3 March

Today’s WSJ Article – Retailers Join Payment Chase

What do Retailers want in mobile? Well they certainly DO NOT want a wallet which they can’t control and is restricted to a containing credit cards, at a cost of 350 bps cost (sorry ISIS). One retailer told it to me this way

“Mobile Operators know how to run dumb pipes, not create business platforms for marketing… their current wallet initiatives are akin to a toll bridge, NFC is their toll booth where they stop me before reaching my customer.. to cross their NFC bridge I have to wait in line and when I arrive at the gate they don’t want $0.50 they want 3.5% of what I’m carrying in my truck, and a copy of the shipping manifest (the customers names I’m going to see in my delivery). This model doesn’t work for me. “

Retail is under assault. Globally retailers have had their gross margins compress from 4.2% in 2006 to 2.4% in 2011. They view mobile as a principle tool that has led to this margin compression. When I go into talk to the majors and say ‘lets talk about mobile’ .. their response is usually something like “yes.. how do we stop it.. can we put disruptors in our store”? Of course there is much shock value here… particularly for Silicon Valley types where everything mobile is good. Read my previous post for more perspective here.

Few people know that ISIS is charging Bank issuers for the privilege of having their cards in the wallet. The only way issuers can make the up front investment is to have a product that pays for itself quickly. That product is a credit card. This means that the ISIS wallet is 100% credit.. for a retailer that has a transaction mix of 30% cash, 40% debit and 30% credit this means adding a payment type that is a 100% mix of its most expensive type. Retailers ask: will this ISIS wallet drive increased spend? Why on earth would I want to do this? For Consumers this means you have to pay with cards that are “privileged” and not the card you want to pay with. A major advantage for Google is that it lets Consumer decide what is in its wallet. In the Google model, Issuers face no cost in getting their card in the wallet, Stores can add their own private label or loyalty card.. and anyone can market.. Consumers are in control. Google Wallet is not just about payment.. but about advertising, loyalty and incentives. This point is missed in the mainstream press.

The WSJ article is off on a few points.. Retailers are not focused on the mobile payment side at all (..well perhaps agreeing not to allow bad ideas to get started is agreeing on a wallet strategy.. but in a negative sense).

What are Retailers looking for?

- Mobile as a tool for enriching the customer marketing, shopping and purchasing experience.

- Ability to deliver above to ALL Consumers.. not just ones with the latest phones

- Retailer friendly protection of sensitive consumer information

- Lowest cost payment (Google is the only entity that allows customer and retailer to store ANY card.. example paypal does not support store private label)

- Integration with loyalty and marketing programs

A consortium of highly competitive Retailers face that same challenges that a consortium of highly competitive Mobile Operators do.. Neither will work unless they can deliver value. Individual companies do not excel in designing business platforms that benefit others, and are therefore very myopic. Consumer’s are very reluctant to use a retailer’s own app while they shop or checkout… For example if I was shopping in Target, why would I use Target’s iPhone app for price comparison? will I get the same results as Amazon’s?

What should you expect from Retailers?

- A defensive play. Retailers are well positioned to slow adoption of technologies that don’t make sense for them. There is a high degree of collaboration among retailers here .. most of it resulting from their success in pushing back on interchange in various markets (recently Durbin in the US).

- Something that makes financial sense for them.. FAST. Given their margins.. they have no flexibility in making investments that don’t have a solid plan. Just as the MNOs look to card interchange.. Retailers also look to 3rd parties like CPGs (think trade spend and coupons) to fund consumer facing initiatives.

- Cost reduction is usually more of a focus than sales creation.. this is particularly true when competitors get together in a consortium. I’m not going to say much more here.. but I think you get my point. For example, if I enabled ACH payment on my loyalty card.. I would take interchange from $0.21 debit down to $0.04… Target has done this with their Red Card.. a FANTASTIC product. http://tomnoyes.wordpress.com/2010/12/06/redcard/

- Customer control. Retailers want to own the consumer shopping process… or at least feel like they own it. Quite frankly Google has built the platform to enable this, but Retailers are concerned about data.

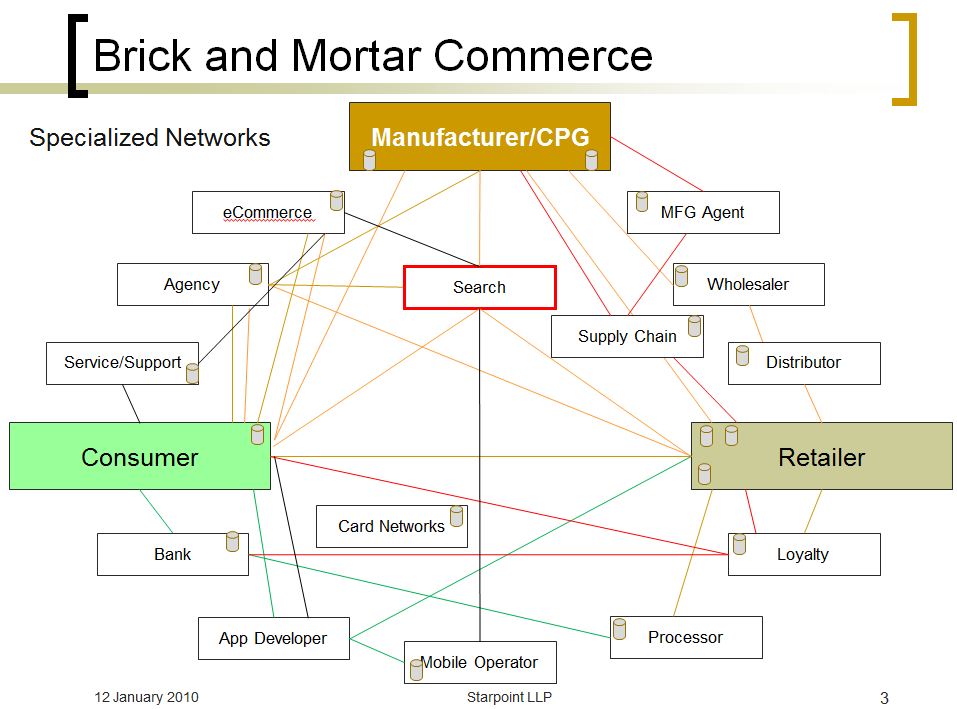

There is a tenuous balance to make mobile work in retail. This balance is between: Consumer, Retailer, Bank, Manufacturers, Mobile Operators, Advertisers, .. “Platform effectiveness” or “Consoritum effectiveness” has a strong correlation to: data, reach (distribution), relevancy, effectiveness and control. Just as MNOs are not balanced, neither are Retailers.. Consumers will migrate to where value is delivered. In Retail, selling a commodity good at a higher price is not a winning business model.. I consider myself fortunate to work with many of these groups, what is most ironic is that each group views a consumer as 100% owned by them. My position is that NO ONE owns the consumer… that consumers are driven by value and will change their behavior when value is delivered.

In my view, a neutral party ( like Google, Apple and MSFT) are much better positioned to bring participants together. Neutral Parties are akin to public highways with optional services.. They are not picking sides.. or forcing you to stop at the toll booth and hand over a percentage of your merchandise to complete a “commerce” process.

—- Addendum

BTW I admit that I’m a fan of Google. It is my baseline because nothing else is in the US market (POS Payment with phone).. and Retailers love them. It is the only company I know of that has Retailers calling them to request a visit.. why? Google delivers sales.

Great example of collaboration is Google Local Product Search (http://www.google.com/intl/en_us/products/local.html). Stores can choose to share store level product inventory. Think of how sensitive this data is.. what you are selling in which store (0r just a binary in/out of stock). Retailers love this function and enthusiastically share this data with Google because it improves the way consumers choose a physical retailer from an online search. It drives sales. Payment is only the last transaction in a long research, marketing, shopping, selection process.

Your feedback appreciated.

Google Wallet is DOA. Most of the key staff are gone and carriers have shunned the product..

Mastercard has already shown that mobile payments increase transactions 3-8x. That is enough to entice ISIS traction by merchants.

ISIS will be the winner here and not Google wallet.

Well.. not really the whole story. Ajay is my old boss.. a tremendous exec.. I’ve know Ed McLaughlin for 12 yrs.. lets just say the MA data referenced above is “soft”.. so soft I doubt you would find one retailer that would stand up for it. Increases “card” transactions.. or transactions for a given merchant?? You get the point.

Google Wallet DOA? Sure the google engineers left.. but it is far from dead.. Is it the standard flavor of NFC that we all hate? probably not.. but you will be positively surprised..

Keith: 3-8x?!? I’m sure it’s very industry-specific but I can’t imagine that adding mobile payment capability at a 7-Eleven would boost transactions by that much. Maybe at certain vending machines?

Also, isn’t it early to proclaim ISIS a winner? Sure the link below is definitely a positive, but IIRC they were actually supposed to have a service piloting around now. At least Google Wallet and Square are up, running, and gaining SOME traction/users. And Paypal has to at least be in any discussion.

http://contactlesscities.wordpress.com/2012/03/06/austin-salt-lake-city-to-get-isis-app-first/

Pingback: Digital Wallet Strategies « FinVentures

Pingback: Google Wallet Thoughts « FinVentures

Pingback: Random Thoughts: Settlement, NFC and CLO « FinVentures

Pingback: Future of Phones.. Good Enough? « FinVentures