Banks Need A Change in Perspective

Short bullet point blog (My issuer friends just put me on the 10 most wanted.. but I’m really trying to help).

Short Blog

© Starpoint LLP, 2025. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted in whole or in part in any manner without the permission of the copyright owner.

Adyen was the largest network “tokenizer” and realized the benefits through enhanced authorization rates and reduced fraud. As I explained in Tokens and Binding 101, this history of tokens in payments is long, with each stakeholder maintaining an ability to tokenize. While all token strategies protect data, network tokens differ in RULES, binding (to a customer and device) and acceptance. For example, Visa’s Cloud Token Framework (CTF) and Mastercard’s Digital Enablement Services (MDES) address 6 key areas:

Short Blog

Visa held their Investor Day last week on Feb 20, and I encourage everyone to read through the presentations. Most of you know my strong network bias, V/MA are my top personal holdings. I’m not a financial analyst; my investment hypothesis rests on the strategic need for card networks and their sustainable advantage in meeting those needs.

Let me provide my top 7 reasons why I am so firmly behind the networks, with references to investor day content and my previous blogs.

Continue readingUS Payment Infrastructure is in the midst of completing a major renovation.

Let me preempt the #1 question most of you are about to ask “are card volumes at risk”? Nope, why on earth would banks want to walk away from the most profitable retail banking product in the history of man (see Future of Retail Banking)!?

Let’s talk about tokens. When discussing tokens and payments, it’s important to clarify which category of tokens you’re talking about. Today, I’m not discussing NFTs; instead, I’m discussing card network tokens. It’s hard to believe I’ve been writing on this subject for almost 15 years. For a historical refresh, here are a few of my old blogs

Continue readingAs we wrap up 2024, I thought I’d outline a few key areas I’m tracking and things to look for in 2025.

Continue readingBull Case For Visa and Mastercard

Very Long Blog. 4 Page Exec Summary. Feedback appreciated. This blog has been my “blocker” as I’ve iterated over the last 7 months. I’ve thinned this down from 31 pages (which no one would read) to 23. No I will never write something this big again.

The thoughts below are an update to my 2016 Small Wins, where I outlined how the forces that have driven scale, and shaped organizations, are atrophying (Transaction Cost Economics, asset intensity, information intensity, finance… etc). Paul Graham’s calls this change Refragmentation, I call it Transformation of Networks.

It’s as if the gravitational constant (the big G) is changing and new forces are driving the formation of new networks influenced by a rapidly evolving world of “weak links”. Information intensity has moved beyond “tweaking” 100 yr old business models to transform the design of industries, communities and people.

Whereas the 2016 blog was more about the “possibilities” enabled by tech, this blog is about the reality of how things will evolve.

© Starpoint LLP, 2024. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

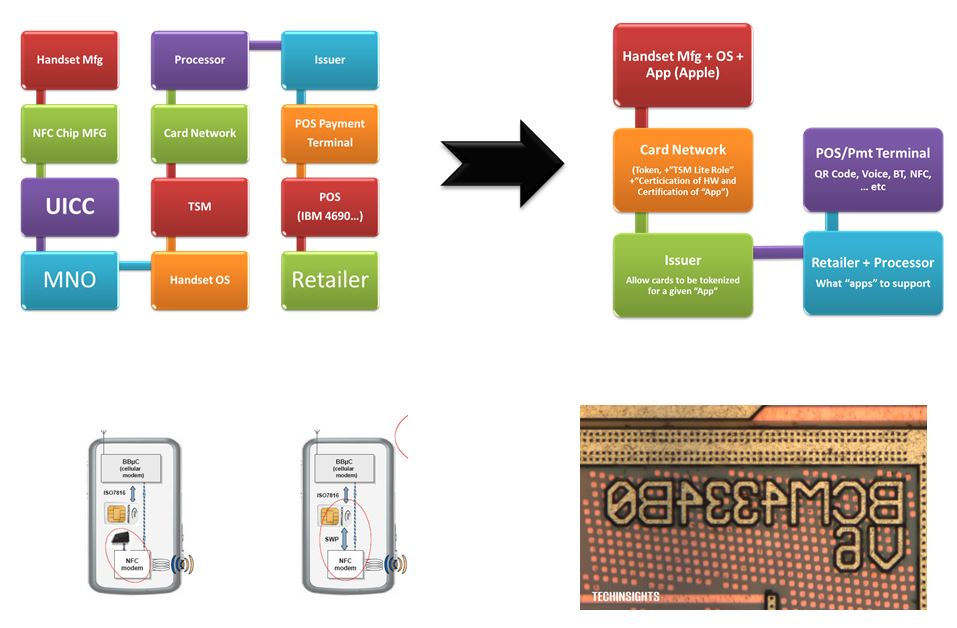

What are the core functions of a digital wallet and what will the future bring now that Apple has opened up their Secure Element (see blog)?

I’ve been writing about wallets for over 12 yrs. Let me recap some history

First Reactions

© Starpoint LLP, 2024. No part of this site, blog.starpointllp.com, may be reproduced or retransmitted, in whole or in part, in any manner without the permission of the copyright owner. Also see our Legal/Disclaimer (this is a highly opinionated and partially informed blog).

The DOJs complaint was formalized last night

Notifications