June 10 2011

I read a fabulous survey of acquirers in Digital Transactions today: Forget PayPal And Google. Acquirers Are Most Worried About Visa, MasterCard. My favorite quote?

55% of the respondents agreed with the statement, “Larger issuers and acquirers will increasingly seek to disintermediate the card networks in the years to come,”

So much to write on this week.. so little time. So here are my abbreviated views:

PayPal going after Google.. core issue really seems to be that PayPal’s culture is changing and working for card execs is a big change from working in a young growth start up. Hence the original “valley” team is running for the exits. PayPal is upset at the exodus.. but they should probably look in the mirror for the cause.

Visa paying 22x revenue for Fundamo. Visa is hyper aggressive in mobile.. and they should be. But they have done a very poor job of articulating their strategy to the market. The only way to hold them accountable for progress is to get them to be very specific on transaction volume in emerging payment types. What is their NFC GDV? Mobile Transfer (VMT)? Offers? Active Wallets? PayPal excels here and hence has much market credibility because they are transparent with their numbers. How can investors hold Visa accountable for the investments they are making.

My favorite Visa division? PR! These guys are masters.. did you notice that the Fundamo announcement was coupled with a sustaining investment in Monitise. Just last year Monitise was their emerging market strategy. This goes along with the Square investment on the same day that Visa rolled out new mobile security standards (which Square did not comply with but are “committed to”.. going forward)… You can’t make this stuff up.

Google wallet. Great product, great team… no further comments. Funny that ISIS didn’t see this coming or they could have saved a bundle on building a wallet of their own.. humor is amplified by fact that google/android will be only mass produced NFC handset over next year or so.

Clearxchange. Finally! A bank initiative with some legs. I really like the fact that the top 3 banks are getting together on this. P2P is a no win for any non-bank.. I wish that they just bought Cashedge as opposed to building it themselves.. but hey getting 3 banks to agree on something is close to 8th wonder of the world.

Square.. Billion dollar valuation!?. See the electronic transaction article above for more detail… I wrote a blog showing that PayPal is 7x more profitable per transaction than Square. Talking to several Square employee prospects I understand that they want to get the MSB licenses to enable ACH funding.. my eyes squint on this one.. they are a TPPA… they don’t have consumer solution.. they are a merchant solution. Perhaps they have some new secret sauce I’m not privy to.. BANKS.. this is what happens when you let an acquire capture customer contact information and why you should shut them down (see related post).

NXP Reports that they anticipate 100M+ NFC chips in next year.. WOW!! Given that Apple is not in this game.. RIM and Samsung/Android will have a great new market for devices if this projection holds. (see NXP CEO quote)

Verifone building a new business plan to support enhanced POS terminals. This is not a terrible plan.. on paper. But most merchants view the payment terminal as a nice little processor controlled device that enables them to stay away from all those nasty PCI compliance issues. Doug’s earnings chat last week indicated he was building a business around keeping these new devices fresh with applications (on the Payment Terminal). I wonder what IBM, NCR and Micros think about this? Or even the store CIO? Most stores at least actively manage their cash registers.. can you imagine creating a whole new IT team to manage version control, release planning and testing on the terminals.. Heck this is why retail stores freeze these things.

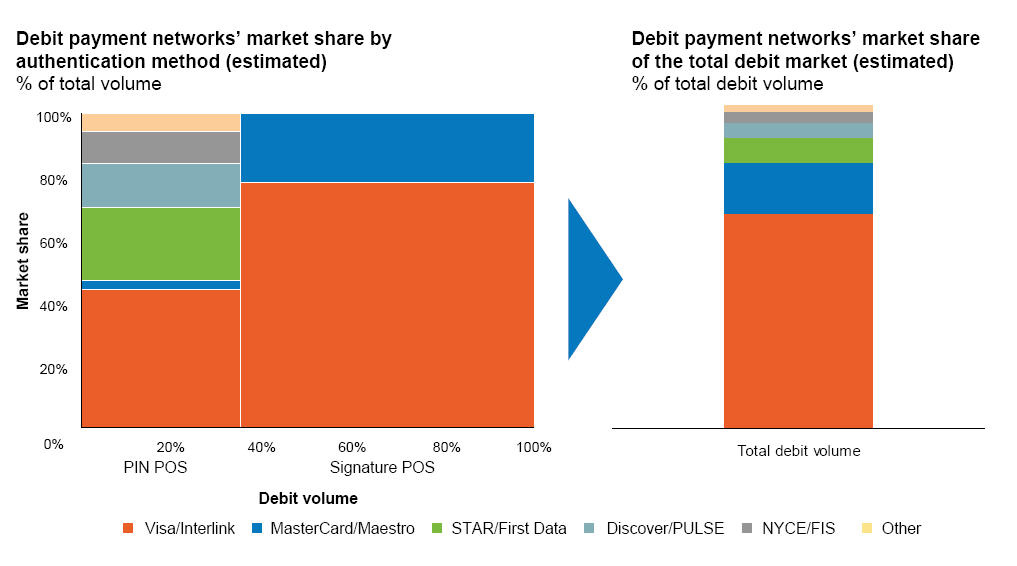

Durbin.. banks are down in the dumps this week as $12B in debit revenue goes down the tubes.. the final rate may be above $0.21.. but its not a win for the banks. There are some very big investments being made by the banks to further reshape products. In this I completely agree with the Electronic Transactions article above.. I see consolidation of the 6 debit networks.. and at least 2 banks experimenting with their own branded ATM/Debit card. Why should Visa get any cut of the $0.21?

Where are you getting the 22x revenues for Fundamo? Are you saying that they only generated $5M with all the software contracts they had and relationships with mobile networks?

I’d like to know too…where did that figure come from??