Today Google Wallet 2.0 launched (Google Blog announcement)

[youtube=http://www.youtube.com/watch?v=VuFVsaFCzsw]

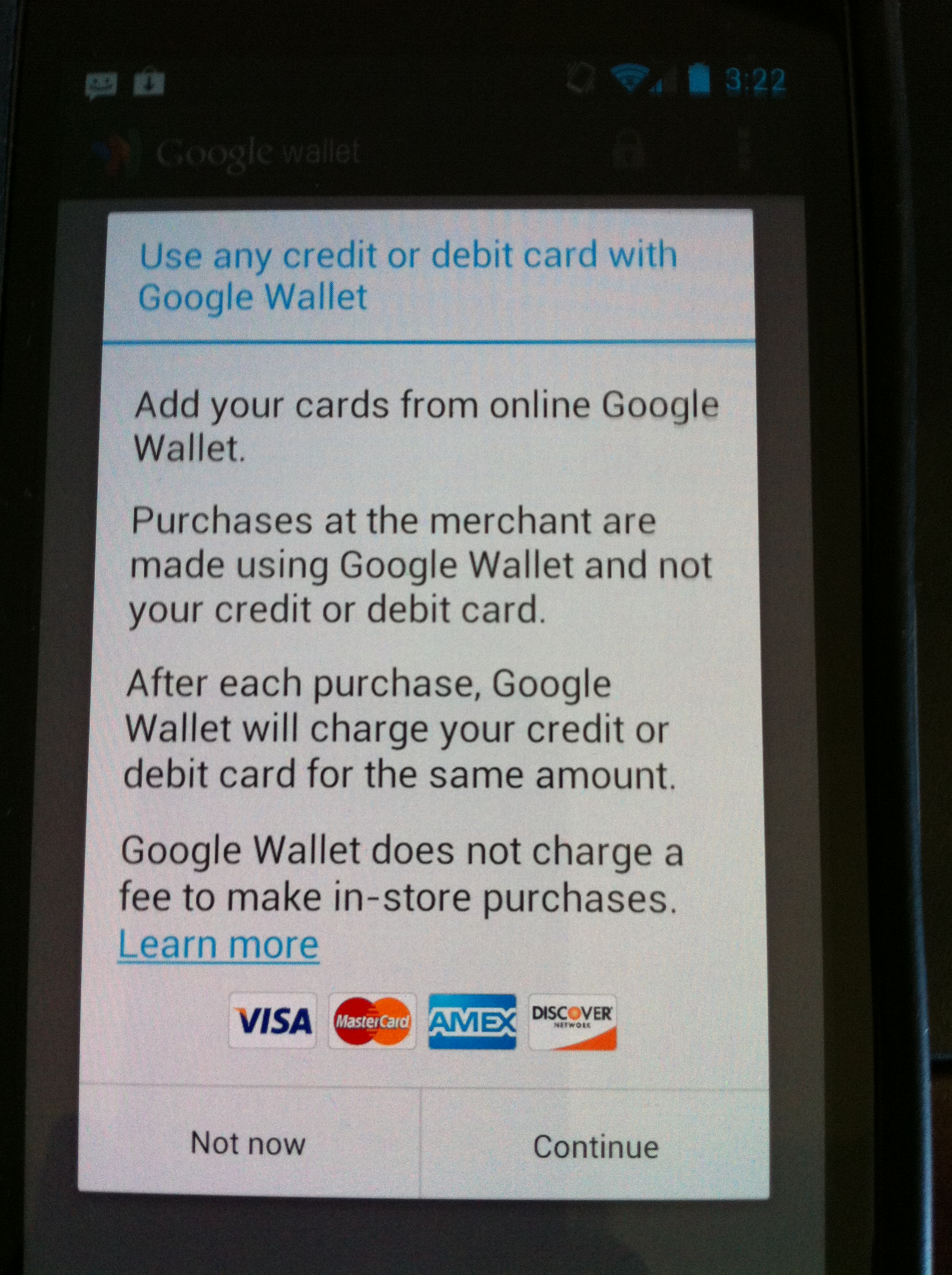

Google will now allow me to add any card I want.. my Bank of America Debit, Citi Credit, my business Amex… My cards sit in the cloud and I can access them on the device at the POS, online, or for a mobile purchase. The device has a single card that acts as an “ID” that points to your account in the cloud. The gateway/acquirer then resolves this ID to the card (stored in the cloud) which you want to use and then processes an authorization with the corresponding issuer. Not all that different than how PayPal and Amazon work today (which card do you want to use)?

Google’s approach has empowered consumers and destroyed the ISIS Walled Garden Strategy. Banks no longer have to queue up to do OTA provisioning.. consumers just add their accounts. Retailers no longer have to take credit cards in mobile payment…

My view is that this is a huge leap forward, but there are at least 2 more steps to go. Allowing consumers to control the wallet must be followed by an ability for retailers to deliver value (independent of the latest phones). After all there are no payment problems in the market today (none of us ever left a store because they would not take our form of payment). Retailers are more concerned about driving top line sales growth, than bottom line card costs.. but the tools to do either are limited.

The wallet has the opportunity to be the “hub” of many new commerce experiences. What other company has the tools to create advertising campaigns? Shopping experiences?

A key “unknown” benefit is how broadly Google will expand the functionality of wallet outside of NFC. Afterall if I have only one master account.. I really don’t need an NFC phone.. I could use plastic or one of those stickers. TXVia can certainly add value here.

Who are the winners?

- Consumers. They control what goes in…

- Retailers. Every retailer today should be thinking of having a pre-paid/gift/loyalty card with Google. Why not? Issuance is 100% electronic and should cost nothing. The other immediate benefit is lower cost

(blended) due to debit mix and a new “platform” to offer targeted incentives (google offers) that is integrated into the payment.Updated.. it looks like all Google wallet transactions are at regulated pre-paid debit rates. With Google wallet.. every transaction is at the lowest transaction price. Bancorp Bank has assets of $3.011B and is thus not covered under Dubin. Hence my best guess at the interchange is 1.05% plus a $0.15 (see comments below). - Small banks. Now your cards can go in the wallet … TODAY. You don’t have to pay ISIS that $1M after all.

Hey.. I could write more.. sorry for the short note. My previous blog gives a few other hints http://wp.me/pv8i-uv

Note the good discussion below.. my read is that the Google Card is a debit covered by durbin.. So merchants win big on card costs here. Everything is a debit…

Tom, the press release from Google is somewhat misleading.

Is it *any* card or just the cards from the partner banks (it’s free for a bank to apply, but will many/all do?..)?

Single ID to another card “mapping” means double acquiring – one can solve that issue if the other parties “play along”, especially the retailer and/or the acquirer (i.e. processor alone is not enough). Does that mean G-wallet only works with selected outlets (or that Google takes a loss on each transaction)?

They refer to online payments, but then mention NFC – does it mean one can only pay online using G-wallet stored on compatible phones? Can I pay at Amazon with G-wallet without entering card details (if I have to do the latter, how is that different from the current user experience)?

Most importantly, they say online connection is not needed for payments (i.e. there is no real-time authentication) – looks like they are using simple CNP approach, what’s the “Wow” factor (and where is that “Secure” part of their story?!)? Or do they run authentication using that “single ID”, stored on a secure element – hence the need for “supported phones”? Does that authentication stretches to e-commerce?

Am I missing something (big)?..

hey its in production.. start using it.. Is there a fee to load your card on paypal or amazon? You have a good question on CNP.. I would love to know the answer. I’m fairly certain the merchant sees the transaction as a debit card… If true that is a big wow factor..

As for the merchants, prepaid is treated as credit, rather than debit, transaction.

No… first of all the issuing bank is free to charge whatever they want to for any given merchant. Even for Credit cards an issuer can choose to cut a special deal with a specific merchant. In the debit world, US rules got more complicated with Durbin. The new rule provides an exemption for prepaid debit cards, as a protection for low-income consumers, but the exemption will take time to be programmed on the POS terminals. Most US prepaid card issuing banks fall into the exemption category, because they have assets of less than $10 billion.

General purpose reloadable (GPR) cards have restrictions based on asset size of the financial institution AND fee type structure (see here). As stated “reloadable cards issued by financial institutions with more than $10 billion in assets can be exempt only if they refrain from charging overdraft fees, allow the first ATM transaction each month to be free, and do not allow underlying funds to be accessed by any means other than the card itself”. Given that Google will probably allow P2P transactions on this account it will be covered by Durbin’s debit rules.

H

ence my read is that Google wallet card is a GPR card covered by Durbin and hence is $0.21 + 5bps for every transaction.Just realized Bancorp is the bank behind the card. With assets of $3.011B their debit is not regulated. Hence my best guess at interchange is 1.05% plus a $0.15.For other pre-paid cards (US and Asia), on Oct 1, 2011 Visa’s standard pre-paid rate moved from 0.95% plus 20 cents to 1.15% plus 15 cents. See standard rates here http://merchantrates.com/interchange/rates/visa/prepaid-cards

Finally found this info I saw earlier (http://support.google.com/wallet/bin/answer.py?hl=en&answer=2701024): “If prompted by the cashier, say that you’re “paying with credit” via MasterCard®.” What do you think, Tom?

Paying with credit means it rides the credit rails (Signature Debit and Credit).. if you selected debit.. it will prompt you for PIN and merchant could route outside of the Visa/MA/Amex networks directly to the bank. See my blog for more details

So paying with credit is selecting the network (mastercard). This does not correspond to rates. A pre-paid card cannot (by rule) charge interchange like a credit card. It had a seperate MDR table.

Merchant document – Good overview here. MDR is set by acquiring bank. http://www.cdgcommerce.com/documents/Article-RealScoop_Merchant_Fees.pdf

Bank document – Interchange Fees http://usa.visa.com/download/merchants/visa-usa-interchange-reimbursement-fees-june2012.pdf

http://www.mastercard.com/us/merchant/pdf/MasterCard_Interchange_Rates_and_Criteria.pdf

Visa Rules

http://corporate.visa.com/_media/visa-international-operating-regulations.pdf

From the google help doc you reference, it looks like there will be other banks like Citi that could also do OTA provisioning if they want to…

Sorry, forgot to add this:

If all, effectively, G does is links/”maps” a single ID to other cards, what stops Apple from slapping an NFC sticker on iPhones and linking them to cards already stored in iTunes/AppStore, thus creating an alternative to G-wallet (with better interface/UX)?

If NFC is “living dead” for now, what’s the excitement?

If there are two payments “back to back” involved, what about time delay? Will G share all the purchase details (in real time) with the issuers?

Is it just me or are there more Qs than As (for now)?..

all good questions. regarding back to back…. think of the first transaction as a “directive” to the merchant acquirer.. Remember the retailer never gets to see the PAN in the first place. It is encrypted at the swipe.. and the acquirer decrypts and routes to issuer based on BIN. So just add in a step… in the decryption also add a directory and a pointer to the right card. Problem here is that there are more than one acquirer.. so it must be done at the “issuer” level.

Google is likely the “issuer” of the card, so every acquirer routes transactions to “google” for auth, which they in turn route to the appropriate issuer in the google wallet. If I were Google I would work with the large acquirers to move this “translation” upstream into the acquirer (for speed). But a major benefit of acting as “issuer” is that they will see all card transactions. This must drive the big banks a little crazy.. No TSM here.

My excitement is that I can now load more than one card in my phone. Still not much business value.. perhaps I should be more restrained.. progress here is just so slow.

I am referring to your statement “which they in turn route to the appropriate issuer in the google wallet”

– Would be interesting to see how issuers (consumers actual card) would see transactions coming from Google Wallet – what category merchant would that be and what rules would be applied in cases of refund, chargeback etc

Google would be the merchant of record.. they could pass additional data to the issuer (level 3 data) to provide additional transaction detail

I was less excited by the announcement but perhaps I didn’t “get it”. How is Google “Cloud” Wallet 2.0 any better (read: more likely to see wide consumer/merchant adoption) than Paypal POS or ‘pay with square’, or a number of other cloud wallets:

1) GW currently works on a small number of smartphone models, AFAIK (my ATT Samsung Galaxy 2 isn’t on this short list, unfortunately)

2) still requires POS mods (or MasterCard PayPass, which, apparently, hides merchant name from issuing bank?! http://tcrn.ch/Rj9nnk)

In other words, while the promise and potential is there, is GW not subject to the same uphill climb in terms of adoption by both retailers and consumers – as other ‘wallet’ offerings?

…reading above, I guess you’re thinking that GW will easily onboard merchants with “all GW transactions cost you Durbin debit rate, Mr. Retailer”? If so, that’d indeed be interesting to a retailer, but does Google simply then subsidize the interchange? ie. a consumer’s GW is ‘funded’ by 1 or more credit cards; meaning Google will have to pay interchange each time those cards are charged – even if the merchant is somehow subject to durbin debit rate only…

Pingback: PayPal vs Google (at POS) « FinVentures

Just came across this piece of info from one of the GW’s partners (http://www.firstcapitalpayments.com/index.php/products/gw). It seems that GW’s card payment is indeed processed as a debit transaction. However, that transaction can then charged to the consumer’s *credit* card (not to mention the CNP nature of that second transaction). In theory, that means GW incurs a 1-1.5% loss on every transaction… Is that so?..

Pingback: Google Wallet Goes Plastic « FinVentures

Pingback: Private Label.. “New” Competitive Environment? | FinVentures