18 August 2010

Great WSJ Article Today – Paypal looks to real world commerce

First Draft…. final tomorrow.

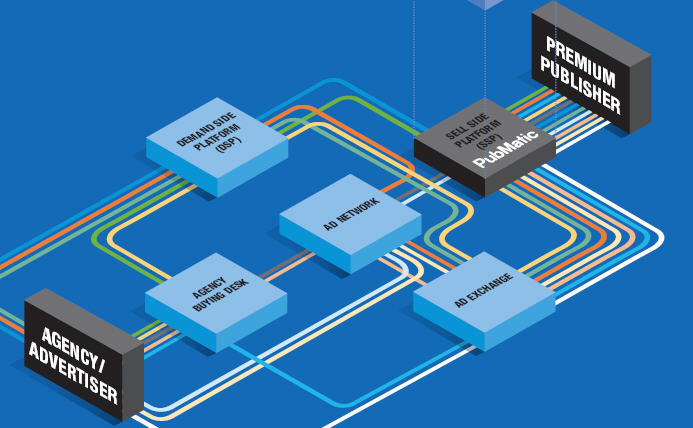

As stated in my previous blogs about Apple, Bling, and the Mercury NewCo we are in the midst of a revolution in consumer payments, driven by large non banks, with new value propositions. For example, we see established organizations like AT&T, Verizon, and Discover collaborating (Mercury NewCo) with a payment value proposition driven by mobile advertising, Card networks attempting to develop PayPal killers (see Visa PayClick) and mobile handset manufactures attempting to create models for payments separate from banks (see Nokia and Apple NFC).

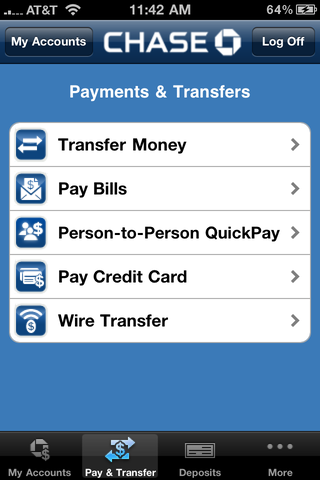

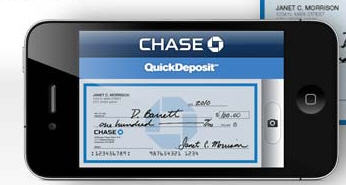

The worst kept secret in mobile payments today is: there aren’t any (except for MNO unbanked solutions). Efforts like Mastercard/Obopay have failed globally because they have focused on P2P (no existing volume). Alternatively, PayPal’s efforts are focused on the POS. Enabling any “merchant” to accept any card either at POS or virtually (see previous blog on PayPal’s virtual terminal). This approach is a win for banks (card acceptance), a win for consumers (convenience/loyalty), and a win for merchants (reduced merchant fees and interchange).

PayPal is best positioned of any major player to link the virtual and physical payment worlds (see here for detail): they have a consumer base, merchant base and a phenomenal fraud/risk team of 300+ with commensurate tech and ops. However their ability to execute is not without challenges. For example, what % of their current merchant base does POS transactions? Will there be a need for merchant terminals? If so who will pay? As discussed in the article above, Bling has been mentioned as a potential approach. Issuing Bling tags to PayPal’s employees is certainly a useful way of testing the consumer issues associated with issuing (and using) a payment tag.

My guess on PayPal’s “focus”?

Given PayPal’s strengths I would see a “phone as POS” approach as the most logical. As consumers we focus on our individual accounts, but PayPal is one of the few “2 Party” payment networks (others are Discover, Amex) that also include merchant acquisition. 2 Party systems are uniquely positioned to control the costs and value proposition between the merchant and the consumer. One of the major NFC challenges is POS infrastructure: who will pay for it? The phone as POS would certainly address this Gordian Knot for small merchants. Small merchants are a group that also feels the most pain in interchange and card acceptance fees due to their lack of negotiating leverage. Oddly enough large banks seem to be supportive of PayPal’s efforts here with the view that their actions will help drive cash replacement. In other words, if PayPal’s innovation is indeed focused on NFC acquisition then they will be able to process all cards..

On the merchant side, PayPal has already completed much of the heavy lifting with its existing virtual terminal service. This service equips PayPal merchants with ability to accept any card at the POS (see Virtual Terminal blog). NFC or RFID form factors are just another abstraction for this card. On the consumer side, I would expect to see PayPal working to link PayPal accounts to multiple form factors. Expect PayPal to make an acquisition in this space.

As of today, here is my view of the teams competing in mobile payments at POS

- Mastercard/Citi/Obopay/Nokia

- Visa/Monitise

- Apple

- AT&T/Verizon/Discover/?Google/First Data

- PayPal/?

More to come tomorrow.