8 March 2011

Why do I like the Payments business? It is ubiquitous, sticky, with good margins and strong annuity revenue.

What do I hate about the payments business?

In the US, it is over regulated, concentrated, difficult to change and frustrating enigma driven by large FSIs with unlimited resources…. Within Europe the situation is little different.

After coming back from last week’s trip the Valley, I was attempting to develop an investment hypothesis on Europe, mobile, payments and innovation in general.

While Europe’s individual talent is second to none, and capital is plentiful, the European market is designed to resist change and thus impedes the development of early stage ideas and companies. Early stage companies can incubate within a single country but are challenged to expand beyond, due to complex regulatory and market dynamics. Navigating these dynamics causes early stage companies to develop more slowly, thus a requiring a higher risk premium on invested capital.

– Tom’s European Venture Capital Hypothesis

SEPA Overview

(European colleagues can skip this section).

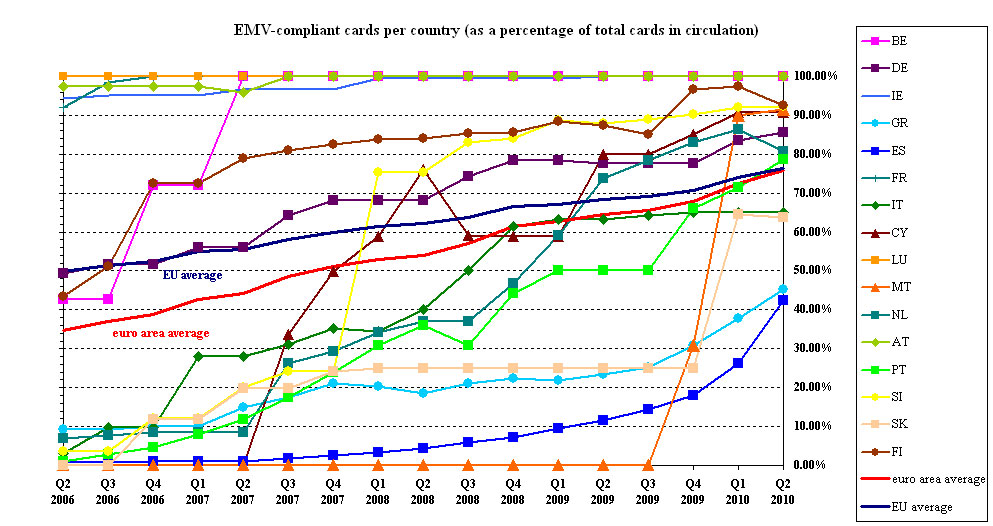

SEPA and PSD (SEPA’s enabling legal framework) attempt to create harmonization of payment schemes across the EU (See SEPA Blog, and excellent PodCast). The result? 837 pages of detailed and contradictory EU law with no business incentive. SEPA has been plagued with delays and issues, as should be expected given that there was no business incentive nor a PAN EU regulator to enforce it. SEPA Credit Transfers and SEPA Card Framework have been in place for a few years (2008). While the SEPA framework commoditizes payments, and while this is consumer friendly, there is no business incentive to for large banks to implement it (see Barclay’s consumer support on SCT). The same can be said for the SEPA Card Framework (See MA’s Self Assessment). The main points from ECB’s regular status report:

- Banks must create greater awareness of SEPA, and must offer better products, based upon the SEPA infrastructure. Government should accelerate programs to adopt SEPA as the standard for its disbursements.

- The banking industry must commit to work together to remove obstacles which might compromise the Nov 1 2009 launch date of the SEPA Direct Debit. Debates on the launch date, the validity of existing DD mandates, and interchange fees must be closed out rapidly.

- Bank systems need to be improved to enable end-to-end straight-through-processing, originated by files submitted or by e-payment, e-invoicing, and m-payments.

- The ECB wants to see a target end date for migration to SEPA products, and for exiting out of older credit transfer and direct debit.

- The SEPA card framework in its current form has not yet delivered the reforms which the ECB wants. In particular, ECB wants to see a European card scheme emerging.

- The ECB perceives a lack of consistency in card standards. It wants to ensure that a clear set of standards are adopted and promoted throughout the industry.

- A common, high level of security for Internet banking, card payments and online payments is needed.

- Clearing and settlement organizations in many countries have made good progress on SEPA, and several are upgrading from national to pan-European.

- The banking industry, and its representative body, the EPC have not sufficiently involved other stakeholders.

SEPA’s Impact on Innovation

European harmonization is a fantastic objective, but translating EU guidance in to country law, with each country’s banking regulators responsible for interpretation and guidance, is problematic. This becomes even more difficult when Banks (who were not included in the SEPA design) have an inverse adoption incentive. An analogy in the telecom world would be telling the land line carrier that the must open up the switch to anyone that wants it at no cost.. and they have to assume all of the risk and operational responsibility.

Early stage companies and “payment innovators” are left with a complex set of constraints.

- Dependent on local national relationships to launch a product,

- SEPA creates harmonization, but country specific laws and regulatory guidance are unique

- ECB initiatives (ex. See ELMI) create opportunities for non-bank participation in payments, but SEPA has removed all margin from the business

So in Europe we see the consequences of over regulation. While SEPA was designed to increase competition and create new European schemes, there are few business models capable of supporting investment. Hence Europe is not the place to start a retail payments business. Hence Asia, LATAM and Canada are all great places to start a payments business (my picks: PH, HK/China, Brazil, Malaysia, SG, Colombia, Indonesia and New Zealand).

Europe and Advertising

I don’t have time to finish the thought here. For those of you that read my blog you know I’m very enthused about the prospect for advertising to be a future payments revenue driver. Unfortunately for the EU, consumer privacy regulations (and subsequent “tracking” issues) are the most onerous in the world. In Germany for instance, my Citi team was forced purge the web log of IP addresses every 30 minutes.. for our own customers. The point here is that we could not even maintain loosely correlated consumer information in regulated accounts. Google has similar problems today (see Das ist verboten).

Where is the EU opportunity?

Where there is an intersection of: low margin payments, businesses with frequent cross border (within EU) transactions, without need or desire for banking relationship. MoneyBookers is an excellent example of this model in gaming.

Other possible investment drivers relate to when payment transaction infrastructure is a commodity:

Arbitrage – Move intelligence to new regions or countries where the cost of maintaining it is lower

Aggregation – Combine formerly isolated pieces of dedicated infrastructure intelligence into a large pool of shared infrastructure that can be provided over a network

Rewiring – Connect islands of intelligence by creating a common information backbone

Reassembly – Reorganize pieces of intelligence from diverse sources into coherent, personalized packages for customers

Thoughts appreciated.

Mirek Kula provided an excellent comment… a tremendous exec

Theme is that my blog focused too much on the negative implications for Banks, not the “whole new world” it opens for non banks.

… the innovation and potential success will come from non banks… which will now be able to experiment with new payment instruments and schemes.

It is possible that banks’ margins in payment business will be squeezed even more.

While Stand-alone payment margins are thin in isolation, new business models will couple payments with new services in a much more efficient cost structures and at a lower risk. If you take the consumer risk from the equation, the marginal cost of a payment transaction is next to nothing.

Note that a great majority of small payments, even in Europe are still cash (way over 50% in UK of all places). The question is who can process small payments in a way that is more convenient and cheaper than cash?

Yes, SEPA is confused and expensive, but PSD works, so the new regulatory category of “Payment Institution” is already up and running. This is why organisations (eg, telcos) are getting the PI licence so that they as non-banks can offer payment services. This will mean more competition, and therefore (hopefully!) more innovation. This will be more important than the harmonisation.

I wonder if the US should go down the same route: regulate the core banking businesses more strictly, but open up the payments business more.

Great overview on the current European payment landscape Tom. SEPA has always been a very ambitious initiative and goal, but up against the card networks and alternative incumbents (e.g. giropay, iDEAL) it’s always looked like a tough business case. Assuming the rails are put in place, the question is, can merchants form their own competitive payment network or can the ACH networks, think VocaLink, use the fast and cross border pipes to innovate and competete with a low cost payment solution.

Pingback: CEO of Tempo Interview « FinVentures

Pingback: Building Networks and “Openness” « FinVentures

Pingback: Back from Asia « FinVentures

Pingback: Push Payments « FinVentures

Pingback: CEO View – Battle of the Cloud Part 5 | FinVentures

Pingback: How do Deregulate Payments (like Telecom) | FinVentures

Pingback: Structural Changes in Payments - Starpoint Blog - Finventures