![]()

24 February 2011

Monday I wrote about Apple’s “NFC Twist” and how a multi SE environment impacted MNO’s NFC business case. From Monday (I hate to quote myself.. but it keeps from following the link)

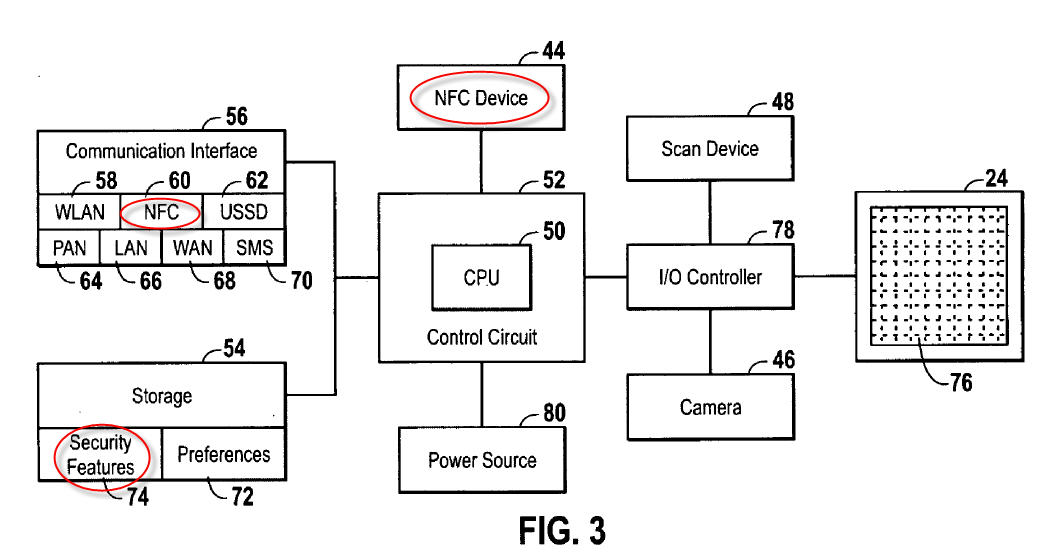

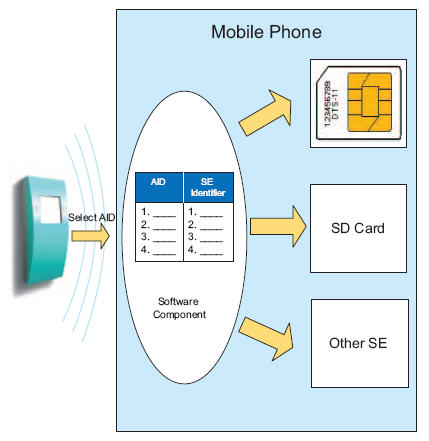

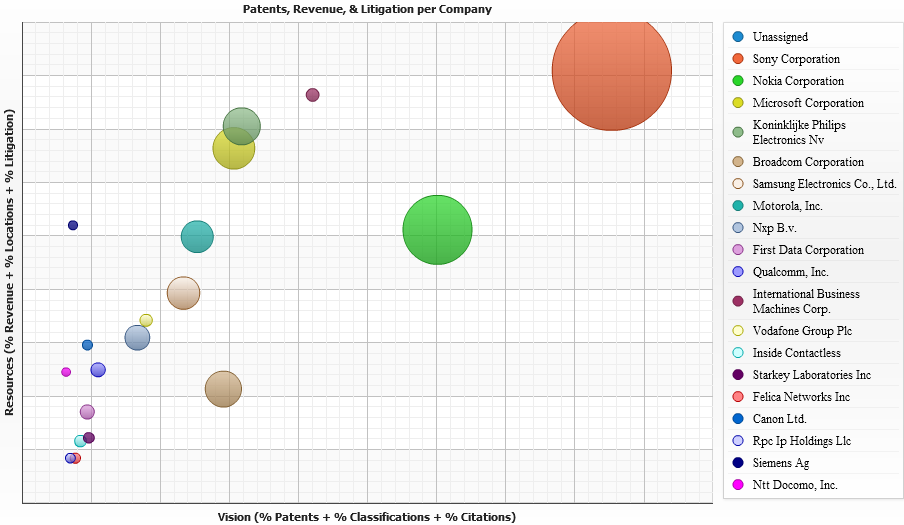

The champion of Multi SE architecture is Inside Contactless (OpenNFC).. a very very smart “Judo” move that leverages NXP’s substantial momentum (in integrated NFC/controller/radio) against itself. Inside’s perspective is that there is no reason for the ISO 14443 radio to ONLY be controlled via NFC (treat it like a camera). Inside’s OpenNFC provides for “easily adaptable hardware abstraction software layer, which accounts for a very small percentage of the total stack code, meaning that the Open NFC software stack can be easily leveraged for different NFC chip hardwalet multiple applications and services access it”. Handset manufactures love this model.. MNOs hate it. As I stated previously, closed systems must develop prior to open systems as investment can only be made where margins and services can be controlled. OpenNFC changes the investment dynamics for MNOs, and provides new incentives for Google/Apple/Microsoft, … to transition their closed systems into NFC platforms.

For Banks, Handset Manufacturer and Startups…

I cannot understate the importance of this approach. My guess is that Apple, Motorola and RIM are all planning to pursue “OpenNFC” . Multiple applications can now leverage the 14443 radio IN ADDITION TO the MNO controlled (SWP/SE) environment. Applications can then ride “over the top” independent of carrier controlled (TSM Managed) OTA provisioning.

In business terms, what does this mean? ISIS was founded under the assumption that it controlled the radio and all applications accessing it under NFCs secure element (SE) single wire protocol (SWP). Nothing could use the radio unless the ISIS TSM (Gemalto) provisioned it. Visa, Mastercard, Amex were all looking at a future where the BEST they could do was exist as a sticker on the back of the phone. In the OpenNFC model, the radio can be accessed directly through the handset operating system (assuming the OS integrates to the Inside OpenNFC controller). This provides the ability for applications on Android and iPhone to access the radio. In this model, Mastercard DOES have the ability to get PayPass into the phone. My guess is that one driver of MasterCard’s hiring of Mung-Ki Woo from Orange was his unique perspective on how to make PayPass work within this InsideContactless model.

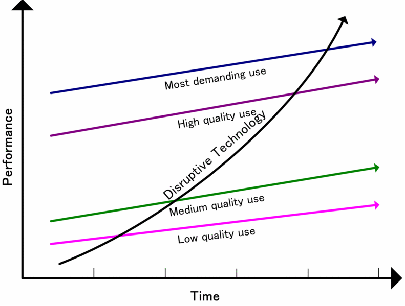

For ISIS? This is a tremendous impact to their business model. Perhaps something they cannot recover from. MNOs invested tremendous effort in developing NFC, now they are having their legs taken out from under them by a contactless vendor and the handset manufacturers. For ISIS to succeed they must run much faster and expand scope from a narrow payment pilot (over next 18 months) to building a platform that can compete AND interoperate against Android. Yeah.. that big. Their advantage is in control, security and provisioning. Unfortunately, because they have focused on the “control” aspect as the centerpiece of their business model, they have developed no alliances. In this, ISIS may well follow the failure of Canada’s Enstream. A group that got all of the technology right but failed to develop a sustainable business model.

Start-Ups

Start building to OPEN NFC. Game IS ON. Assume that Android and iPhone will let you access the radio…. For a fee.

For Consumers

CHAOS. What do you do when 5 applications all want to submit your payment.. .or read an RFID.. which one do you use? For a view on the mess this will cause, see the Stolpan whitepaper.

I believe this approach benefits Apple much more than Google. Apple’s platform “control” and QA testing will be essential to getting this off the ground. My guess is that Apple will have only ONE NFC payment option.. APPLE PAYMENTS. Perhaps a gatekeeper model where multiple cards can be store but Apple collects a fee.

Although Apple has an advantage in control. Google has the opportunity to deliver a much better value proposition to consumers, businesses and application developers. I’ll stick by my Axiom that new networks must start as closed systems delivering value to at least 2 parties. But can Apple compete with its Gosplan (USSR State Planning) like controls against open Android?

Background

NFC Background for non-techies reading the blog, there have been many, many global pilots of NFC.. but no production rollouts. From my previous blog

What is NFC? Technically it operates on the same ISO/IEC 14443 (18092) protocol as both RFID and MiFare so how is it different? I’m not going to get into the depth of the technology (see Wikipedia), but the biggest driver was GSMA/NFC Forum’s technical definition (UICC/SWP) that ENABLED CARRIERS to control the smart card (NFC element). This in turn enabled carriers to create a business model through which they could justify investment (See NFC Forum White Paper).