11 February 2011

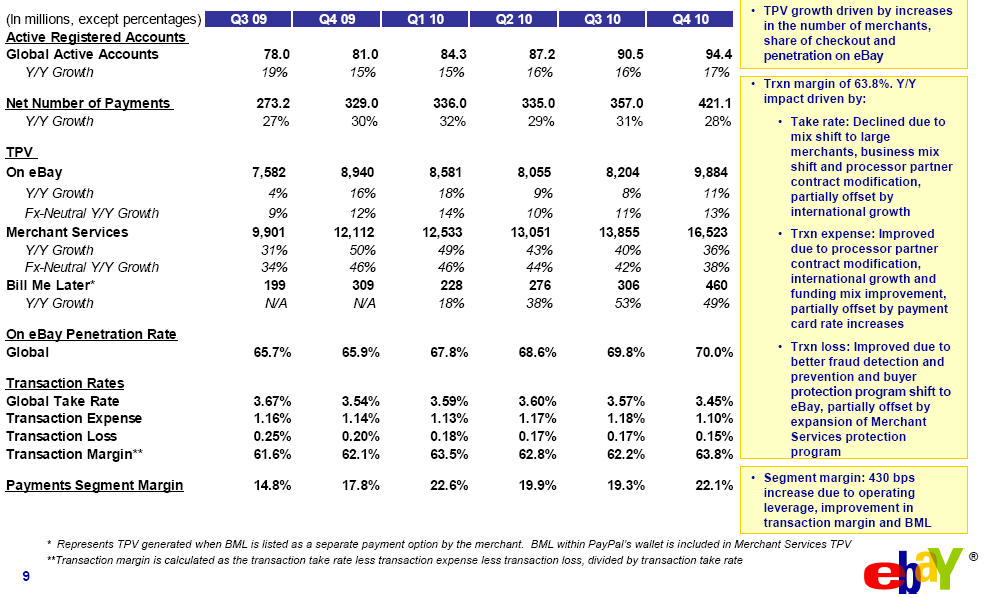

I finally got around to reviewing eBay’s 2010 results given that today is analyst day. PayPal is a machine! 24% Rev Growth on 28% increase in TPV (ex FX), with off e-Bay growth of 38%.. just tremendous!

I’m a very big fan of what they have done internationally, and the prospects the have at the POS (related blog). I encourage readers of this blog to take a read through their 10-k (http://investor.ebay.com/sec.cfm ).

One aspect of their business I don’t understand well is BillMeLater, given its 50% YoY growth, $1B ANR, and 14.4% risk adjusted margin I thought is was time to get a little more in the details.

From eBay’s 10-K : BillMeLater

…Currently, when a consumer makes a purchase using a Bill Me Later credit product issued by a chartered financial institution (WebBank), the chartered financial institution extends credit to the consumer, funds the extension of credit at the point of sale and advances funds to the merchant. We subsequently purchase the receivables related to the extensions of credit made by the chartered financial institution and, as a result of that purchase, bear the risk of loss in the event of loan defaults. Although the chartered financial institution continues to own each customer account, we own the related receivable, and Bill Me Later is responsible for all servicing functions related to the account.

WebBank is a Salt Lake City, Utah based ILC operating as a subsidiary of Steel Partners Holdings L.P.

From FDIC (http://www2.fdic.gov/idasp/index.asp). WebBank: 2010 Income $4.3M, Assets $84M, Liabilities $65.4, Equity Capital $19.2, Employees ~40.

WebBank provides similar services to Prosper (P2P Lending), From US Senate:

Loans arranged on the Prosper web site are physically made by WebBank, a Utah-based industrial loan company regulated by the Utah Department of Financial Institutions and the Federal Deposit Insurance Corporation (FDIC). Once bidding on a loan closes, WebBank funds the loan, the loan funds (minus the origination fee) are electronically deposited into the borrower’s bank account, and WebBank sells and assigns the loan to Prosper, without recourse, in exchange for the principal amount of the borrower’s loan.

eBay has $1B in BillMeLater receivables running through a company with $19.2M in Capital… I’m somewhat impressed that WebBank can do this kind of origination volume with 40 employees… But the margins certainly don’t look very good.

Many retailers are thinking about instant credit…. is this the ideal retailer/bank model? Origination Risk would likely not have been something I would want to have taken on at Citi… certainly not at these margins. Is there something else in the Steel LP that makes this attractive?

Pingback: Payment Start ups – MSB or Bank? | FinVentures