Short blog – 80% confidence

© Starpoint LLP, 2022. No part of this site, blog.starpointllp.com, may be reproduced in whole or in part in any manner without the permission of the copyright owner.

Phase 1 of TCH’s token efforts will be in SRC model. A bank branded “wallet” acting in the DCF role for TCH PIs . Just as VAC has enabled the elimination of physical hardware for acceptance, issuers see a plastic-less future for cards. They want to own the issuance of cards and want much more than a token, they want the entire “wallet”.

Go to market is either as:

- TCH as SRC System, or

- Visa as the SRC System for all TCH banks (V and MA) with TCH is a “unique role” managing all consumer data, registration, payment tokenization, …

Per my previous blog on SRC, 3DS 1.0 was rolled out globally in 2008 with a liability shift and rate reduction. This did not occur in the US, and US banks have been resistant to V/MA efforts to participate in network led SRC (3Ds 2.0). While they had been working on their own wallet (see Authentify), either Visa or TCH convinced them to drop their own wallet efforts and jump on board the SRC standard. Who is running what is the question. As of today I think Visa is the lead.

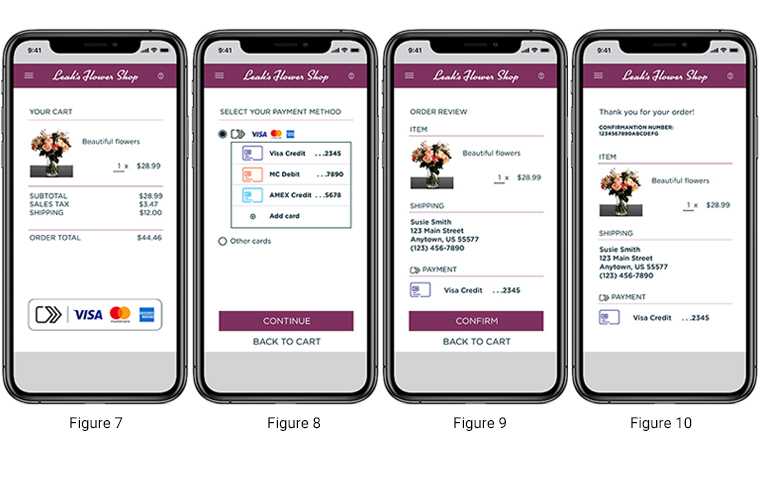

What would this look like to consumers?

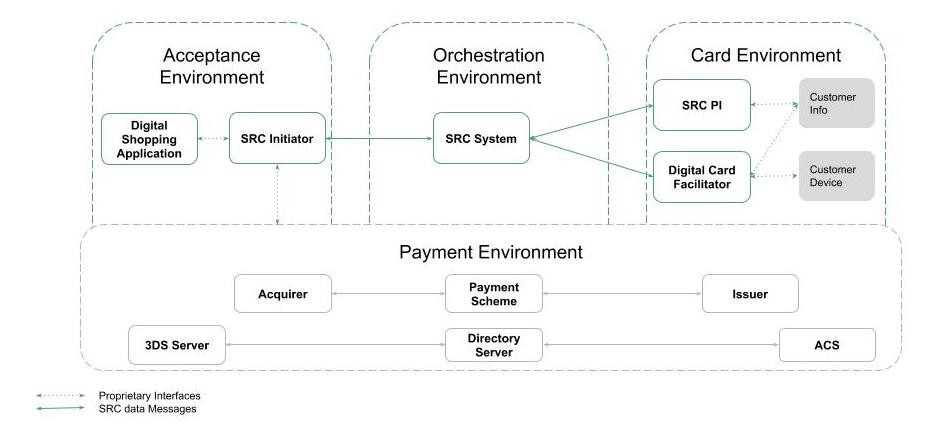

Generic SRC flow is shown below and available from EMVCo Whitepaper

In scenario 1, the SRC Logo would resolve itself to TCH operating as the SRC System and DCF role. The bank’s Authentify wallet effort was just a phase in their efforts to expand to SRC. Figure 8 above is the big unknown, my assumption is that issuers will auto-enroll all customer payment instruments and make them available. These instruments will be represented as TCH tokens. Who will resolve them and at what stage?

The merchant processor must resolve the token to route them. When VTS and MDES are token providers this is not required (for processing), but processors are not integrated to TCH… With one big exception – Chase Merchant Services (PaymentTech). I believe all 4 of the early eCom processors are on CMS.

Side note: TCH is the US token vault for both VTS and MDES so they have the ability to resolve all tokens.

Unknowns.

- Does this mean that TCH just appropriated SRC for US eCom?

- How do non-TCH banks use SRC?

- Is any of this a better experience than Apple Pay? or the Shopify Wallet? or Chrome autofill?

- Can SRC support multiple SRC system providers that compete?

- How will V/MA credit be routed? Will issuers find a way to route off network (ex everything is chase token)

- What volume is at risk? eCom with infrequent merchants? Trusted merchants have COF and larger merchants do their own processing function or would resist the SRC button without a clear benefit.

- How to banks educate consumers on the benefit? US consumers really don’t care about eCom card fraud today. Is it a privacy/data security play?

- How will this integrate with the online banking experience?