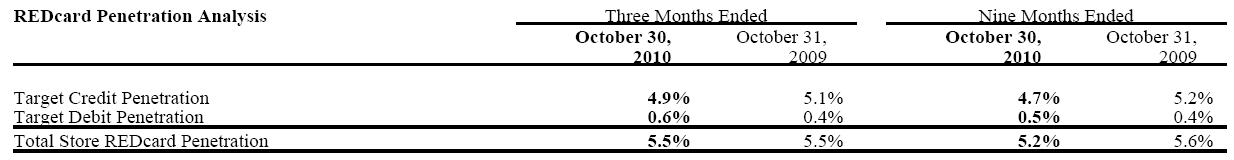

VMT also suffers from 2 widely held misperceptions: it is “instant” and mandatory. With regard to the first item, just as with any debit transaction funds can “post” to the account but actual clearing and settlement is at best next day. It therefore remains up the each bank when to show the “post” and when to make funds available (within the Reg E guidelines it can be up to 2-3 days). With respect to VMT’s “mandatory” status, I’m surprised that this issue has not been picked up in the mainstream press. Visa has lost its ability to force issuers to do anything, particularly when a contract addendum is required. I can tell you with certainty that 4 out of 6 large US banks DO NOT plan to implement VMT on the debit side. These banks like being in control of their liabilities run off and payment channels. Visa has much better adoption prospects on credit side, but the “mandatory” date has slipped from Oct 2010 to something more “flexible”.

Retail Banks are very reluctant to provide Visa/MA an avenue for service and product growth that they neither own or control. Visa’s attempted to “force” issuer’s hand by making the AFT/OCT transaction set mandatory is rather amusing and makes for good theater (see Visa Money Transfer Overview – Issuer presentation). The “incentive” for issuing bank to accept new agreement is a $0.50/tran revenue share (beneficiary). Market data clearly shows lack of participation and hence Visa is attempting to adapt and shift focus of VMT to narrow market opportunities. I’ve listed three example efforts and probability of success (reaching $10B+ TPV).

1 – Large Bank (<10% probability of success)

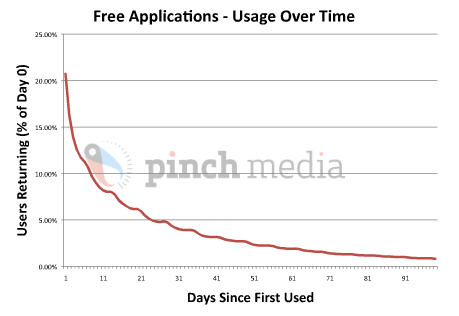

Work with a large bank (like Bank of America) to lead adoption and create a critical mass with a focused value proposition (example: USBANK mobile phone/NFC). We all understand the convenience strategy for the NFC/POS/Phone focus, but for P2P? If you are scratching your head, join the crowd. Why would banks outsource P2P payments to Visa? If Visa only gets 1-2 “a major banks” to join them, what will be the P2P proposition? I can just see the Visa commercial “with Visa Money Transfers, you can instantly transfer money to some other cards some times and funds will show up in 2 days”….

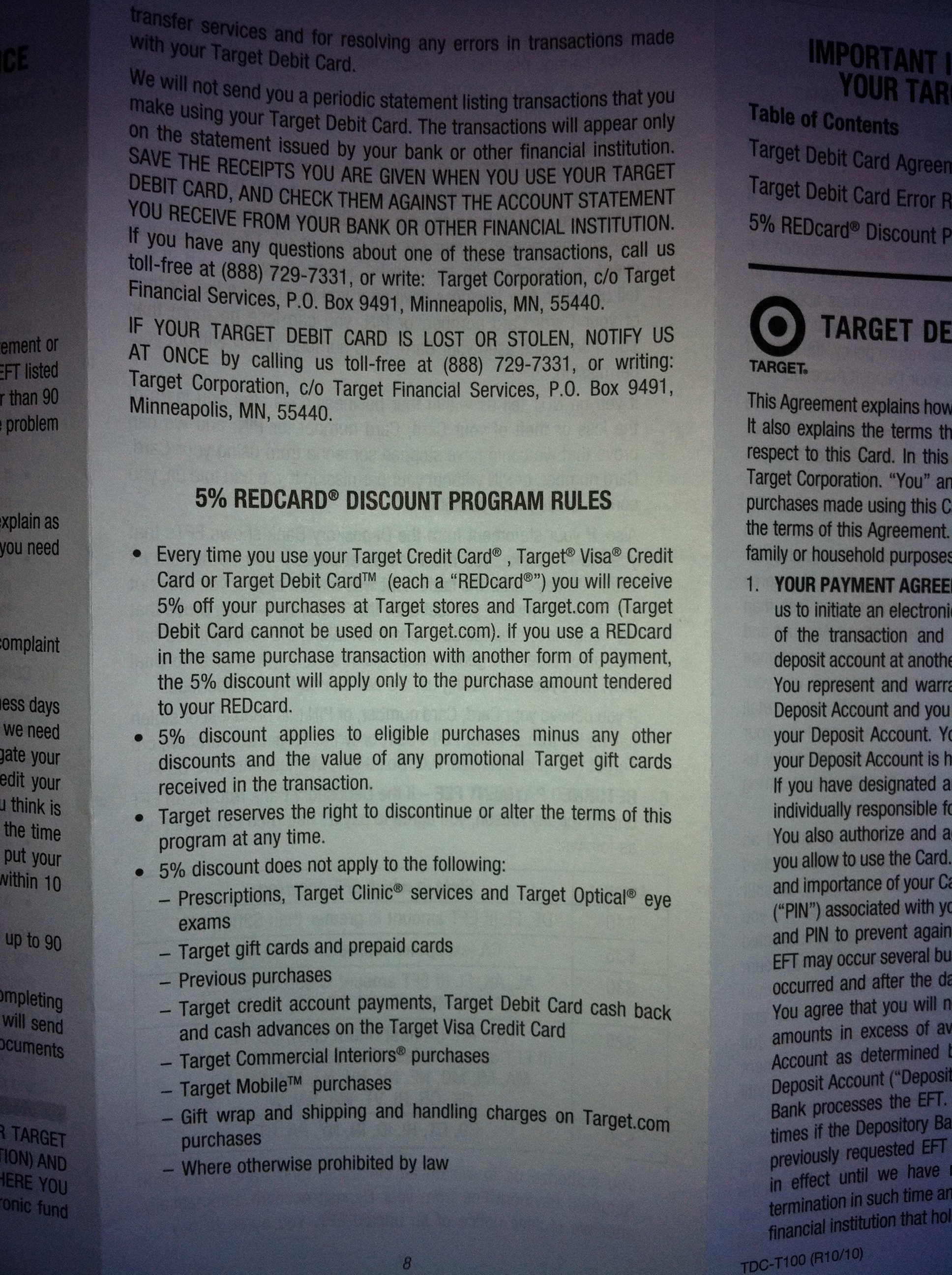

Beyond the issuer adoption issues, yhy would you pay $0.50 to send money to a domestic bank account when you could do it for free online? The problem here may be that the bank’s card team doesn’t talk to the retail team… Banks need to think strategically about this and stop Visa’s P2P efforts in their tracks. Card-Card transfers present consumers with a very confusing option and forsake the enormous bank investments in shared infrastructure (ACH, RTGS, Clearing House, Early Warning …).

Message for smaller banks.. Visa is NOT getting commitment from the majors to adopt this “mandatory” transaction set. The “Mandatory” Oct 2010 date has been pushed back to April (and will probably be pushed back again). To be clear, the credit side of the house loves the idea of VMT, the debit/deposit side does not. The “value” of VMT is on the Debit side. Can you imagine the customer experience of any solution using VMT.. it only works for 50% of the cards. Message to vendors: don’t build your solutions around VMT.

2 – Domestic Payments – Emerging Market (<10% )

Solve specific problem in emerging market (India domestic money movement). Few people realize that (within India) Western Union and MGI are licensed to receive only. They cannot transfer money within India. Hence banks like ICICI and HSBC are offering VMT. As noted in a previous blog, each bank may choose to act as either remitter and/or beneficiary. Citi for example allows VMT receive, but not send. The VMT service fills a small gap in India today, but this gap should recede as banks accommodate recent updates to NEFT/RTGS process . In fact only today, India’s RBI launched Instant Interbank Mobile Pmt Service. VMT’s consumer value proposition is built around gaps in bank services and requires bank (issuer) sponsorship.

With respect to VMT as a cross border money transfer service, Visa will have no trouble signing up beneficiary banks in emerging markets. What they lack is origination network (above). They will see some progress with mid tier banks in specific markets (MEA), as they extend thier role as cross border processor (from P2B to P2P). Enabling beneficiary banks to nudge out the MSBs. This is why RBI approved the VMT service in India.. it was good for banks and bad for MSBs.

3 – NON BANK partners (40%, if emphasis is on prepaid)

MoneyGram Example. Following in the theme above, Visa is a network business and the strategy of any network business is to increase volume. Given that issuing banks are not signing up for originating AFTs, Visa is moving aggressively to create partnerships with MSBs, post offices and other non-banks for “cash in” services. These non-banks can also sell pre-paid cards through additional partnerships. This is not a “bank friendly” strategy, but market focus seems to be non-banked.

If card based money transfer is not the future what is?

The answer really depends on what problem we are trying to solve. Remittances? POS? P2P? In the unbanked world, interchange and sender pays does not work. Regulators will not let US based companies derive revenue from G2P payments to the rural poor. Visa has many assets to create a successful solution, specifically in its Monitise unit, but ACH payments do not provide a great business model for Visa (or its bank partners). Again reinforcing the axiom that retail payments is a very low margin business (in steady state). This is why MFI and MNO models present a better opportunity, payments supports the profitability of their existing business models to a segment of customers that they already serve.

Will Visa find growth in VMT? Absolutely, growth from 0 is always and easy achievement.

Will it be a $50M revenue business for them? Not that I see, neither in emerging markets nor in OECD 20. Visa’s 10+ innovation initiatives are a mystery and a nuisance to issuers, banks no longer want Visa to control and view P2P as an encroachment on their core deposit relationship. In emerging markets, the regulators will not let Visa succeed beyond the top end of the market (not the base of the pyramid). Since writing this, Visa announced that Indian regulators approved the VMT scheme for inbound remittances. There will be some success here, primarily with regional banks looking for a focused partner (UAE Bank looking toward India remittance service).

What should Visa do? Instead of attempting to develop customer facing services and brand (ie payclick, VMT, …) that compete with bank offerings, it should focus on expanding the capability of the network to handle additional data types (fraud info, POS items, coupon, location, …). Make the rails more robust and new ecosystems will form to take advantage. Of course the downside of this approach is that it takes agreement of 4 parties to make this type of change, hence the change cycle is over 20 years. This is one of the reasons that new networks are forming which support new business flows and switch data to Visa only when necessary (business remittance/invoicing is excellent example, eCommerce another). This cycle further isolates the card networks, and drives innovation outside of the “card process”.

See August 2010 White Paper from US Federal Reserve

http://www.frbatlanta.org/documents/rprf/rprf_resources/wp_0810.pdf

Thoughts appreciated.

![]()

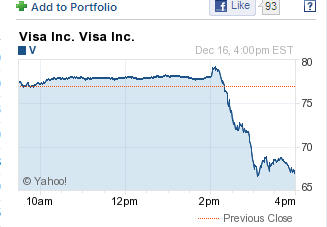

WSJ – Issuers Howl

WSJ – Issuers Howl