- Venture Beat

- American Banker Article on Obopay’s strategy Shift

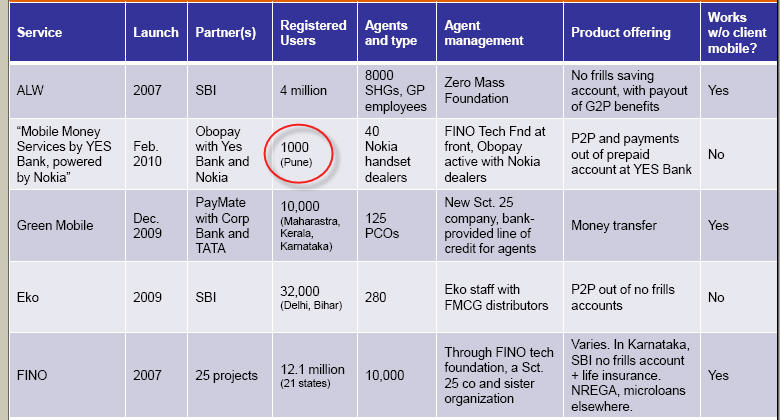

What a complete waste of $126M in invested capital. My response to VentureBeat article is a picture from CGAP

Thats right.. 1000 customers in a Yes bank pilot.. that will make for a global total of .. 2000 !? I’ve also spoken to 3 of the major banks which hosted the Obopay team as they described their new services…. lets just say there will be few returned calls. In the US (retail banking side) The Clearing House and Cashedge already own this space, internationally it is Monitise (1M+ consumers). On the card side there are few attractive P2P models and card teams’ focus is therefore on POS. The problems that Obopay continues to face at banks:

- Branding payments Obopay

- Weak business case for P2P

- Technology is easy.. risk management and fraud ops is hard

- Card groups are focused on mobile at POS (NFC).

- Banks are not very fond of Visa or MA right now.. they feel that payments is their business (imagine that).

The American Banker Article is spot on in Obopay’s continuing evolution. The “salmon swimming upstream” from the Citi pilot is complete rubbish (bankers ask them to give you names, references and volumes). It would seem that there is an organizational tendency to tell a story and how that story led to product design. Whether it was Carol’s trip to Africa, or the only US Bank pilot. The real story seems to be that they can’t find any traction with anything they do. Now they plan to create ” a mobile platform” for banks. Looks like that space is “a little” crowded already (back to the future?).

I would like to see Obopay take on a little more candor, they know their situation and will have a hard time finding customers while they blow smoke over their status, plans and platform. See Nokia’s India market evaluation here. Perhaps Obopay is launching the US services based upon the realization of the Nokia analysis…. there is no revenue in emerging markets.

Why am I so hard on Obopay? Because this team is focused on the unbanked, a group that needs protecting. Obopay has received far too much attention (and capital) that could be allocated to successful ideas and teams. As they shift their focus off of the unbanked world, I will be less inclined to criticize as the large banks have the resources to clear the obfuscatory fog that is generated by this amazing marketing machine called Obopay. My hope is that Nokia and Mastercard restructure Obopay’s few assets and create a new organization without the accumulated baggage, perhaps into 2 entities : one focused on the unbanked in honest partnership with NGOs, and the other focused on Nokia’s handset/wallet.

See CGAP Article http://www.cgap.org/gm/document-1.9.43424/CGAP_-_Building_viable_agent_networks_in_India.pdf

http://tomnoyes.wordpress.com/2009/11/12/obopay-india-another-failure/

Pingback: Obopay Update – 3Q10 « FinVentures