13 June 2011

Please see my disclaimer at top.. this is a biased blog.. (comment necessary because the PayPal folks don’t like me this week)

The rumors of my death have been greatly exaggerated…

– Mark Twain

To restate from my tweet yesterday… Google Wallet Dead? Come on.. Just draw a simple chart 50 engineers working on a May 2011 go live.. and now 13 months later Google just stops working on it ?… just goes away? The Wallet team has only gotten bigger.. Do honestly think 50+ engineers are are all working support? Obviously something new is coming up..

What will the “new” wallet address? Well let’s look at the obvious issues:

- Consumers don’t use the wallet after an initial “novelty phase”. I could have saved Google quite a bit of money on this one.. this is what my NFC pilots in 7 countries taught me at Citi. This problem is not unique to Google… it effects all NFC pilots. Customers just don’t care whether they tap or swipe. This is the central problem that must be addressed.. there IS NO VALUE in the payment itself.. but rather the COMMERCE PROCESS. (see my previous posts)

- Carrier control of the NFC element. This is just a mess, as is the entire supply chain (see 12 party fur ball). It is beyond repair. The carriers want to charge for each and every access of the secure element. That’s right, they want to charge credit card companies $1M a pop to get their cards in, and Hotel room providers for the right to enable phone as door key. This is a replay of their “walled garden” strategy they have tried many, many times (see Carriers as Dumb pipes).

- Ubiquity (what goes in the wallet). Do Consumers really want to use a wallet that only accepts 3-4 specific issuer cards? Google wants customers to put whatever they want in the wallet, at no cost.. loyalty cards, debit cards, prepaid cards. Their “problem” is neutrality.. they appear to be a competitor to everyone (see related blog). Google wants to “enable” everyone.. if banks can create value… fine.. if merchants can create value.. fine. .but they are not taking sides. After all it is the consumer that chooses what works for them. For example, I don’t use Target’s iPhone app for price comparison inside a Target store…

- Ubiquity (phone types). There is a limit on number of NFC enabled phones available for consumer use. You can’t create momentum by forcing people to upgrade phones.. that plays into Carrier control. The objective of any Wallet is not to force a phone upgrade, but to deliver consumer value.. to every consumer.. online and offline (my Blog on TXVIA). You must feel sorry for the carriers.. they would love to ship 2M+ SWP enabled phones.. but there is no supply chain cranking them out.. (yet I digress).

- Ubiquity – Acceptance. The big retailers are not jumping over themselves in a rush to support tap and pay. Who pays for all of this new infrastructure? How can small merchants bypass stand alone terminals from Verifone and specialize cash registers (ex Square’s Register solution is superb)?

- The most important element: VALUE PROPOSITION. Take a look at Google’s merchant list for launch (http://www.google.com/press/pressrel/20110526_wallet.html), now take a look at ISIS (http://news.paywithisis.com/2012/05/15/isis-adds-first-merchant-partners/).. Notice a difference? The big retailers are running away from the carrier/bank back mobile payments initiatives because #1 they don’t drive customer acquisition/sales #2 have higher cost payment instruments (credit only). New value propositions must impact both.. See blog on Retailer’s Wallet plans

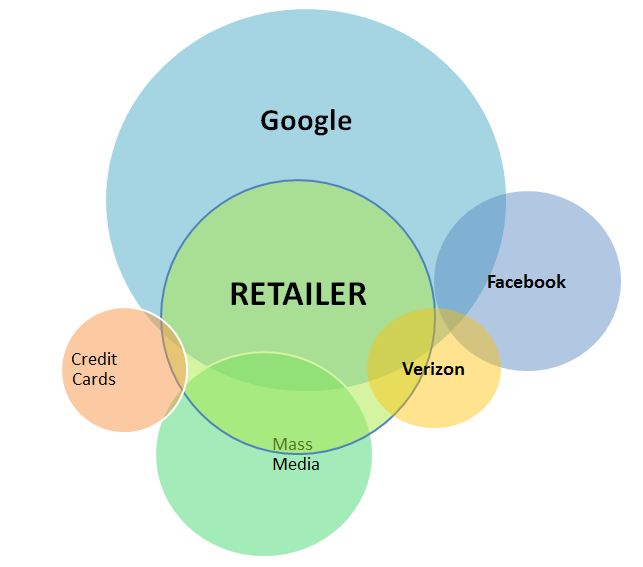

As I’ve stated before, pretend you are a retailer and draw a Venn Diagram. Put yourself in the middle. Now think about how you are going to influence customers before (or while) they shop with you. What % of customers does Verizon or ISIS currently influence? How about the banks? PayPal? Draw a circle for each… base the size of the “influence circle” on number of times these companies influence with YOUR consumers every day. INFLUENCE.. NOT SERVE or INTERACT?

Folks, the challenge is NOT PAYMENTS.. but Value in COMMERCE.. Value requires supporting consumer and retailer interaction in 100s of ways.

I have no idea of what Google will release, or when they release it.. but I do have a great deal of confidence that it will be a major step forward in addressing the issues above.