Back from Asia

23 March 2012

Just getting back from 4 weeks in Asia.. During my time there, I met with Capital (institutional investors, PE, Sovereign Wealth Funds, Banks, VCs), Companies (MNOs, Handset Manufacturers, card networks, retail) and Comrades ( my old teams from Citi and Oracle).

While stuck here in SFO (on my last leg home) I’m thinking about how to structure 5-10 blogs (as well as 4 weeks of expenses). One of the reasons I write this silly blog is the act of writing seems to help me to structure my “raw data”(as well as having a community of great folks like you to give me feedback). My primary goals are to identify: where investments are being made, business model innovation, and true market opportunities. For obvious reasons I don’t always highlight the gaps (in detail) as this is where I invest or look to get something else moving.

The Asia market is exciting and complex. I have to admit it was much easier staying on top of it when I had 10-20 people in each country competing locally (who could distill what I needed to know). Given my current focus on Early Stage companies, I’m particularly keen to stay abreast of the Asian “start up” economy as well as the local venture community.

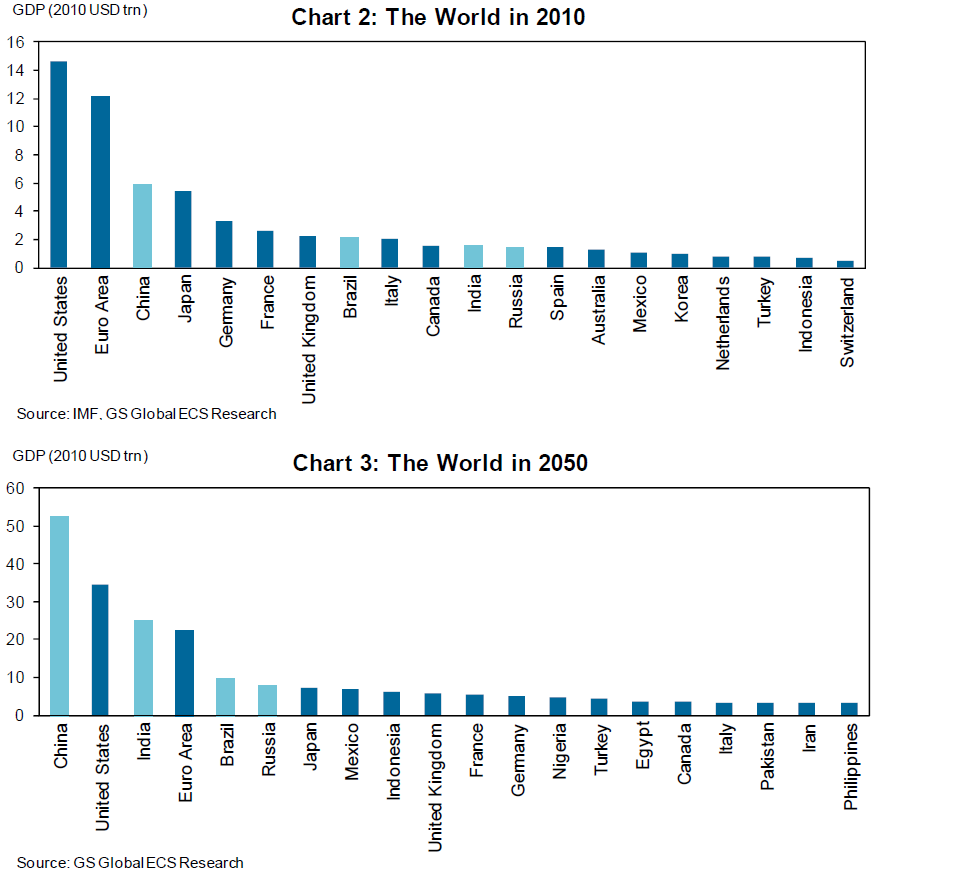

What makes Silicon Valley so vibrant? US Market Size, Human Talent, Companies, Capital, Regulation, Tax, Infrastructure, Legal, … The first item, US Market Size, continues to dominate my approach to Early Stage companies. This US is such a unique place.. $14.6T GDP, $4T in Retail Sales, $705B in Marketing Spend, 608M Credit Cards in the grasp of most of its 311M citizens. A start up could take just 1-2% of the US market (in any given area) and have some kind of sustainable success.. In the ROW… it would take 10-20% of the local market. This “market size” factor heavily influences the approach of local companies (specifically), and innovation (in general), within Asia.

Following the hypothesis for products originating in Asia: they must capture a very substantial share of the local market to become sustainable. Existing domestic institutions are better placed to both make the capital investment… and “shepherd” the product launch. This dynamic has existed for 100s of years, a form of “organized” innovation by a market leader. These market leaders are also organized into networks of suppliers as we see it in Japan/Keiretsu, Korean/Chaebol, … As you can imagine, large companies typically don’t innovate much beyond their core products. After all their managers must seek a place in the organization if the initiative doesn’t work out. Today’s WSJ had a fantastic article that further detailed how this “innovation dynamic” created a destructive force in Japan’s consumer electronics industry.

WSJ Today: How Japan Blew Its Lead in Electronics

Previously I also wrote on Europe’s attempts to “standardize” payments infrastructure actually ended up killing all innovation in the area (note… Europe is NOT one market when it comes to banking and payments).

http://tomnoyes.wordpress.com/2011/03/08/payments-innovation-in-eurpoe/

Investors – Start in the US.. then expand

Thus most VCs correctly direct start ups to focus on the US for initial product launches (for now….). The key exception: China. Most of you know my blogs are generally focused in 3 networked businesses: Banking/Payments, Advertising, and Mobile. Starpoint’s general investment thesis is that the mobile phone will be key to linking all three of these networks… to become the point of confluence between the physical and virtual world (commerce, advertising, social, payment, …). I have so many stories on China that I wouldn’t know where to start.. The 30 second summary: You can’t compete without Guanxi , the opportunity is insane, the regulators are tough, US VCs can’t “experiment” in China and local partners are hard pressed to see what value you have to offer them in a domestic market.

Asia Blogs

Here are my thoughts on future blogs

- China Market Dynamics.. Payments and Commerce

- DoCoMo and the Japan NFC consortium

- NFC bets in Asia – Transit Focus

- Handsets – Future of commodity hardware?

- SingTel’s Amobee Bet

- US Start Ups: Penetrating Asia (picking resellers)

- Emerging Markets – Payments/Regulatory Update

- …?

Interesting topics. Would also love to hear about the power of mobile carriers in East Asia, as it seems like they have more relative power than in the U.S., compared to the payment processors or the mobile OSes. Also interested in whether retailers are more willing to give up data in return for mobile payment systems than here in America.

One note – the large Korean conglomerates are called “chaebol.”

Sean.. thanks for the correction.

How about India? I would be keen to know your perspective about the Indian domestic market for Banking/Payments – and I believe there are innovation opportunities at both the top end of the market and the so called “bottom of the pyramid”. Specifically opportunities around financial inclusion.

-srp

Suresh, thanks for the note. I haven’t said this explicitly in the blog, but I’ve moved from closely following India to keeping track of it as a hobby. There is so much potential in the country… but the politics and regulatory craziness makes investing there worse than a gamble. I’m sure many excellent folks from Nokia Money now also join me in these sentiments.. in our alumni base we can probably count the Vodafone team, and most of SKS’ original investors. To be clear there are few markets in the world with greater needs, better teams and ideas … but on the flip side it is the worst regulatory and political climate on the planet. One of my last posts on the subject was http://tomnoyes.wordpress.com/2010/05/12/mnosrbi-disintermediate-agents/