Update 1May

Dorsey just tweeted Square’s numbers. See here on Tech Crunch

Looks like analysis below is directionally accurate, actually a little kind. TPV moved to $2M on that day (of Tweet).

Note that Square revenue is $59k for the $2M TPV, or 295 bps. Transaction Margin is revenue less Square’s processing expense: issuer fees, processor fees. As listed below, this should translate into net square transaction revenue of $10k (note on my post last night I was wrong.. never post at 2am.. error rate is high).

Dorsey picture shows 9k active customers (merchants) on this particular day, which is again consistent with estimates below. Total Active is probably 3x-4x of this, so average transaction amount is probably around $10-$15.

Funny that Visa bought into Square on the same week that it rolled out new mobile swipe security standards. Visa is highly sensitive to Chase needs, and given Chase’s equity stake here they wanted to show support.

Could Square work out? sure it could.. but it is an intermediary solution at best as it is US only (No EMV), and will compete with new mobile solutions which we will see rolling out by fall.

Original post below

24 Feb 2011

Today’s TechCrunch Article

Following Square is a Hobby. My alarm bells go off whenever a non-payment team “innovates” in payments. My December blog Square Up Update estimated that Square had 5-15k users. Today’s TechCrunch says Squares 1Q11 TPV is $40M and that they are “signing up” 100k merchants per month. My guess is that “signing up” means downloading Square on your iPhone.

From this TPV we can derive Square’s revenue and their “active” customer base

Rev = TPV * Transaction Margin

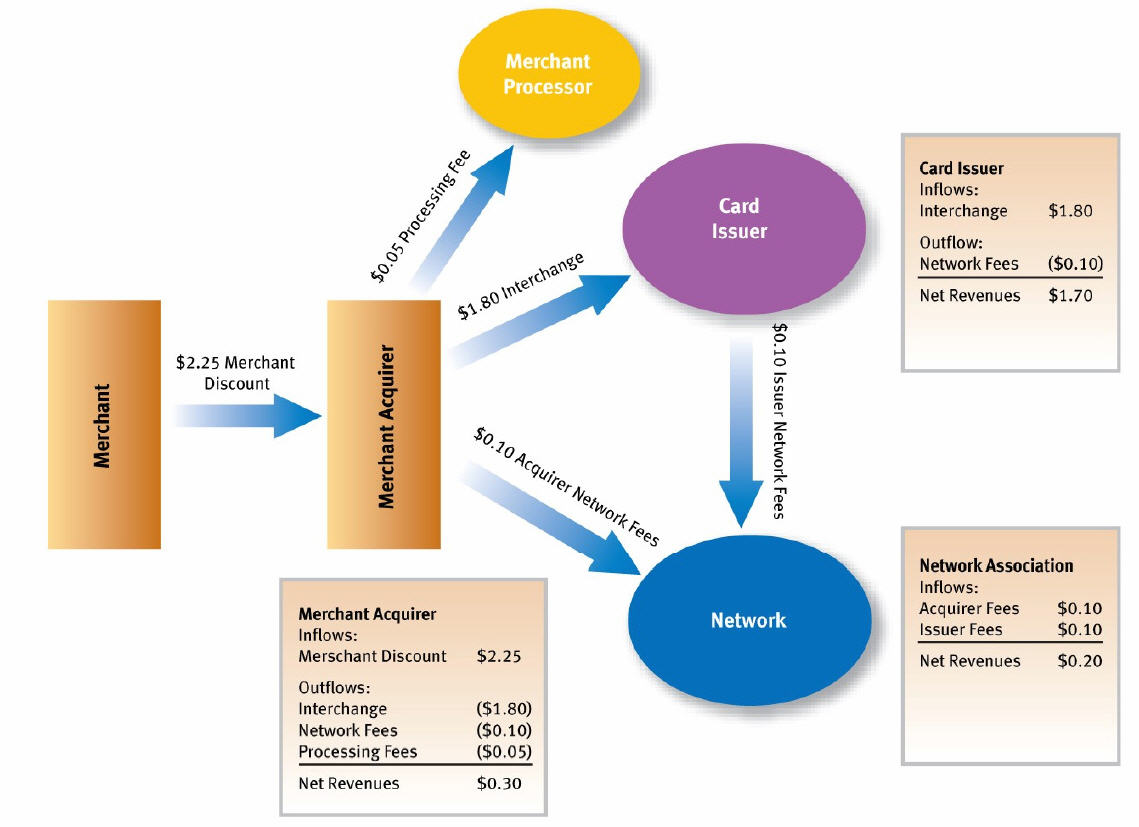

Transaction Margin = Merchant rate less cost of funds = 275bps – 225bps = 50bps

Square 1Q11 Rev = $40M* 50bps = $200,000

Rev lost from eliminating $0.15/tran fee = 0.15* 40M/$10 = $600k

Active Customers (Merchants)

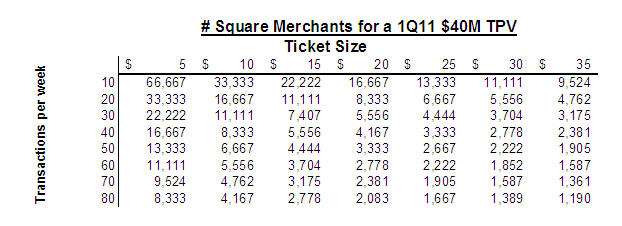

Lets assume that average ticket size is $10 and average square merchant accepts 50 transaction per week (10/day, $6,000/ quarter). This means that Square has 6.7k active merchants. For other iterations see chart below

Is Square really shipping out 100k doggles every month, while only 6-7k merchants are active? I have no idea, but it cannot be a good thing if they are.. see www.sq-skim.com.

Summary

- Square’s active merchant numbers are likely to be around 5k-30k

- Eliminating the $0.15 fee is a very big revenue hit… 1Q Rev looks like $200k now

- Square’s doggle is still not on the PCI compliance list (see PCI org’s list of approved applications )

- Just as in any merhant account, settlement funds are held to mitigate risk. Does a small merchant want to wait 60 days for payment and pay 3% for the priviledge of accepting a card? This is not a Square issue, but an industry issue in moving down market into cash replacement. PayPal solved a real problem (CNP Transactions) for a real community of buyers and sellers that coordinated (eBay).

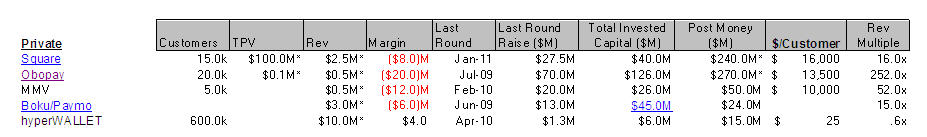

My guess is that Square sees the light at the end of the tunnel and knows it will not be a pretty collision. Evidently Square is burning through its newly received $27.5M (courtesy of Sequoia and Khosla) to grow the merchant base as fast as possible in hopes of attracting an acquirer. Square’s last round closed on a $240M valuation, assuming trailing revenue of $2.5M on $100M TPV, valuation is 16x revenue. However now that the /transaction fee is eliminated.. we are looking at 75% reduction in revenue and valuation on forward revenue is near 240x. Believe or not.. OBOPAY was still more highly valued.. In both cases, investors have just doubled down and created valuations driven toward an exit strategy.. not on a sustainable biz plan.

The only entities that would be interested in Square are large card issuers who could unilaterally charge a different interchange rate for their own cards (ex Chase and BAC). But the bank business case for an acquisition would be very tough, as a single bank could only reduce interchange for the cards it controls, resulting in a 10% improvement in transaction margin (at best). A Visa or MA acquisition would alienate the acquirers and processors. I just don’t see a logical exit for them with anyone. Issuers don’t want to pick winners in this space.. they want broad adoption. If JPM and BAC cut special interchange deals w/ Square then they will be pressed to do the same for PayPal.

eBay’s analyst day conference 2 weeks ago showed how aggressively paypal plans to move in the POS space. PayPal’s Virtual terminal not only lets merchants take cards with NO CARD READER, it has partnered with Verifone to act as an acquirer. Next month, we will see some super applications at APSI conference. One of which will demonstrate the current Nexus S operating as an NFC acquiring terminal. .. You don’t even need the doggle or the “signature”..

Pingback: Tweets that mention Do SquareUp’s $$ Square? « FinVentures -- Topsy.com

Hi Tom

As usual, great post.

As you and I discussed a year ago, isn’t this the same issue for all these providers, including the p2p’ers?

Expensive money chasing a commoditized market where the land grab means everything?

Of course implicit in your example, is the cost of funds issue.

Certainly the apex of the hype cycle.. can you imagine that Javelin estimated $7B in mobile payments last year!!? If I put an NFC sticker on my bicycle is that a mobile payment?

Real people are betting (entrepreneurs and investors) their names on this stuff so its important to cut through the fog. Bob to your point I absolutely feel like the same ideas get cycled over and over again.. perhaps replacing one word “card” with “mobile”.. that is NOT innovation.

The very last sentence is what intrigues me the most and where I see the most opportunity in the future. Nexus S and NFC. I was so excited when I saw that released and immediately thought of you (hope you write up on that soon ). iPhone 5 is supposed to have that as well, I believe and all Nokia/MS phones will also have NFC if the rumors are true.

). iPhone 5 is supposed to have that as well, I believe and all Nokia/MS phones will also have NFC if the rumors are true.

Cheers!