Cross Border Card Transactions

17 January 2012

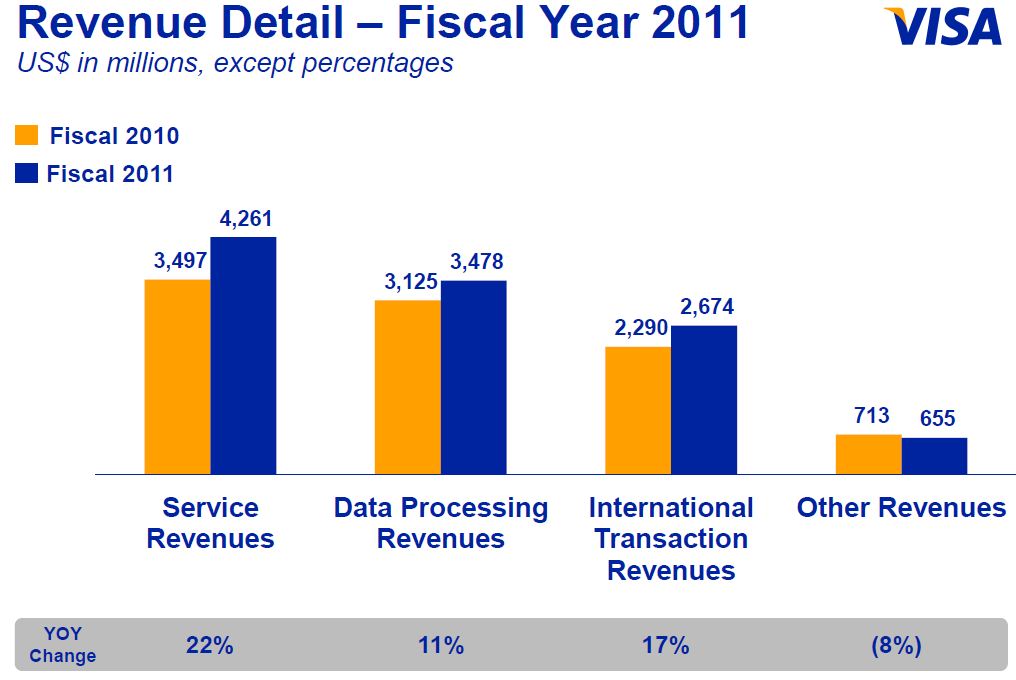

International transaction revenues are now 17% of Visa’s earnings (similar to MA). I try to have a cursory knowledge of payments.. but have to admit the dark world of cross border and network rates were a significant blind spot. Thanks to those folks who walked me through it. The information generally available is very poor. Don’t get your hopes up.. I’m sure this blog is equally as poor.. with perhaps a few new pieces of data.

My guess is that cross border remains a mystery because neither banks nor retailers want you to know who you are paying and how much you are being taken for. Cross border represents a tremendous area for growth and profitability… it is low hanging fruit.. Let me see if I can describe the fee dynamics. Note there are many, many variations here. I some geographies the government mandates exchange rates.. in others DCC… Not to worry.. the banks make a very nice margin in all scenarios.

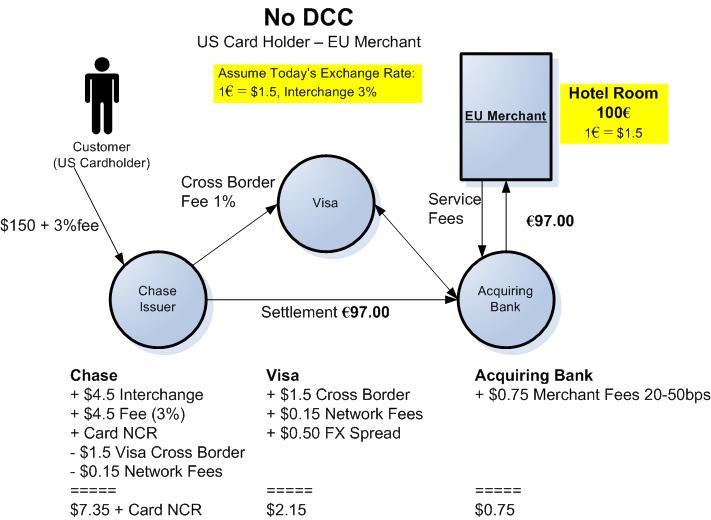

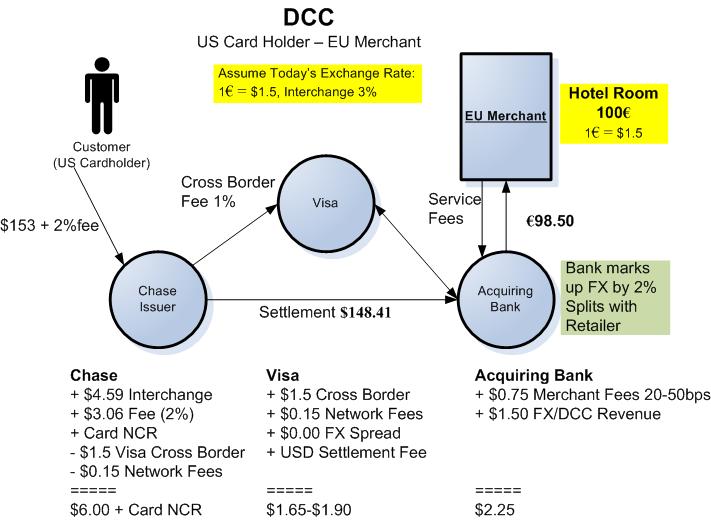

Let’s take a look at 2 scenarios for a 100 EU hotel room bill, one using DCC and another without (My conversion rate of 1USD= 1.5 EU is a little off).

DCC is a mechanism developed by acquirers to earn FX… giving merchants an incentive to change POS by splitting revenue with them, thereby decreasing their cost (net interchange). With DCC adoption, issuers and Visa were faced by the loss of FX revenue, sometime around 2005 Visa instituted a new cross border fee of 1% (paid by Issuers). Issuers subsequently mark up this 1% fee with their own (see this WSJ article).

Network rules mandate that all cross border transactions go through V/MA. This drives the big banks like Citi crazy as they have banking licenses and consumer BINs in almost every country.. but still must pay Visa freight for settling cross border transactions AND let Visa manage the FX (in most countries). Given the margins here.. there is much room for global prepaid travel cards. This was a driver behind Mastercard’s $459M purchase of Travelex Pre-paid business in Dec 2010.

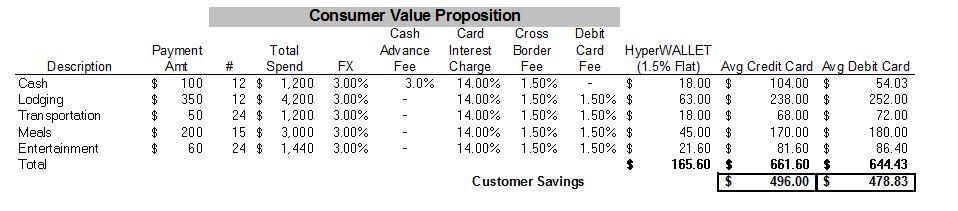

I’m starting to see quite a bit of interest in this space as the big banks ramp up their presence in pre-paid. For global businesses.. there is a solid case to be made for issuing pre-paid cards to employees that regularly travel. See my consumer value proposition below. In full disclosure I’m a board member of hyperWALLET.. and I like them quite a bit (always a good thing for a BOD member).

Pingback: CEO View – Battle of the Cloud Part 5 | FinVentures