Square $1B Valuation… ?

29 June 2011

What shocked me most about Square today? Kleiner’s lead in the round. I know the KPCB team well, and they are the best VC I’ve ever worked with. Given my negativity… a re-evaluation is in order. Both to protect my reputation with my KPCB friends.. and for my own sanity.

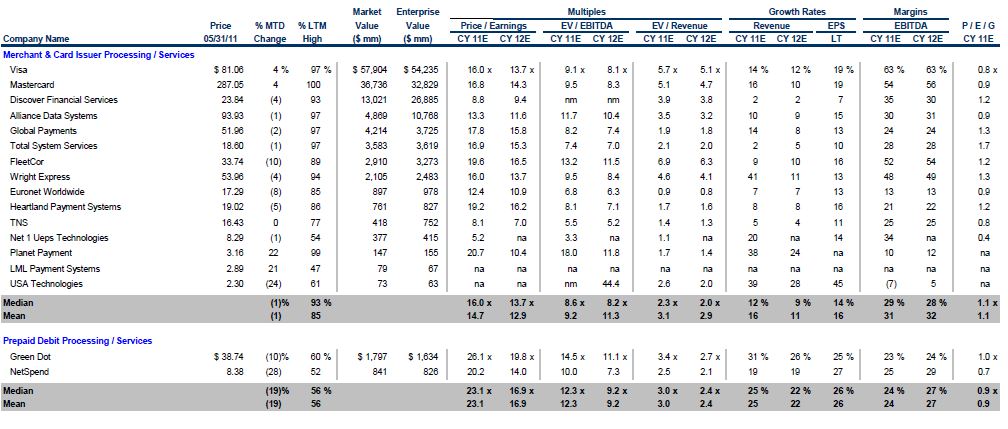

There is no way that Square can justify a $1B valuation as a payment company. At $1 billion in annual processing volume, Square would be roughly the 70th largest merchant acquirer/ISO in the country. Global, the largest pure play, processes $135 billion annually, has other businesses, and has a $4 billion market cap. See data below from my friends at FT Partners (a great Advisory team in payments).

3 years ago, Jack pitched KPCB on the idea of Square as the PayPal of Craig’s list… KPCB passed. The business model has changed substantially, and is now on V3+.

Why did KP invest in this last round? I haven’t spoken to them, but my guess is that it is no longer about payments.. but about changing the checkout process at the POS.

Here is my guess on Square’s V3 Business Model

1) Create a path to exit the transaction business.. they don’t want to manage sub prime acquiring risk.

2) Create a software/platform business for mainstream retail. Work with major retailers to use Square register as the way retail (and retail sales agents) interact with consumers. In other words re-engineer the buying experience at the POS. KP always looks for “big bets”.. this would certainly be one of them. In this Version 3 business model, Square will interact/integrate to legacy POS systems. They will also attempt to own the mid market and replace current POS vendors in the mid tier. At the low end they may still be working deploying the Square we see today, but it will be challenged by PCI Rules. For a more detailed look at current plans (they evolve rapidly) see this excellent post:http://mashable.com/2011/05/23/square-card-case/

3) Create an advertising/incentive business. We hear them working on this today, but their current customers are dry cleaners and hot dog stands.. obviously they need to move upstream. Advertising and incentive will be the primary basis for their new revenue model.

Perhaps this is why Square is working their employees 20 hours a day.. they know that the big guys are also all over this. IBM, Cisco, Nokia, NCR, Micros, Oracle, SAP, MSFT … I doubt if they will just sit back and let Square throw out a new POS system. What competency does Square have in Campaign management and advertising? Who owns their current data? This last point is very relevant.

Consumer transaction data collected by Square today is property of merchant. Although hot dog vendors may not care… Large retailers know how sensitive it is.. Square’s future model depends on both the consumer and the merchant giving up consumer data at the line item level in the POS. I see apparel and large department stores as possible candidates.. perhaps even electronics.. but the challenges are tremendous.

Can all of this work? It depends on the retailers.. having Visa on board may actually be a drag on their merchant adoption. One thing is for certain.. their valuation is certainly not based on their success as a payments business.

good analysis as usual. hadn’t made the Square/Global Payments connection but it’s pretty illuminating once you do.

Pingback: Apple’s Commerce Future = Square? « FinVentures

Pingback: Square passes $4B GDV « FinVentures