Visa’s Mobile Strategy: Hedge your bets

I frequently write this blog just to provide a little structure for my own thoughts. While I attempt to avoid “stream of consciousness” writing.. my efforts are not always successful. Top of mind today is the question: what on earth is Visa doing and why? Any time you see a major company come out with a press release with no customers, or proof points it bears a little research. Last week I wrote on Visa’s mobile wallet announcement (or non-announcement). Why would they do this?

Here is a short inventory of Visa’s (and Visa EU) mobile “related” announcements over last year

- Visa Money Transfer (July 2008). My related Blog

- Visa Monitise Investment (June 2009), 2nd Monitise Investment (July 2010)

- Visa Monitise launch mobile money for unbanked (Mar 2010)

- Visa Inc. Completes Acquisition of CyberSource (July 2010)

- Visa iPhone (Dec 2010)

- Visa to Acquire Playspan (Feb 2011)

- Visa Europe and Monitise Partnership Agreement (Feb 2011)

- Visa Square Investment (April 2011)

- Visa Mobile Discounts (April 2011) . Related Blog

- Visa Click to Buy (May 2011)

- Visa Mobile Wallet (May 2011)

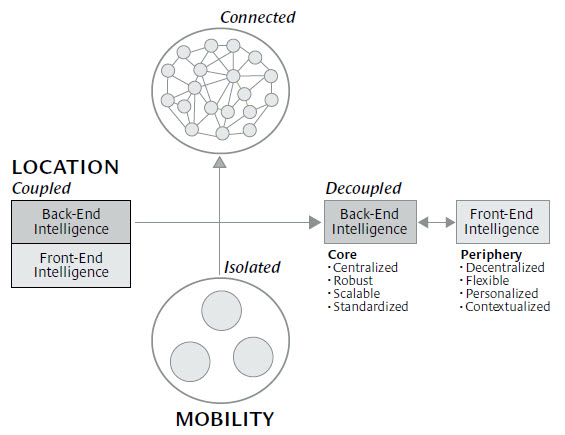

Clearly Visa has been thinking about mobile for quite some time (listen to Bill Gajda). As I’ve stated many times the great thing about a (well designed) global network is resiliency.. it is resistant to failure.. the challenge in running one is the same: resistance to change. Every network evolves around delivering value to the core constituents (nodes) who are CURRENTLY using the network. Networks also evolve around a business and revenue model, as a network matures value evolves out from the process of coordinating transactions to managing interactions (HBR Where Value Lives, Jan 2001)

modularization takes hold, the ability to coordinate among the modules will become the most valuable business skill. Much of the competition in the business world will center on gaining and maintaining the orchestration role for a value chain or an industry. … Connected by networks, different companies can easily combine their capabilities and resources into temporary and flexible alliances to capitalize on particular market opportunities. As these “plug-and-play” enterprises become common, value shifts from entities that own intelligence to those that orchestrate the flow and combination of intelligence. In other words, more money can be made in managing interactions than in performing actions.

Why is it so hard for Visa to change? Visa’s history is that of a bank owned consortium and although they are a public company today, their legacy and network was built around a bank centered model. The banks were very thoughtful in constructing Visa and its rules, to attract smaller banks the majority owners (Chase, BAC, WFC, C, USB) created a structure to ensure no single bank could take advantage of the network, and a rule making process that was optimized for “stability” not “adaptability”.

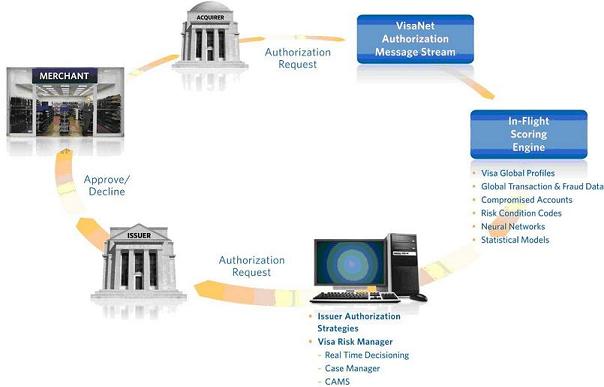

For those outside of the payments business, Visa operates like the NFL League Office. It cannot make rules in a vacuum, nor does it own the teams, the network rights or the ticket sales. Innovation teams in Visa are more like “advocates” and “evangelists”, they can not force change on their member banks, but rather paint a picture on what is possible. The Visa “franchise” thus has tremendous difficulty adapting to a new game just as if the NFL would have a challenge in coordinating a new sport like snow boarding. Although the fan base may be the same.. and the team owners are interested in generating additional revenue.. it’s a stretch for their network to adapt. This dynamic correlates to why Visa failed in eCommerce and companies like PayPal and Cybersource excelled. Both POS and CNP were payments, but the environment of the transactions were very different, particularly in fraud and required new “rules”. To stick with my NFL analogy, both POS and CNP required fraud services to surround transaction authorization.. just as both snow boarder and football player need safety equipment.

So what is Visa’s strategy? Internally, they know they missed out on eCommerce.. but it wasn’t their fault, they were bank owned until 2008. What they see is a new wave of mobile that will effect all of commerce (US $4T .. excluding Auto) not just eCommerce ($176B). They can’t afford to miss this boat.

The problem is that Visa’s existing, bank centered, network is rigid and ill suited for more than POS payments. The mobile revolution at the POS will be much more than payments, particularly as both the POS and the Mobile phone are each able to coordinate across many different networks. Technologies like NFC will also provide much greater potential for authentication and authorization separate from any single network (note I didn’t say payment).

The biggest challenge for Visa to overcome is value delivery. With the prospect of Durbin killing upwards of 20% of overall revenue (70%+ of Debit Rev) Visa is “squeezed” between preparing for a new world order driven by a new network (not yet profitable) and driving its existing business growth (moving along at a respectable 15% clip). The TOP ISSUE with Visa’s mobile NFC Payment is VALUE. Banks are looking to drive NFC to drive CREDIT volume (as opposed to Debit). This is why certain retailers with narrow margins (ex Grocery) are not supporting NFC (See my blog on BestBuy’s experience). The ISIS consortium in the US was leading with a “debit like” payment product that received strong interest from retailers.. with prospect for very low interchange. Alternatively, bank and Visa led schemes have the merchants paying for the “privilege” to take NFC.

If Visa’s mobile efforts were removed from the revenue pressure of the parent we would undoubtedly see Visa work to establish a new, more cost effective network built around Debit (See my previous blog on the “evolution” of debit networks) and they have worked to some extent on this with VMT. Or even build “new mobile rails”, as they attempted to do with Monitise and are now rumored to be investing in Fundamo for same (targeting emerging markets).

As it stands today, Visa is playing the role of a portfolio manager and evangelist. Selectively supporting and investing in mobile initiatives in an attempt to leverage their network. This is a “services” approach to their existing network. The structural challenge is that new services on Visa’s existing network equates to lipstick on a pig (or a snowboard on a running back). How can Visa deliver value to a POS transaction when it is forced (by issuers) to be credit only (250-350bps). To be perfectly clear this is NOT a technical challenge, it is a business model challenge. Bank/Retailer/Card relationships are very strained right now. A good example is “coupons”, Visa has their own coupon service (referenced in PR above) and has every technical capacity to offer a great experience. Visa could actually deliver a killer app in this space if retailers would only give up line item detail on what was actually purchased. The technical capacity for Visa’s network to deliver “level III item detail” has been in place for many years. Do you know how many merchants give up this information? Almost none.. (example Office Depot has it on their Chase co-branded card). Merchants trust neither the networks, nor the issuers with their price list or customer information. Visa is not able to “pay” for this information as it does not own the customer and cannot leverage this either. This all goes back to why Visa took 3+ years to roll out the offers service in the first place.. it had to get issuer permission for each consumer.

Every network begins with delivering value to at least 2 parties. My bet on mobile payment is based on a history. A history where banks (and Visa) have demonstrated poor competency in retaining their role as intermediary between consumer and retailer. A new retailer friendly network, that conveys much more than payment information is needed.

Visa for you to execute in this space, spin out Bill Gajda and team to build a new network. You certainly have the capital and intellectual horsepower to do it.. Don’t think of mobile as a service on VisaNet.. We will know this is moving when we see PayWave Debit volumes taking off.

Analysts.. lets start making Visa publish transaction volumes for NFC, VMT, eCom, Offers.. shining the light on this investment “hole” will help them in the long run.

Tom,

Thanks, I thought I was taking crazy pills or something when I saw Visa’s highly touted non-announcement. Seriously, the video, I saw a similar one in 1997 from Philips – yes that Philips in the innovation center in Eindhoven. We are all going to use mobile devices – OK. We are going to pay with said mobile – OK. Visa is going to be around – OK. This is news ?

As always thanks for bringing some sanity.

Pingback: Thoughts for the week – June 9 « FinVentures

Pingback: Visa’s Wallet Strategy – Part 2 « Near Field Communications / Smart mCommerce

Pingback: Card Linked Offers « FinVentures

Pingback: V.me: Issuers please give me your customers « FinVentures

Pingback: CEO View – Battle of the Cloud Part 5 | FinVentures

Pingback: Payments Part of OS: What does that mean? | FinVentures