28 October 2010

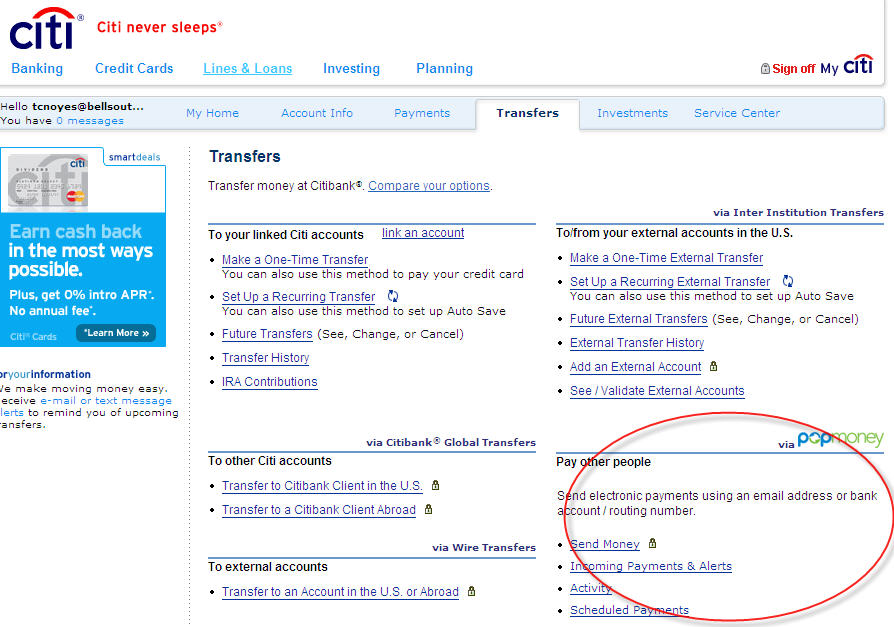

Citi just went live with Cashedge’s POP Money service. Citi is now the leader in mobile payments for both retail (this service) and card. Congrats to the Citi team for getting this done.

You may ask why does POP Money position Citi above Chase’s QuickPay? The answer is network and integration. With Quickpay, it only works if you are a Chase customer or you go through the registration process. With POP Money, Cashedge can deliver direct to account distribution to every one of its 100+ enrolled banks, as well as manage risk in transfers to accounts at its largest retail bank customers (Citi, BofA and Wachovia all use Cashedge for external transfers). The customer experience is also integrated into online banking and the funds transfer process.

From a network perspective, PayPal is the only other company which could surpass Cashedge in number of “links” to deposit accounts (~30M, ~20M respectively). The key difference is Cashedge is a bank service provider and has much better risk controls for P2P transfers (as opposed to online purchases of goods). As a bank service provider, it is also integrated into key bank risk infrastructure (ex. Early Warning’s DepositChek).

It would seem that Bank of America and Wells are intent on following Chase down the road of building a home grown system. Quite a shame, as Cashedge is a bank friendly vendor helping to keep banks at the center of emerging payments. The bank battle is not a technology one, it is against non banks and customer mindshare. Citi clearly recognizes this, keeping control of payments and delivering value while minimizing execution risk. I hope BAC and WFC will move in same direction, doing your own thing may satisfy the NIH folks.. but creating a bank owned service which can be used by any bank customer means that you will eventually need to integrate to POP money… at some point.

All great points, silo’d networks don’t work, eventually all FIs will need to connect, especially to Popmoney

Pingback: Obopay Update – 3Q10 « FinVentures

POP money is a great product introduction for Citi. Once they work through the kinks, it is bound to be a hit. It is very intuitive and moves well from desktop to mobile. Why pay any way else?? I also think the name is catchy!

Pingback: Clearxchange « FinVentures