15 March 2010

Previous Post NFC Break Out – VISA/FirstData/AT&T

My updated prediction is now first week of April. This is real.. and it is imminent.

Q: What will it mean when every AT&T subscriber receives a pre-paid Discover card with an NFC sticker? (Note back in March I did incorrectly guess it was Visa instead of Discover)

Answers

- Tipping point for mobile commerce, ushering in a new era where the mobile phone can transact with a wallet that spans the virtual and physical world, aggregating every other account type and payment instrument.

- A new business for AT&T which could drive 30-60% growth in LT revenue

- Software REVOLUION. The “Next wave” for iPhone AND the entire mobile commerce ecosystem (see googlization)

- New mainstream marketing channel as couponing integrates with payment, location awareness and detailed knowledge consumer behavior/preferences

- Card business killer for Bank/Issuer revenue as MNO Pre-paid encroaches on the consumer relationship AND issuer debit/credit products (Decoupled Debit)

- Cash replacement for small value payments as merchants of all types adapt POS to accept NFC, and small merchants take out POS terminals in favor of making their phone a cash register

- .. would love to hear from you on the next 100…

Business Model

Retention or revenue play? AT&T Universal card changed the credit card landscape in 1990. ATT demonstrated it could both create a card business AND leverage distribution muscle as it attracted over 10M card holders in under 2 years. Citi acquired the AT&T Universal card for $3.5B+ in 1997 and it remains the largest affiliate card in Citibanks’s portfolio.

The biggest variable with anything “consumer facing” is the marketing investment needed to push it into critical mass. Example, will AT&T develop some program to incent “pay by phone” use like a $50 credit with $200 of spend? Discounted airtime rates? Rewards program? AT&T has proven it can deliver new technology and ecosystems (iPhone and Universal card)… and subsequently has many options.

AT&Ts pre-paid revenue model will likely see MUCH lower margins than their 90s card business, perhaps something of a split between a pre-paid card and a “decoupled debit” (which the US banks have long feared). How will customers “load the funds”? How will they encourage bank funding? Will Citibank get its act together and partner to extend credit (existing universal card holders)?

Given that there are many unknowns, here is my high level estimate on year one financials. Assumptions:

- 85M subscribers (7M iPhone)

- Year one penetration of 5% (4.25M or 60% of iPhone base),

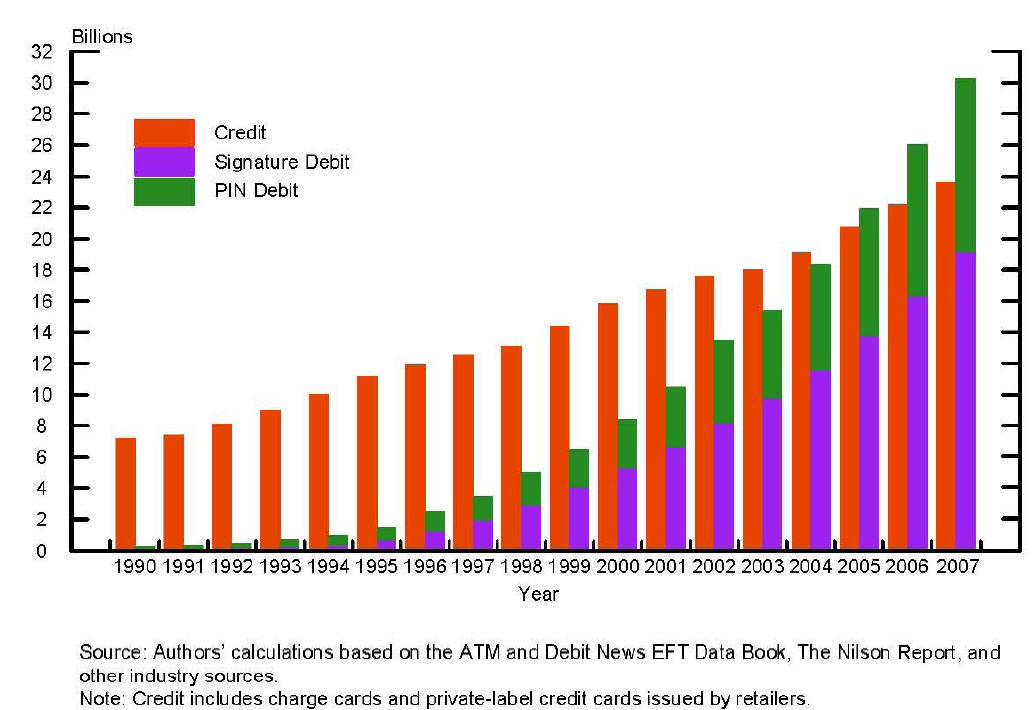

- Average purchase amount $40

- Annual TPV = 50%(85M*0.05*$40*5*12) = $5B (note: 50% for linear ramp up)

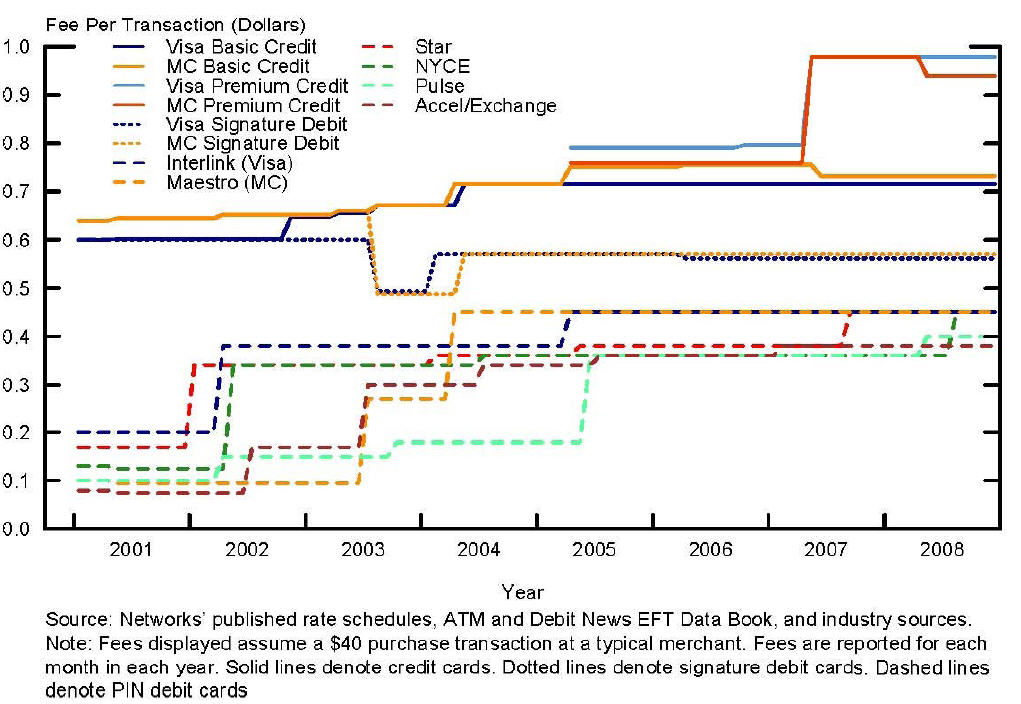

- Take rate 120bps (Note there are current issues w/ NFC interchange, see BestBuy)

- Revenue $60M

- Processing expense (30% of Rev, 100% ACH funding) – $18M

- Marketing spend – $50M

- G&A – $3M

- 12 mo EBITDA – $(11M)

$11M loss obviously doesn’t take into account many unique one time expenses, but it does provide some insight into the dynamics. It seems as though AT&T is spreading out the other “investment costs” through a consortium of First Data, Visa and a number of smaller companies. I would also expect to see a number of new revenue streams (marketing) as merchants experiment with other new Visa sponsored services like mobile coupons. The tech industry needs an initiative like this to expand the “mobile app” world consumer base beyond its current iPhone demographic.

Related Posts

- Payments Views(decoupled debit)

- Visa Interchange Rates

- NFC Tea Leaves (Feb)

- NFC Break Out – VISA/FirstData/AT&T (23 Dec)

- Visa – New Mobile Payment “Rails”?

- Google-ization of Financial Services (24 Sept)

- $5B MNO Opportunity: KYC

- China Mobile

- First Data/Tyfone

- Visa Changes Debit Debate, Backs Contactless

- NYTime Interchange

Pingback: Citi “learns lessons” on Obopay « FinVentures

Pingback: Bumping payments? Paypal Bump « FinVentures

Pingback: Tyfone/First Data « New Ventures in Financial Services

Tom,

Great post. Does this imply that a high decibel contactless education campaign is forthcoming from Visa. Considering that nearly 80 million contactless cards are already in our pockets with little usage, how do you see the ATT/Visa initiative change the status quo?

Manju

Great question.. that would imply that there is a strategy…. Currently vendors like TruSM are making great progress NFC enabling college campuses.. I don’t see either Visa or MA active in “multi use” NFC. They seem “single threaded” … perhaps an opportunity there… big bank issuers may balk at the customer service headaches around supporting any application/card that could open doors and pay bills.

Pingback: US Carriers Form New US Pre-Paid Venture « FinVentures

Pingback: ISIS: Moving payments from Rail to Air « FinVentures

Pingback: ISIS: Antonym of Nimble? « FinVentures