My #1 favorite new banking service in the US. Well done Akoya, TCH and member banks.

Previous Blogs

- Banks launch Akoya (Feb 2020)

- Consumer Data Bureau (May 2022)

- Open Banking in the US – CPFB’s proposed 1033 Rule

- Plaid and Pay by Bank (Oct 22, 2021)

Message to FinTechs: Start connecting directly to banks via Akoya. Akoya is now live with over 200 financial institutions. Technically Akoya does 4 major things

- Transform legacy OFX interfaces to FDX

- Add tokenized credentials (ie OAuth)

- Manages the service agreement(s) and

- Looks across transaction requests for bad behavior.

The Consumer benefit? Transparency and control with alignment between your bank (data providers) and those 3rd parties that have your permissions. Banks need to have the central role here as they are regulated and held accountable.

For example, few consumers know that once you perform an “instant verification” of your bank account, linking to, say, PayPal, the 3rd party provider (ex Plaid or MX) retains your credentials and regularly checks your balance (ongoing forever).

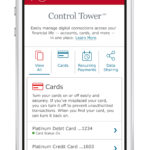

As I outlined in Consumer Data Bureau, the banks now provide an overview of “who” has access to your data, and provide you with controls to manage (see Wells Fargo “Control Tower” now known as Access Manager).

Why should FinTech’s change to Akoya (from an Aggregator)?

- Consumer integration into banking interface with transparent permissions

- Continuity of access through potential changes to passwords, identity tokens or authentication methods (ex passkey)

- Continuity of data across new accounts, changes in names, addresses, …etc

- Directly supported by bank(s)

- Fees/costs

- Given the impending move of Akoya to within the EWS umbrella, the potential for new identity-related APIs and services.

This is my favorite new banking service.. 5 stars. Well done Akoya, TCH, and Member Banks.

Technical footnote

Most FinTech’s don’t realize the complexity of large banks. Many large banks maintain separate core deposit systems in different states, or the result of various acquisitions. The back-end tech can be a mess. Online, mobile and OFX have been the common data distribution points for banks over the last 20 yrs. Yes, OFX is “dead,” but the servers still exist and have integrated the complexity successfully.

Akoya provides consistent transformation and translation of the OFX messages into modern FDX protocols. Sure banks could dump the OFX servers they have had running for 20 yrs, but the Quickbook users would be quite upset.. They pay for access. The “open banking” channel has no revenue.. Thus the minimalist approach. More in my open banking blog above.