Banks Need A Change in Perspective

Short bullet point blog (My issuer friends just put me on the 10 most wanted.. but I’m really trying to help).

Stimulating community discussion is the #1 reason I write this blog. The intersection of payments, banking, and technology is evolving rapidly, and I’m fortunate to engage with great minds like Dave Birch and new friends like Simon Taylor. Dave’s recent post on crypto predictions got me thinking about a topic I keep coming back to—wallets and networks.

As a former banker, I’m naturally more skeptical about FinTechs disrupting the core of banking. Consumer behavior is incredibly difficult to change, and financial services are among the most competitive industries in the world. If there’s one concept where my perspective diverges from many thought leaders, it’s the power of bank networks (read more). These networks are the foundation of financial transactions, and they continue to define the way money moves.

Let’s talk about tokens. When discussing tokens and payments, it’s important to clarify which category of tokens you’re talking about. Today, I’m not discussing NFTs; instead, I’m discussing card network tokens. It’s hard to believe I’ve been writing on this subject for almost 15 years. For a historical refresh, here are a few of my old blogs

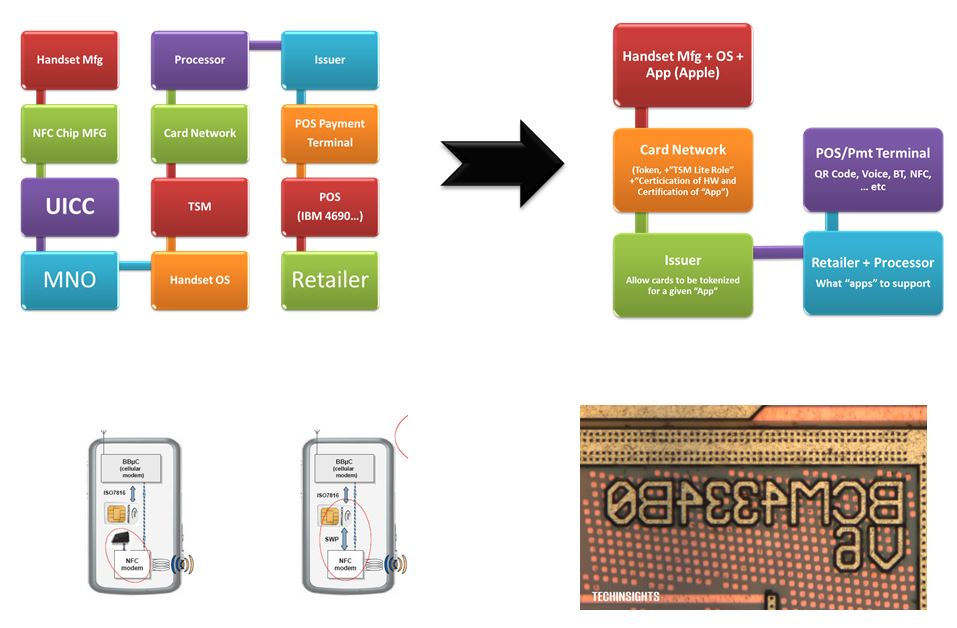

Continue readingWhat are the core functions of a digital wallet and what will the future bring now that Apple has opened up their Secure Element (see blog)?

I’ve been writing about wallets for over 12 yrs. Let me recap some history

Apple Opens NFC. Just off the phone with Apple. They were nice enough to treat me as a journalist and I was able to ask a few questions.

Winners: Consumers, Merchants, Banks, Networks and Affirm

Losers: Branded PayPal and Venmo

Apple’s WWDC is on Day 2. Today we will see significant enhancements to ApplePay and Wallet in forthcoming iOS18 (to be released this fall). Here are the highlights in order of impact.

ApplePay will be supported in every browser. This will be a game changer and dramatically increase payment volume flowing through Apple wallet (and their platform). Just last week, the WSJ published a great piece on why retailers hate that consumers make large purchases on their computers. Apple will expand ApplePay to support all browsers AND provide a major upgrade in experience, security and fraud.

Continue reading© Starpoint LLP, 2024. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

The Times (London) Article – May 29 2024

In January of this year, Apple offered commitments to the EU to assuage their concerns about NFC payments and mobile wallets related to the EU’s Marketplace Fairness Act (MFA—see blog). Apple’s approach follows Google’s model in Host Card Emulation (HCE—see Apple Developer Doc).

Flexible Credentials

© Starpoint LLP, 2024. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner.

Visa’s network is the largest commercial network in the world, moving over $15T in volume over 4.3B cards in over 200 countries. Visa’s core is called VisaNet, a real-time messaging network between banks. They don’t move money but send instructions to and from banks, merchants, consumers and other approved third parties. The banks move the money, primarily through net settlement on ACH. The beauty behind Visa’s network is its operating model, which allows thousands of partners to invest billions of dollars. To defeat Visa, you not only have to create a better network, but you must also create a better economic model for EVERYONE to switch, AND overcome the combined investment of all current stakeholders. This is why SEPA failed (see Power of Bank Networks).

This week, I outlined several of the friction points in the US card payment network in US Payments Where to Invest. Today let me try to articulate a few reasons why US banks are attempting to build a new eCommerce Wallet (Paze) as well as some additional merchant commentary on their efforts.

Notifications