Free Article

“Launched by J.P. Morgan Payments and Mastercard, Pay-by-Bank is an ACH payment that uses open banking, which enables consumers to permission their financial data to be shared seamlessly between trusted parties to let them pay bills directly from their bank account with greater security. No longer will they be faced with the tedium of typing in routing and account numbers each time they need to pay a bill. “

Mastercard PR

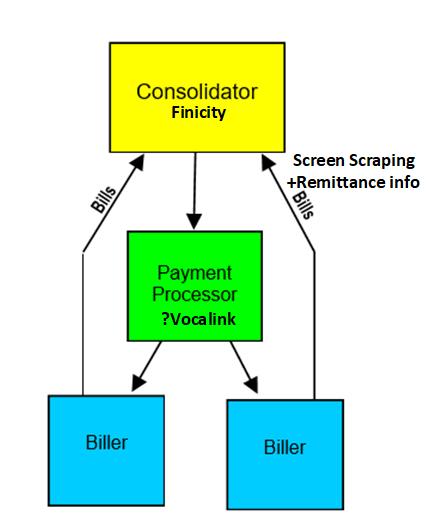

The initial launch will likely leverage MA’s finicity acquisition to integrate to biller direct websites and place either a MA card or a tokenized DDA into payment where possible (a crude form of provisioning). From a cost perspective, Durbin debit rates ($0.21 plus 5bps) are not that much more expensive than an ACH, but there is a cost. Many billers only accept ACH (ie Power, water, mortgage, …etc) thus this solution can’t be constrained to only card payment.

Assuming tokenized DDA is part of it (ie Vocalink), my bet on the long term strategic goal is to place retail banks in the position to provision DDAs into merchant (ie biller) accounts as tokenizenized instruments (ie DDAs and RTPAs). RTP only makes sense if bills are paid correctly, and billers provide consumers “instant” credit to their account (ex pay and settle on due date).

This first release will look more like a revamped online bill pay, with finicity driving a 100% aggregation approach is also possible. In this model finicity obtains the biller direct credentials of consumers and retrieves bill information. The “aggregator” biller direct approach has been around since 2003 with Yodlee BillDirect (see 2003 summary) which included a Pay Anyone service.

Tokenizing DDAs (and RTPAs) is a key near term goal of all TCH banks, thus I can’t help but think that JPMC wants billers to integrate an account provisioning service.

Banks have long held the goal of being the one stop “shop” for paying all of your bills within the online banking experience, but the cost of supporting consumers has been a drag on retail banking. Traditional Bill Pay places the retail bank as ODFI, they own the risk for the payment and the customer support for “why isn’t my bill paid”. A biller direct approach uses the billers own systems to process the payment. This JPMC/Mastercard project seems to have a goal of provisioning of tokenized DDAs with billers (I could be wrong).

Merchant Benefits

Merchants benefit if JPMC initiates payment as the originating bank (ACH credit) as originators bear responsibility for fraud and customer support. Note that Fed data clearly shows that ACH has the lowest fraud rate of any payment scheme, making the economic upside for questionable.

Given traditional bank bill pay’s customer support requirements, my guess is that JPMC/Mastercard would prefer to provision the tokenized DDA into biller so that the BILLER is responsible for fraud (ie initiate an ACH Debit with their bank) and support. This means the merchant owns all of the risk and gets none of the benefit from direct consumer interaction. (it can work either way).

Merchant Downside

Billing is the #1 consumer touchpoint for most businesses. Allowing a bank to aggregate and manage this process takes away cross sell, information, brand awareness and other interactions critical to maintaining a direct customer relationship.

If a bank wants to take this over from you, they should bear the costs of when things go wrong. Banks bear this responsibility in traditional bill pay where they initiate the ACH credit. Merchants should support consumers in their preferred payment methods, yet any technical efforts should be based on the level of current consumer demand.

The “new risk” for merchants involves your consumers providing a third party with their account credentials. Banks are perhaps best placed to manage this risk, but be aware that automated interaction can bring on issues particularly if billers have multiple heterogeneous systems across geographies.

Billers considering this solution should understand the implications of ACH origination. You best approach is to let the banks initiate. If you do accept tokenized DDA, ensure you negotiate the ability to detokenize, and ensure there is no increase in payment processing cost. They should also consider how fraud and consumer support claims are processed, as the responsibility for payment support must move to the bank (or JPMC Partner).

Also note that the “game” played in bill pay is around reconciliation information. Checkfree was the clear leader in 2002, working with merchants to integrate ACH payment with consumer bill information. Ensure your contracts allocation responsibility for incomplete information, or information in error.

Consumer Benefits

JPMC had been running consumer bill pay in a good funds model, where bill payments could take 5 days to clear (but money comes out of your account instantly). Good Funds delay has been a consistent consumer complaint as other Banks (like BAC) run in a risk based model where funds are taken on day of payment. This finicity/Mastercard solution solves a consumer experience problem.

Consumers also gain the benefit of directly permissioning (and cancelling) DDA transfers. I never give my ACH information out for this purpose. I assume that JPMC will create a master “provisioning” service akin to Wells Fargo’s existing “Watch Tower” to let consumers pull their bank information from any biller or any wallet. All of this greatly improves privacy, control and reduces fraud.

Go to Market

It is interesting that Chase Merchant services is not mentioned. Thus the solution must be run out of the MA partnerships team and TCH/Vocalink (as opposed to JPMC’s retail bank).

Given Mastercard’s very small debit footprint in the US they are the logical partner. This solution will compete with Visa Debit and Visa OCT/AFT transaction sets.

Competitors at risk

Bill.com – Significant in 2 yr view

Plaid (A2A) – Significant in 2 yr view

Visa Debit in bill payment – Low risk

FISV – Checkfree – medium risk