5 Oct 2010 (Updated 12/9)

- Obopay Press Release 28 Sept

- Citi launches Cashedge Popmoney (10/20)

- Obopay CFO Tyler Sloat leaves for Zuora (9/13)

- Previous Post – Nokia Assessment

- UPDATE Dec 9 – Nokia Acquires Obopay India..

- Update Jan 10 – Carol replaced as CEO

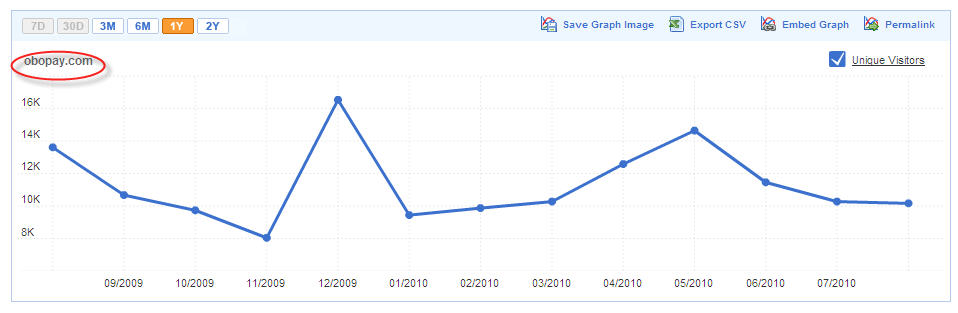

For those that don’t read this blog often, I’m an Obopay cynic. A company that is the very definition of a hype machine (and I came from Oracle). The company has many awards, and very few customers (<20k see site analytics below) and only $3.8M in revenue as of Sept 2010 (no wonder the CFO left).

Why am I so cynical? They are focusing on emerging markets, and the rural poor.. a group than can ill afford to buy into vapor. Press release above shows them targeting US banks now. Good to see them change strategies. Three years ago they wanted to build a direct to consumer brand, investing in money transfer licenses in all US states and alliance with MasterCard. Now they want to sell a new a “white label” P2P bank service?

Given their poor performance to date, MA is starting to step away from them as primary MoneySend platform (example is recent RIM announcement). Citi has also moved on from the limited Obopay pilot it launched in 2007, into a great new service delivered by Cashedge (POPMoney). The press release indicates quite a dramatic shift in the Obopay business model back to the US, with very little press relating to emerging markets (UPDATE NOKIA bought Obopay India). The bank shift may have been driven by cash burn as the $130M in invested capital is not enough to compete against the likes of Visa and AT&T in marketing a new consumer payment service. This strategy shift, and resulting financial implications, may have been a driver of Obopay’s CFO departure (never a good sign). Message to Obopay.. you may want to update your management team page as Tyler’s name is still there.

With respect to a new “white label” strategy, there does seem to be thoughful expansion of their transaction network; Obopay announced integration to both NYCE and STAR (allowing PINless debit) . This network structure follows in the footsteps of PayPal, and is not a bad strategy at all (if you are stuck to a card based money transfer paradigm). Cards have many advantages in P2P use, top among them are the facilities for authorization and “instant” transfer. The word instant is in quotes here because authorization and posting of the transaction can be near real time, but settlement is up to the bank (1-2 days) and settlement network. The downside for Obopay’s card model is cost, particularly sensitive in a sender pays model. Of course these initiatives will bring down transaction cost, but they neglect to address Obopay’s core issues: no consumer value and hence few transactions.

The problems with a bank White Label strategy is that they are late to this game with sales team not geared for banks. They have set themselves up for competition with vendors such as Cashedge, FIS and FISV who host bank infrastructure. Cashedge is the clear leader in mobile P2P here, with the recently launched Citi service and over 100 banks (including Wachovia, BB&T and Bank of America). Chase’s QuickPay is another example of a bank led mobile P2P initiative. As I told one of the major banks last week, the Obopay business case for P2P may look better (because of interchange), but the price is steep (consumer adoption, behavior change and limited use). In other words, there is no proof point for a card based P2P model, as demonstrated by Obopay’s adoption over the last 3 years.

Emerging Markets

Over the last 2 years, Obopay has been active in attempting to penetrate emerging markets (particularly India – See previous Blog on Obopay’s failure). India is a very tough business for any payment players. RBI is well known as one of the toughest regulators on the planet, Obopay (and local MNOs) have been hamstrung in pursuing any model that is NOT bank led. Their YES bank pilot shows the challenges of rolling out a solution that is bank led in a card model… all best described in this Nokia presentation. It would seem that Nokia is taking the lead from Obopay on India (UPDATE 12/9 Confirmed), as it is key to retaining their 60% handset market share. The Nokia team is stellar, and their leadership of India efforts will put them in a much better position to execute against complex alliance and regulatory issues. As a side note, I expect to see Nokia focus on a handset “wallet” (bank/MFI/BC agnostic) with Obopay as the “switch” to IMPS (see related blog) clearing and bill payment (perhaps a future blog on Obopay as the Checkfree/Cardlink of India?). Understand that a government pilot on this approach is under consideration.

Message to investors: make some big changes. You have lost the early lead, and your partners are running away. The risk in competing against the big networks and banks in P2P is not within your investment hypothesis. Banks do not need your core asset (money services licenses) and you do not have the right team to sell and service banks. Emerging markets have limited revenue prospects, and MNOs are capable of building mobile payments from scratch (ref MPESA). MasterCard is making alliances with teams that drive network (either customers or merchants) expect them to develop alternatives.

I’ve found your blog to be insightful and helpful professionally as I work at the intersection between payments and MFIs, with a focus on remittances. We are always looking for early stage payment companies which focus on the unbanked.