January 31, 2011

Yesterday’s post was “Banks will win in Payments”, a general rule of thumb that had one major caveat: Payments which are profitable. What about payments which are not profitable? Primary examples:

- Checks

- Cash

- Online Bill Pay

- Government Payments to Unbanked

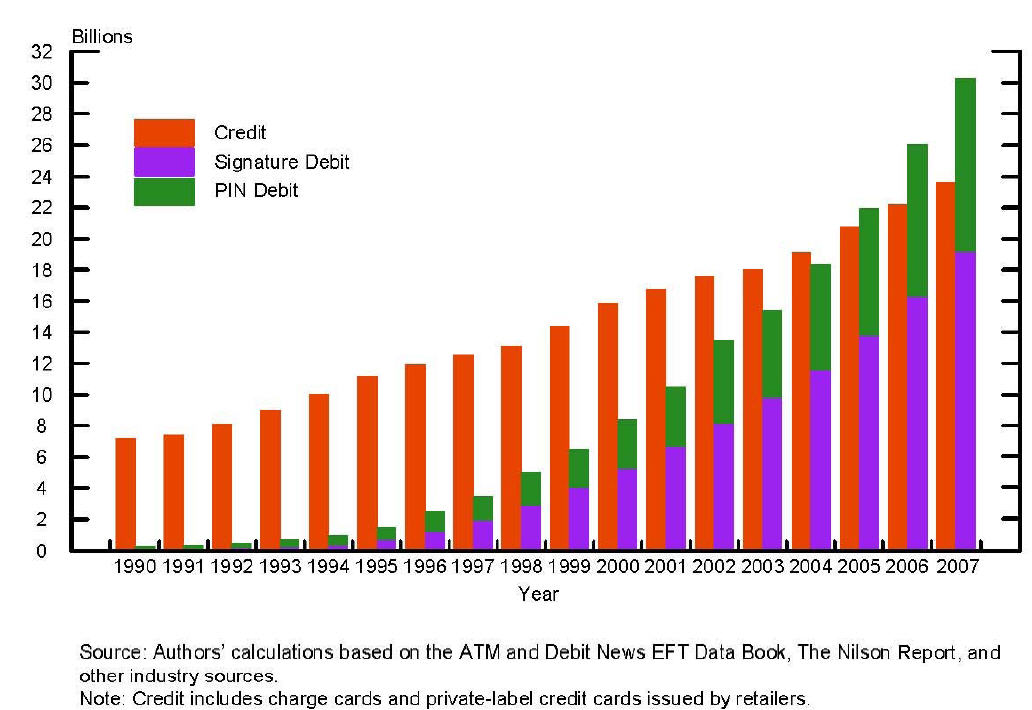

Historically Checks and Cash were a cost of doing “bank business”. Debit cards proved to be the most successful product in converting cash and checks into electronic payments (see Cash Replacement). Recent US financial legislation will move the debit business into a break even business for banks.. from 120bps of the transaction to a flat fee of $0.12. This has caused Banks to take a hard look at the “payment business” to determine if and how they make continued debit investment. Why support a Visa/MA branded debit card at all? Austrailia, Canada, Japan and Germany have similar dynamics here.. if you go to Canada and pay with “debit” it is your Interac card.. a bank owned debit network.. which retailers prefer as their payment mechanism of choice. In these geographies Visa and MA are known for Credit transactions only.

Clearly “payments” are a necessity for every transactional account (Demand Deposit Account – DDA). As US retail banks attempt to adjust DDA account fees, to rebalance overall product profitability, there are new alternatives developing that present a much more cost effective value propositions, particularly for segments below the mass market. Low value payments can support and even enhance existing value propositions of other non-bank networks, a dynamic I described in Why MNOs will Rule in Emerging Markets. As such, we are beginning to see “fragmentation” within “low value” payment solutions. In the US carriers are developing partnerships with mobile billing solution providers (Boku, billtomobile, …). In model, carriers are taking on some additional “credit risk” but are starting off small with digital goods. Low value payment further enhances the overall consumer value proposition for the mobile operator (retention, network use, network effects, on us, …).

Top Tier Banks must tread carefully on DDA fees, not only do they face competition from credit unions (not impacted by the interchange fee limits), and MNOs but also from pre-paid cards and brokerages which provide much of what mass consumers need in transactional accounts. The downside for mass market consumers is one of credit. Banks make credit decisions based upon relationship, credit history and DDA records. Keeping your balances out of a top tier bank (or the banking system) will make it harder to get a loan. As comments are coming due on the Dodd-Frank amendment.. a key bank argument is that the regulation will indeed create more unbanked.

Part 3 will cover new models where ad spend replace interchange in driving payment system revenue.

Message for start ups.. payments are a mine field.. the new debit interchange rates will drastically reduce merchants costs. Be cautious in building solutions around existing debit networks.. banks are planning changes.

Pingback: 2010 PayPal Analysis – Part 1 « FinVentures