Lessons from PayPal

January 25, 2010

I was on the phone today with Jeff McConnell, a tremendous exec with a long history of leading innovation in money transfer (WU, Moneygram, iKobo, …). In some respects it’s hard for me to believe that 2002 is 8 years ago, and I was reminded of how challenged PayPal was in obtaining the proper licenses “after the fact” in its early business.

In his 2006 book The PayPal Wars, Eric Jackson did an excellent job laying out the challenges paypal faced in its early years. In the early days after its inception in 1999, PayPal was moving toward becoming a bank, but the Internet startup decided that banking regulations were too cumbersome. “We just wanted to be able to facilitate a quick payment,” he said. “The question of how to classify PayPal lingered for some time….It’s a sort of modern-era Western Union.. really, all PayPal is doing is shifting money around on your behalf.”

To see the “change” in PayPal’s regulatory approach, take a look at PayPal’s 2002 prospectus.

We believe the licensing requirements of the Office of the Comptroller of the Currency, the Federal Reserve Board or other federal or state agencies that regulate or monitor banks or other types of providers of electronic commerce services do not apply to us. One or more states may conclude that, under its or their statutes, we are engaged in an unauthorized banking business. In that event, we might be subject to monetary penalties and adverse publicity and might be required to cease doing business with residents of those states. A number of states have enacted legislation regulating check sellers, money transmitters or service providers to banks, and we have applied for, or are in the process of applying for, licenses under this legislation in particular jurisdictions. To date, we have obtained licenses in two states.

This 2002 regulatory view, by the Paypal exec team, was based on a position that PayPal was acting as a Third party payments aggregator (TPPA), not in need of a money transfer license. TPPA is a description used for merchants that are charging a credit card for a product or service that they do not own. TPPAs simply facilitate the exchange of money between two parties sometimes using a credit card as a funding source. Several fraud and AML incidents arose which got the attention of both federal and state organizations. It became clear that PayPal was being used for much more then payment for goods within the eBay marketplace.

In Feb of 2002, the Federal Deposit Insurance Corporation (FDIC) ruled that PayPal is not a bank, which accelerated efforts by states to pursue PayPal for violating money transfer laws (New York and Louisiana are most notable). This could have been the death knell for PayPal, as they were operating without the proper licenses. PayPal’s “post facto” licensing efforts were greatly aided by the local political support from thousands of eBay’s buyers and sellers. Today, according to spokesperson Michael Oldenburg, PayPal is licensed as a money transmitter in 43 states (not all states require a license), demonstrating that regulatory risk was far greater than what they articulated in the 2002 prospectus. For those interested in the legal/regulatory conundrum faced by regulators, I highly recommend: Regulating Internet Payment Intermediaries, by Ronald J. Mann, University of Texas School of Law

For today’s “emerging” payment companies, there are 4 primary choices for operating in the US:

- Obtain the licenses

- Operate as an agent of an entity with the proper licenses

- Sell your software to a licensed entity

- Exchange non-monetary forms of value (minutes, eGold, credits, …).

Obtain the licenses

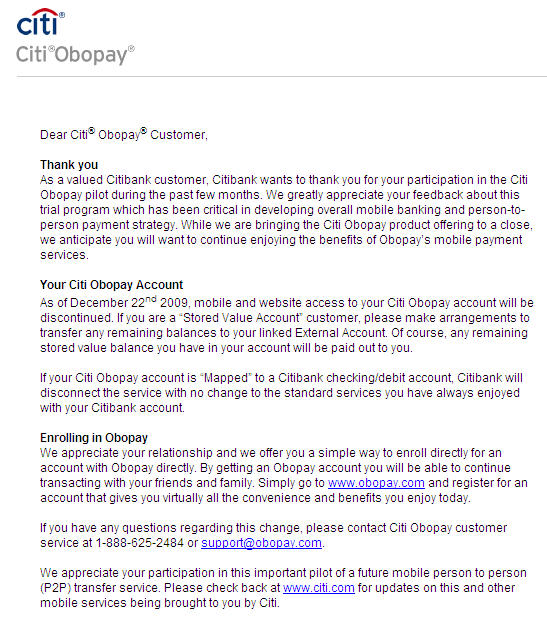

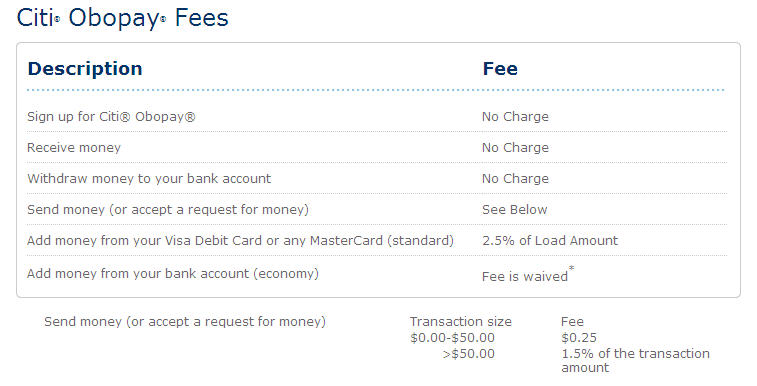

For those of you that read my Blog, you’re probably aware that I’m fairly negative on Obopay, however they do excel in obtaining US MTO licensing (https://www.obopay.com/corporate/stateLicenses.shtml) . Unfortunately, all of these US licensing effort seems for naught as they are pulling out of the US and focusing in emerging markets as the “sender pays” model does not work in developed countries (morphing from a failed US P2P effort to Remittance). Today, PayPal, Western Union, Travelex, Moneygram, MoneyBookers (soon to be NY licensed) also operate as licensed Money Transfer Organizations (MTOs).

Becoming an MTO is not for the faint of heart, as regulatory capital requirements in excess of settlement obligations (fiduciary assets) are a complex (state by state) maze. This creates a challenging dynamic where capital reserve requirements grow as payment volumes grow. As a start up this means you not only need to raise capital to start the business, but also the regulatory capital BEFORE you get the state licenses.

MoneyGram’s 2007 “investment issues” offer many insights into MTO challenges. MGI suffered an $860M+ plus loss as it shifted out of high yield asset backed securities (which lost their investment grade rating). To preserve liquidity it sold $630MM in preferred and received debt financing of approximately $500M, a situation which today leaves MGI common shareholders in a $870MM equity deficit.

Operating as an MNO is not your only choice. I’m amazed at how few companies there are attempting to develop a bank based model. Trolling the dust bin of failed financial institutions may provide a unique opportunity for a start up to acquire the “shell” of a licensed bank to develop a “payment” focused value proposition. The strategy behind Revolution Money’s acquisition by Amex gives Revolution the “best of both worlds”: an acquirer and a bank. If it were not for Amex’s bank charter (and associated regulatory capital), Revolution’s PIN based debit would be highly susceptible to NACHA aggregation restrictions if they are operating as a non-bank, operating as a type of decouple debit.

I know from my own personal experience that operating as a “payment bank” is not without challenges, not just Citi C2it.. (which stopped 2.5 yrs prior to my role), but Citi GTS which today provides many of the banking licenses for payment providers like WU, Vodafone, ZAIN, … In addition to Citi GTS, one of Citi’s most profitable “global” retail bank businesses is NRI (Non Resident Indian) which serves affluent Indians (within the US, UK, …) with comprehensive services that cater to the needs of affluent clients. Citi also effectively up sells NRI clients services within its investment and commercial bank.

Operate as an agent

Pre-paid cards offer a “fast track” to operating a new payment service (Revolution money, Squareup, payoneer, iKobo, …). In this model the service relies on the licenses of the underlying bank (example Metabank). The legal precedent here is rather new as witnessed by May 30, 2007 finding by the First Circuit , which affirmed that the National Bank Act preempted New Hampshire regulation of the pre-paid product. In the “agent” model, it is therefore paramount that start ups seek a federally chartered partner.

There is still substantial “risk” in this pre-paid agent model, as traditional banks and networks control the “rails” for this payment type. For example, Consumer accounts must be “funded” from either a card or DDA account. NACHA has developed new rules which significantly curtail the ability of a “payment aggregator” operating off of a current account (see NACHA Tightens Risk Management and aggregation rules) . Additionally, card networks and acquirers are much more attuned to the risks that these new payment intermediaries present.

My top vendor in the bank model is CashEdge (having been the banker who signed the agreement at Wachovia). CE is the “3rd party sender” for Citi, BAC, Wachovia, PNC and other top banks representing approximately 50% of US DDA accounts. You don’t hear about them much because they are a white label “bank friendly” service. They excel in risk management, with a team second only to paypal. Most of you in the US reading this already use their software.. but just don’t know it. In the mobile space, I love the innovation at BlingNation.

Sell your software

This is rather straightforward. Within the mobile money space, companies such as Monitise, HyperWALLET, Fundamo, Paybox (now Sybase 365) all provide good platforms from which to build an offering. Issue for small companies is that the entities which have the necessary license have largely made significant bets here already. Of course some of the bets by big banks (some alliteration here) have been terrible, most notably Firethorne which has lost the accounts at Chase, Citi and Wachovia all in the last 8 months.

Exchange non-monetary forms of value

Beyond the scope for my discussion here. My advice is that this is a slippery slope and you will have trouble (as a payment company) attracting “A Class” capital. Look no further than the history of e-Gold for education on the issues.

U.S. GOVERNMENT SEIZES E-GOLD ACCOUNTS, OWNERS INDICTED

Summary

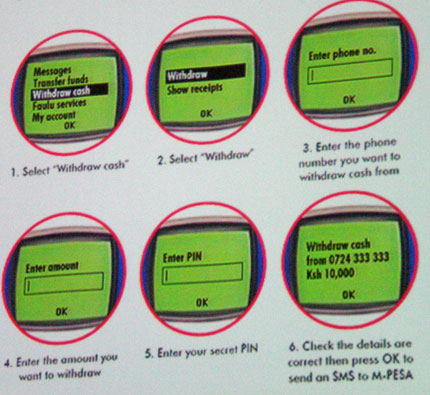

In writing this I cannot help but be struck by many similarities in the “unregulated growth” of PayPal and Vodafone’s MPesa. The growth of both companies was driven by an existing customer base and a value proposition which addressed clear gaps within the payment systems of their respective markets. In both cases, there was no clear regulatory authority to restrict them and once they were firmly established (through contagious adoption) it was too late to stop.

Within the EU, the ECB has developed ELMI regulations that are supported by other initiatives such as SEPA (See http://www.paysys.de/download/Krueger%20e-money%20regul.pdf).

Related posts

http://tomnoyes.wordpress.com/2009/12/16/cash-replacement-part-2/

http://www.banking.state.ny.us/legal/lo020603.htm

http://www.ecommercetimes.com/story/18211.html?wlc=1264432425