21 Jan 2020

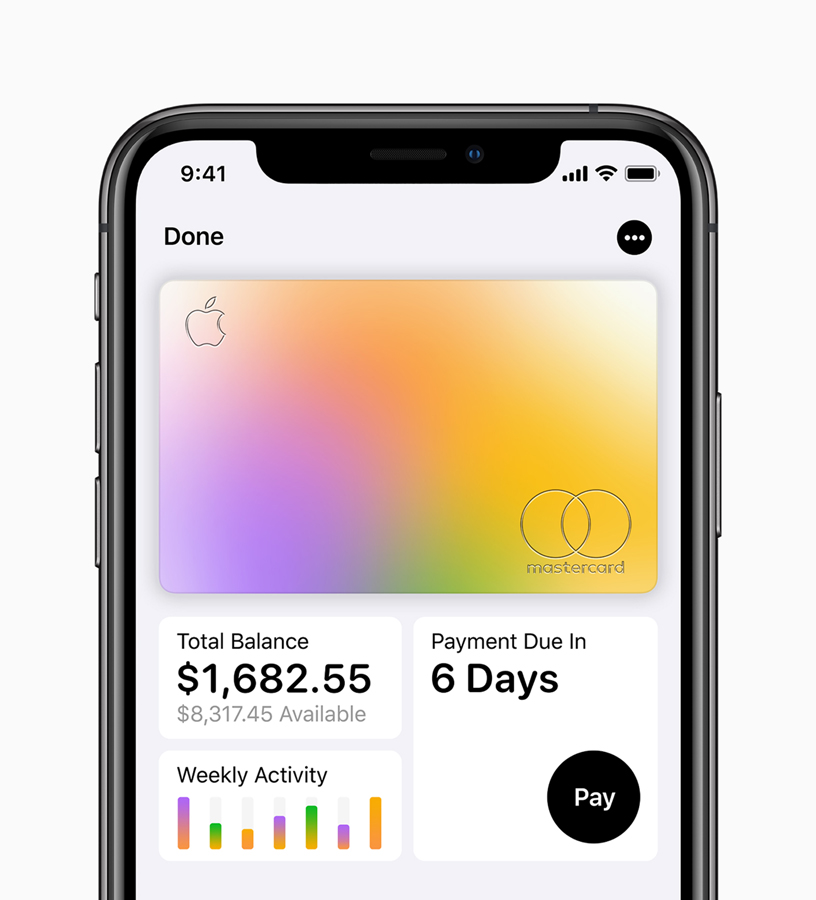

I love my Apple Card.. both the physical card – with its wonderful “feel” – as well as the virtual card and how it is integrated into the Apple Pay Wallet. These payment jewels are all part of a Services Business growing at 20% CAGR that could be worth $650B by next year (MotleyFool).

Pingback: Payments 2020 – MVP Continued Domination? – Noyes Payments Blog