Side note. I have 4 blogs just about ready to go in the next week.

- Value Structures and Organizational Models. This one has been in the works too long and has backed everything else up

- V/MA – Break out growth opportunities (still my largest holdings).

- Updated view on alternate payment schemes

- Banks and “owning identity”. Ownership and control is not the problem. Getting others to value their role and rules is.

Today is a short blog on a topic that shouldn’t take my time: Bank Data

Plaid published a new Blog – Navigating Section 1033 and Open Banking

Not a new idea. If you want to be a hub for data, you want to manage the legal agreements OR have unique data access. Plaid has neither with the large US banks.

US banks are standardizing access, authentication and FDX data structures through Akoya. Plaid is attempting to stay relevant in a FinTech-Bank direct connect world. As the former head of 2 of the largest online banks, I don’t see this working out.

Reasons

1) permissions and the value of data are based upon use. If you can’t manage (and legally define) use then you can’t gain permission (from consumer) or price the value (to share with bank).

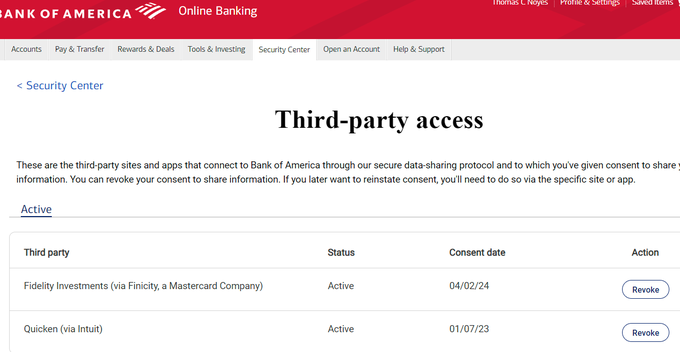

2) Banks view consumer data access as a reg requirement (even in US), however they are looking to standardize both the access, consumer permissions and agreements. For data exchange to take place there must be an agreement between Bank and Partner and also terms and consent by consumer. See my BAC pic below. Banks want a kill switch with every request for every counterparty operating within an agreement. Last yr Plaid went to banks asking to pull once and operate as a “Hub” for fintech’s they said no thanks.

3) Economic model. This is the biggest problem in data sharing and why banks walked away from Card linked offers. After 14 yrs “data revenue” is still in the $10M-$20M range (irrelevant for banks w/ $5B earnings). Its not worth the risk.

4) Bank data is not that unique. Retailers make all their purchase data available to Google, FB and others (see my data games blog). The value of data is at its intersection and bank data is highly constrained in how it “plays” because of the usage/consent restrictions.

5) Banks have a new data monetization vision. See Chase’s Retail Media Solutions. While this is flawed on many levels, banks are working to preserve the uniqueness of their data AND how it plays.

Plaid provides a great near term service, standardizing access to 1000s of banks. Just 3 yrs ago they had almost no agreements in place with banks, they just used banking credentials and scraped the data. Now that they have data feeds they are hoping to move to the agreement stage before Akoya can take hold. In the world of permissioned bank data, I don’t see an intermediary. Particularly one that can’t price and create revenue for banks.

As a side note, Large issuers continue to “fight” and stop both Apple and Google wallets from obtaining transaction data and displaying it within their mobile wallet apps. Google gets all of this data today at SKU level from the retailer (see data games). They have the ability to display, and also to run their AI against it. Apple showed off its Credit Kudos capability by using open banking to integrate UK bank data into the wallet (see article). This is something that the banks will need to move on to comply with pending 1033. Giving consumers their transaction data within the wallet is a need.