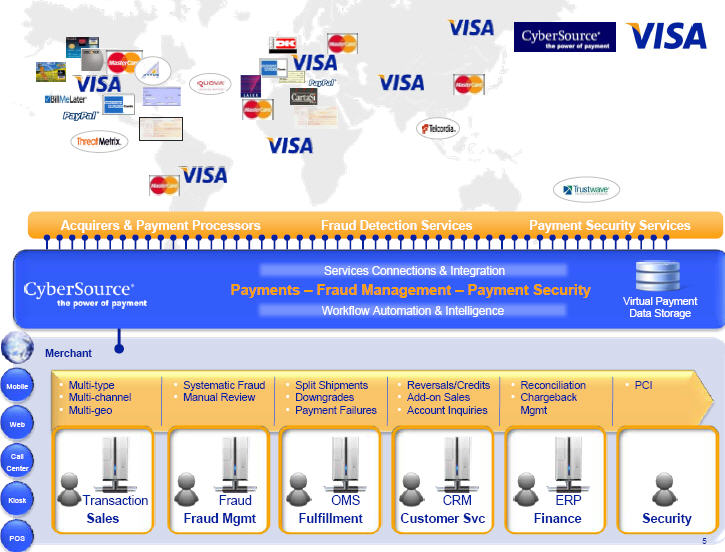

22 April 2010

CYBS/Visa Presentation

CYBS 2009 10K

126x earnings? $3M/employee Why? Did Carl Pascarella (former Visa CEO added to CyberSource Board of Directors on March 5, 2009) intend to drive this when he joined the CYBS BOD?

Part of the job of any payment network is to ensure a balance between network efficacy, profitability, risk and “value” received by each participant. (http://en.wikipedia.org/wiki/Network_effect)

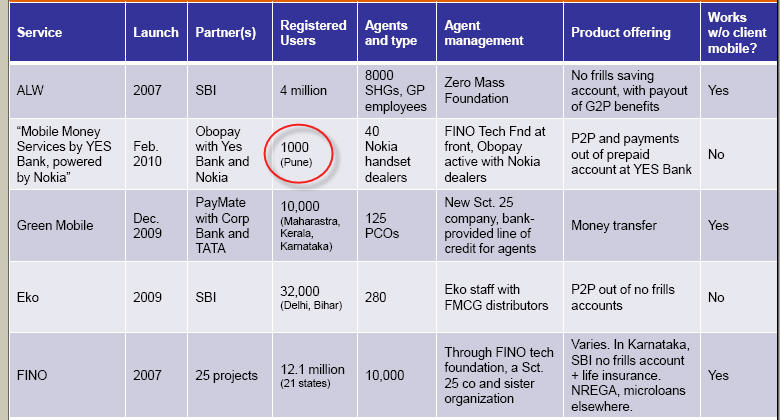

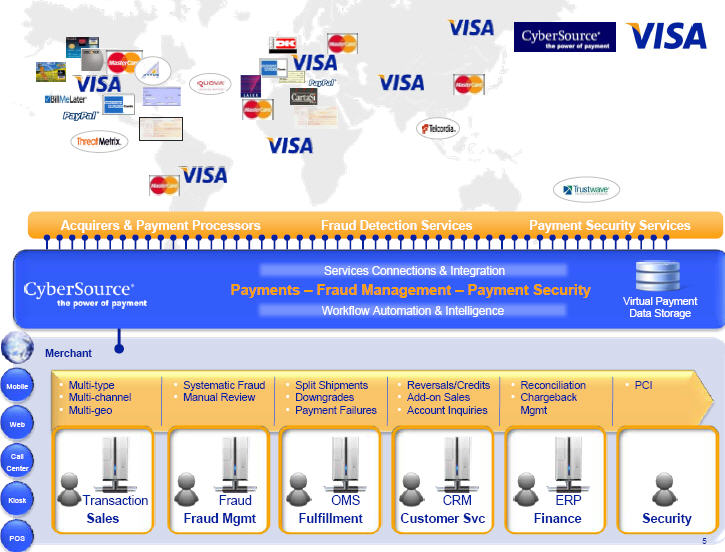

CyberSource bills itself as the “The World’s First eCommerce Payment Management Company” and initially focused on enabling “bricks and mortar” retailers expansion into the online channel. CYBS has evolved to provide global turn key services to any retailer selling goods online… from payment to distribution (ex. Digital software).

CYBS 1009 10K

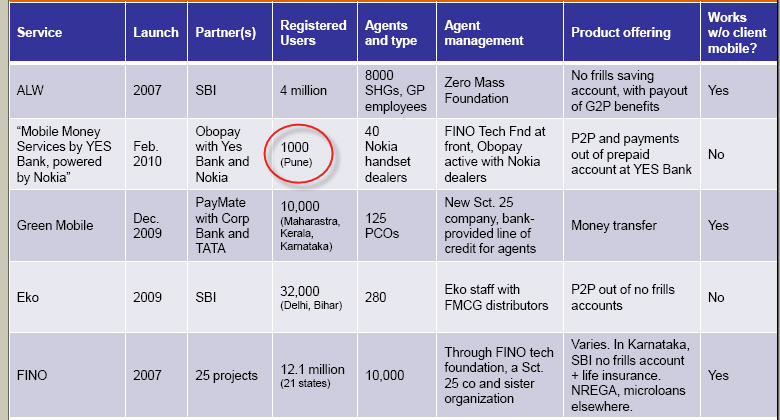

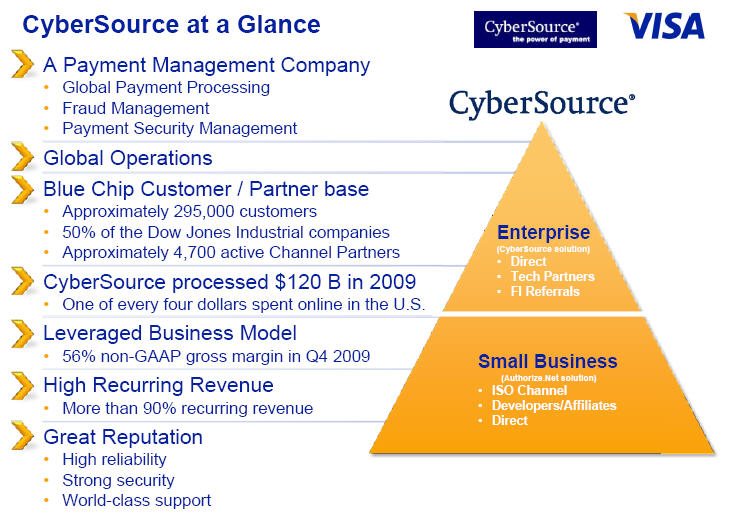

Our customers range in size from small sole proprietorships to some of the world’s largest corporations and institutions. Our customer base includes leading companies such as Air France, Borders Group, British Airways, Christian Dior, Eastman Kodak, Home Depot, Louis Vuitton, Massachusetts Institute of Technology, Microsoft, Nike, Starbucks, and Yahoo!, among thousands of others. To properly serve this diverse set of needs, we divide our potential market into two customer profiles, enterprise and small business merchants, which require different solutions.

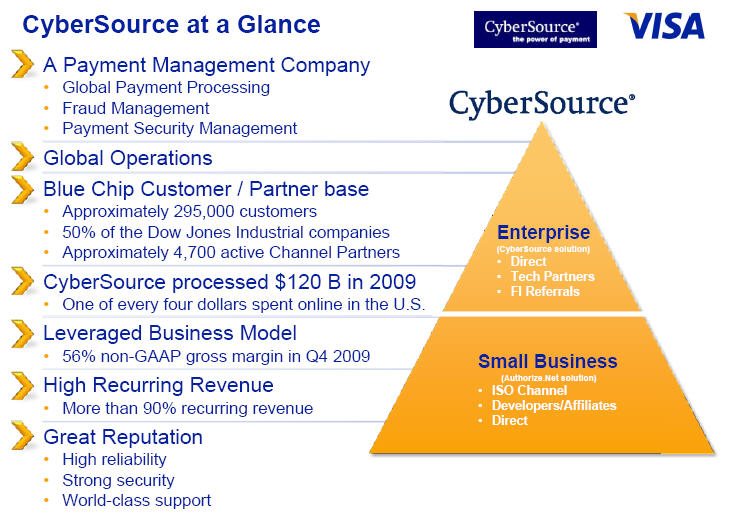

Enterprise merchants have high sales volumes and generally demand the greatest range of payment options and the most sophisticated risk and management tools. These customers often sell in multiple countries and require support for local currencies and local payment options. Enterprise merchants also frequently need to integrate payment processing with one or more internal business systems. We serve enterprise customers by providing solutions that address and simplify the breadth of these requirements.

Small business merchants generally seek simplicity and ease of use. We serve small business merchants by providing bundled services and integrations into popular online shopping cart software, while bringing to the small business market some of the advantages of our enterprise-level services, including important new payment options such as electronic checks, as well as high-reliability and quality customer support.

Retailers face huge hurdles in building teams capable of navigating the complex rules and regulations associated with processing payments from PCI, Sepa, CARD, Reg E, Reg Z, … etc. The very existence of CYBS (and competitors below) show the market for value added services as a precondition to Visa’s goal of: EXPANDING THE NETWORK.

We face competition from merchant acquirers, independent sales organizations, and payment processors such as Chase Paymentech, First Data Corporation, and Royal Bank of Scotland. We also face competition from transaction service providers such as PayPal and Retail Decisions, as well as eCommerce providers such as Accertify, Inc., Digital River and GSI Commerce Inc. Furthermore, other companies, including financial services and credit companies may enter the market and provide competing services. Another source of competition comes from businesses that develop their own internal, custom-made systems. Such businesses typically make large initial investments to develop custom-made systems and therefore, may be less likely to adopt outside services or vendor-developed online commerce transaction processing software.

Cybersource will provide Visa with an enhanced portfolio of services which could address merchant needs, particularly in risk, compliance,  payment/fraud operations. However the expansion of Visa into these services poses a substantial risk to its business model as it runs the risk of alienating acquiring banks and other processors. Currently, I would view that risk as small because of the tremendous issues associated with online (eCommerce/mCommerce) payment system integrity and fraud.

payment/fraud operations. However the expansion of Visa into these services poses a substantial risk to its business model as it runs the risk of alienating acquiring banks and other processors. Currently, I would view that risk as small because of the tremendous issues associated with online (eCommerce/mCommerce) payment system integrity and fraud.

This is a bold move by Visa to drive network expansion, in mCommerce and eCommerce, and expanding value added services which cover ownership of payment risk and operations. The price does seem high if we view integration without synergies (CYBS will have to run at a 45% CAGR to be accretive in a 10 yr horizon). Therefore, Visa’s business case must be driven by new services which can be offered in the short term to all merchants and acquirers (ex Fraud data sharing, digital goods distribution, …).

Can Visa grow this business more effectively under the Visa brand? Absolutely, but expect other network participants (issuers, acquirers, processors) to pressure Visa into managing CYBS as a separate entity. It is important to note that there is no love loss between most merchants and Visa. To address this, Visa should lead with a road show on how it will deliver value. Example.. it will take on fraud loss responsibility, improve marketing and take on compliance risk.

Tangentially, I believe Visa will also likely add significant $$ to merchant marketing programs. Visa is investing heavily in a new mobile marketing/advertising engine... that will sit on the Visa switch. Their existing merchant agreements do not handle this kind of “marketing” services agreement so they needed a new contract vehicle. Given CYBS’s merchant footprint, they now have vehicle which can be leveraged to expand the advertising business in a turn key model which also tracks fraud and fulfillment.