May 25, 2011 (Updated.. I was 25% off on TPV)

TechCrunch Today (Square has 95% chance to do better than PayPal)

TechCrunch – Square Register (May 24)

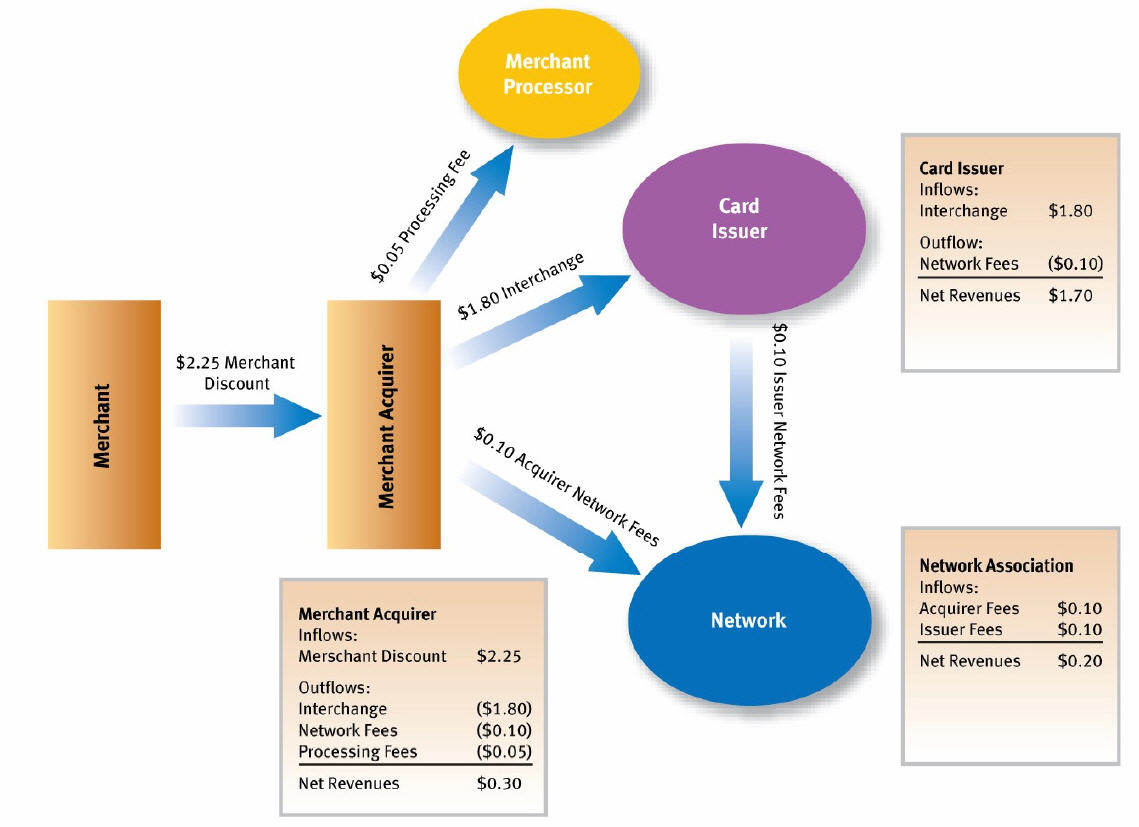

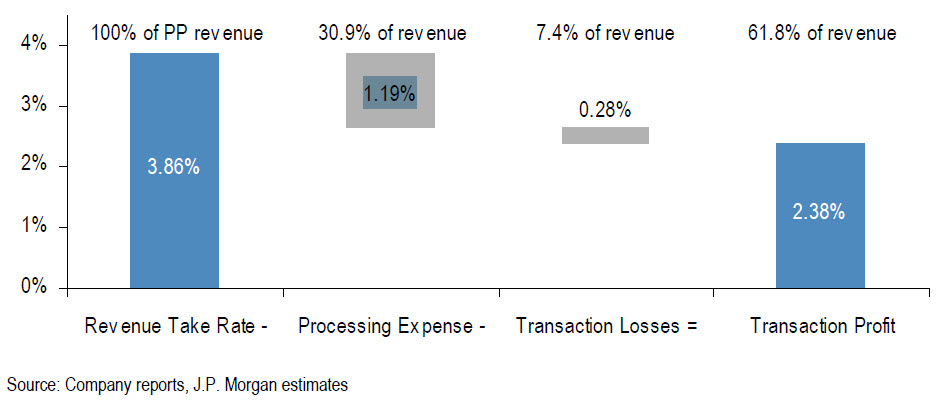

Keith Rabois has been around payments a long time.. and given his PayPal background…. his views shouldn’t be ignored. $1B TPV sounds like a big number, but equates to only $3M in revenue (275bps take rate, 30bps margin). PayPal has a 330-390bps take rate (230bps margin) driven by its 3 party model (both merchant and consumer have accounts). Yes, that’s right… Paypal makes 7x+ more revenue for every dollar processed than Square. So for Square to surpass PayPal, they need $700B in TPV… (in their current revenue model). Given that total US Credit Card TPV is $1.3T (Visa $781B , MA $515) that seems a little unrealistic. (for more detail see http://tomnoyes.wordpress.com/2011/02/24/do-squareups-square/).

So what is “do better”? Number of accounts? Square is sitting on about 20k active customer accounts.. this is a long way from PayPal’s 100M..

The new Square register is a decent idea.. but Square is NOT competing in a vacuum. During PayPal’s early days there was a problem that needed a solution (CNP). PayPal delivered a strong value proposition.. a 3 party payment platform for online purchases. Solving this problem was critical for commerce (on eBay) to take place. The online payments problem, which PayPal solved, was a roadblock to delivering commerce value.

What are the problems that Square is attempting to solve?

- Help Visa drive credit card volume

- Help small merchants accept cards

- Help small merchants communicate to consumers (Square registers)?

- Provide Consumers a Wallet on their phone?

- Help a Craig’s list seller use a card next time they sell something?

Square has done a great job in consumer experience, across all of their applications, but their challenge remains value delivery. Chase and Visa have billions of reasons for sustaining CREDIT card TPV, but this is NOT a retailer friendly value proposition. As I’ve stated, the challenges of increasing card usage with small merchants is not a technology problem, it is a business (value proposition) issue. Square is doing a great service to many small merchants in bringing down the cost of accepting the card, and improving the consumer/merchant experience.

What is their opportunity?

Retail Sales in US is about $2.4T (excluding Auto, Gas, Resturants). This is certainly a larger market than the $176B spent in US eCommerce. What is your guess on % of merchants that do not currently accept cards, and their categories? Take a look as the US Census data, and I would say total sales for “square prospects” are around $100B.

Take a look at the recent Micros/Verifone announcement as an example. Existing POS and terminal manufactures are not sitting on their hands. Who would want to invest in Square? What kind of platform are they building? This is not a group which will rally the industry, but rather spur it to action (or isolate it to individuals/small businesses).

We will soon see mobile value propositions that contain payments.. but payments are just a supporting mechanism of a larger commerce related value proposition. Square is making card acceptance nice and neat for small merchants.. this is a good niche opportunity. I will shave my head when Square “does better” than PayPal.. I give this a .0005% chance..

Pingback: Rumor mill .. instant offers..? « FinVentures

Pingback: Thoughts for the week – June 9 « FinVentures