13 Aug 2010

Time for a blog with many questions and few answers. My natural perspective is that of a banker. Banks are created to act as trusted intermediaries of commerce, and I’m concerned when their ability to act on this charter changes. I want banks to win and to create products that satisfy the customer, build trust, and effectively serve in commerce.

A friend and I were discussing the impact of Durbin’s 2 tier debit structure (Excellent analysis by Mercator here) on the incentives for large banks to continue to issue debit. My perspective (as a banker) has been greatly altered from my time at 41st parameter working with the largest retailers in the world. I’ve developed a new view and a new appreciation for the pain felt by merchants. It would not be too extreme a statement to say that there is a deep hatred of the cards networks. The feeling is both visceral and reasoned. I remember when a senior executive from Wal*Mart came to Wachovia for a presentation and was asked what he thought were appropriate interchange rates for credit and debit. He said “0” dead pan.. then during the quiet of the audience, he said “actually we think we should be paid for accepting your cards” and emphasized that this was not a joke.

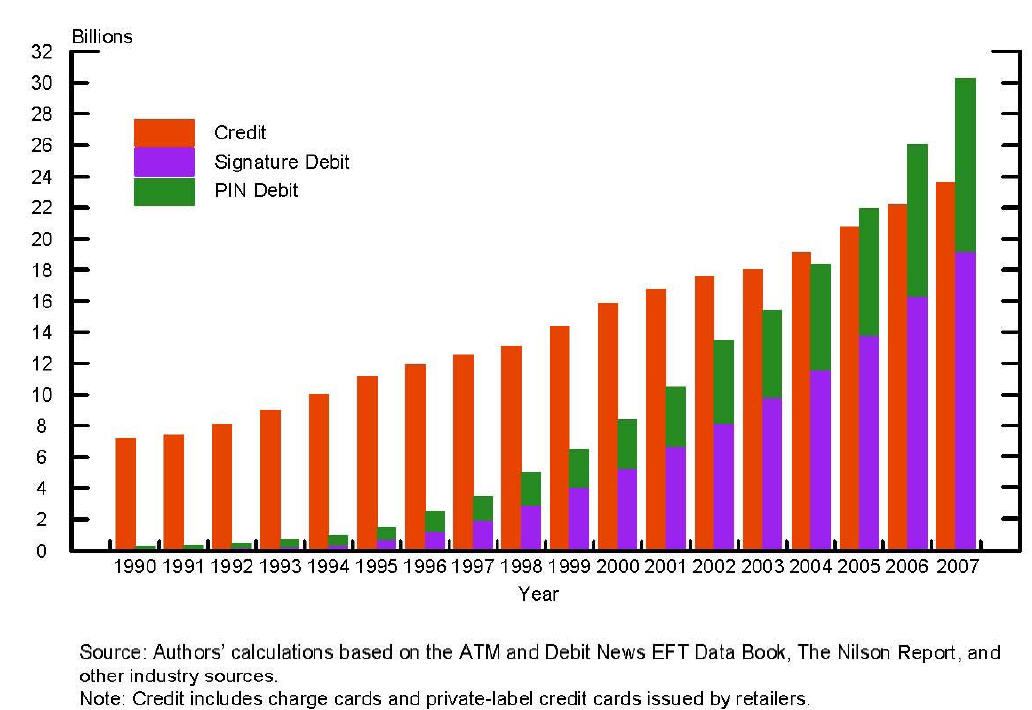

Will Merchants loose sleep if debit goes away? Answer probably rests with what will take its place. The retail banks are very unorganized around payments. With few exceptions (Chase, WFC, USAA, ..) bank payment executives do not get the focus of their retail organizations. In general, retail banks are challenged to relate payments to profitability (and hence the overall retail strategy). Debit was a clear exception to this challenge and a “killer product” for cash/check replacement.

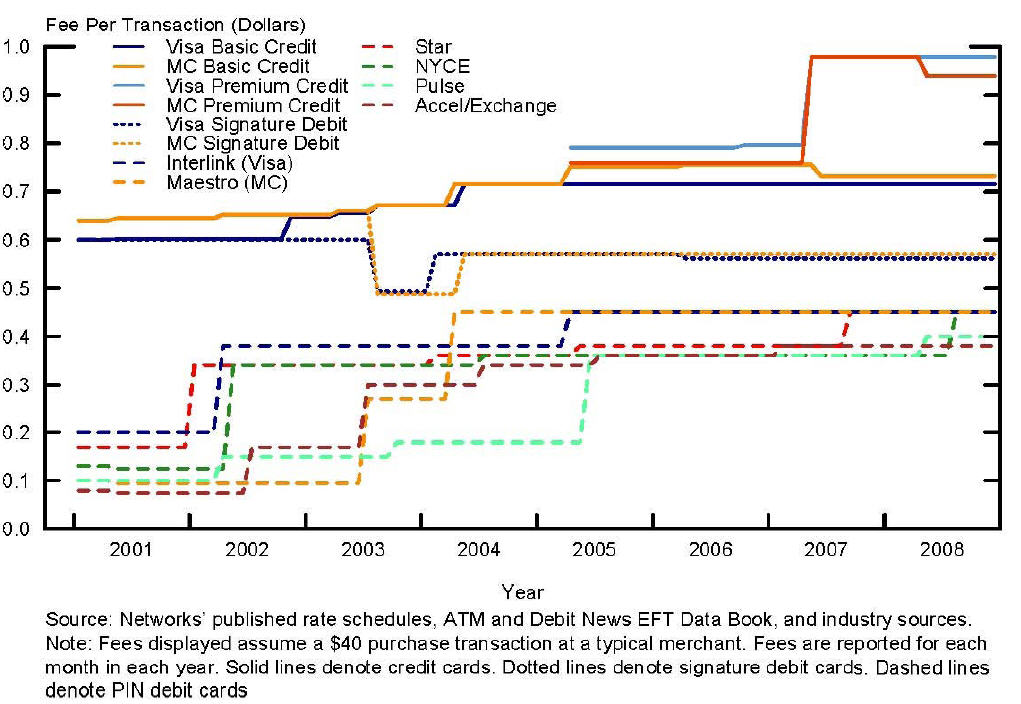

The bank value proposition for debit was clear. However, what was the merchant value proposition? Certainly reduction in check fraud, funds availability… but at what costs? The federal reserve studied interchange rates in graph to the right. What exactly drove this step creep? How did it drive value? What were the economic forces that pushed back against it? What additional investments did Visa/MA make in their network?

Will banks develop a debit replacement? Clearly Durbin has reduced banks incentives to push debit (w/ assets over $10B). I project that the market is ripe for a merchant friendly payment method that is much different than the products available today. Instead of funding the card product on merchant interchange.. perhaps mobile advertising?

Can banks/cards regain the trust of merchants as intermediaries of retail commerce? Could the wholesale or merchant acquisition business which drives a new payment product (ie Amex Revolution Money)?

Thoughts appreciated

Pingback: ISIS: Moving payments from Rail to Air « FinVentures