28 May 2011

As I related in last week’s Post, Clearxchange (let’s call it CX) evolved out of the online/mobile payment groups at Wells and BAC. I also described how bank’s will “Win in Payments” along with a high level view on internal bank dynamics which drive Debit/ACH vs. Credit payments strategy, as well as the fragmentation that is occurring in “unprofitable” payments like ACH, carrier billing and P2P… etc.

Consortiums are not the most nimble of creatures. Banks also have the tendency to follow the lead of the big 3 (BAC, WFC, JPM) in all things retail. BAC/WFC are well positioned to execute in CX, and certainly have a sufficient customer base to make CX work. Their addition of JPM (and associated QuickPay) and the creation of a separate entity also aligns well with getting something done quickly. Developing CX within an existing bank consortitum could have taken much longer than 2 years to get a common bank service built… This “build it and they will come” approach is how many of today’s bank services get their start (visa, interlink/debit/ , clearing house, …).

Unfortunately, CX does not have a sustainable “stand alone” business case. Because it was completed within the channel organizations, business strategy (with the LOBs) was not well coordinated with the other LOBs (exception is JPM, the top bank in payments strategy). I’ve actually made 5 CX payments on launch day already. In BAC, just go to internal transfers and fill out the form on the left (did you receive a transfer). I clicked yes as it did not require an accurate answer in the Ts&Cs..

The service is very solid, but I do wonder what the retail wires group must think. Most bank services today allow for transfers to and from accounts I own at other FSIs (we call this A2A). Now I can transfer money to anyone via mobile with no fee (p2p). What about P2B and impact on Debit? For example, eBay purchase? Or how about at a store? If I can send money to a person with no fee.. what prevents cannibalization of Debit? Because of Durbin making Debit “almost free” is there an incentive to create a new payment network?

My sources tell me that there has been very little planning around CX (outside of JPM) to answer these questions. Not only were people with the big 3 banks scrambling to explain the service internally, their CEOs were getting called by peer banks about why their bank had not been asked to join? While banks are not free from anti-trust concerns.. payments is a network business that requires broad participation. The CX announcement comes at a rather sensitive time for them, as Jamie Dimon chairs The Clearing House meetings, there is little doubt that TCH has also served a forum for coordination on all retail payment “industry matters” like Durbin. Can you imagine working with JPM, BAC and WFC in TCH meeting on retail debit strategy.. then hearing they have a new service rolled out without your knowledge? Not the most polite thing to do.

It certainly was not Jamie’s fault (my favorite bank CEO by far.. fellow Citi alum).. but rather the poor “payments” coordination within banks. In my previous blog Bank’s Need Payment Councils, I laid out how these bank teams had worked historically. CX is a fantastic idea.. and it could even evolve into a profitable service if banks can improve the way the coordinate internally. This is a CEO level decision.. no one wants to tell the CEO that he needs to create a cross LOB council to coordinate payment strategy.. The Citi approach is much more “get a guy to own it”.. like Wayne at Citi, Vin at Chase, or Steve at WFC. But decisions that impact multiple LOBs are very challenging to coordinate across the organization.. CX is the manifestation of just such a dynamic (better to get something done.. then work in a bank committee that never makes a decision).

I’ve been getting called this week on “what is the CX strategy”? The answer depends on who you talk to. BAC has a number of debit/retail payment initiatives.. and there are certainly overlaps..

– New Visa Debit with BAMS/First Data

– Visa Money Transfers (directly competes with CX)

– CX

– Internal Payment Warehouse (3 yrs in making)

– Cashedge (A2A money transfers)

– Pariter (On we w/ WFC)

– NFC Credit w/ Visa and Device Fidelity

– …

If banks have trouble coordinating internally.. the situation certainly does not improv

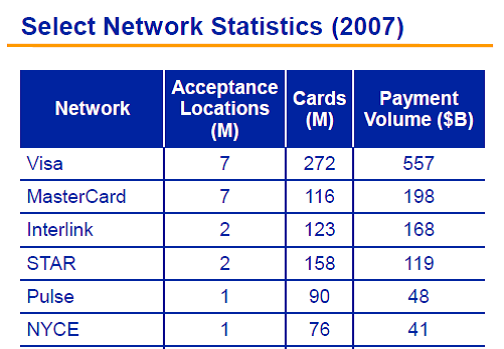

e when 20+ of them get together to set a strategy. Of course this “least common denominator” is why today’s existing payment network is both rigid and resilient. What the banks really need is a firm “platform” vision for payments that they own. For example, what if I broke payments into 3 broad categories: pay before, pay now, pay later? Having multiple products that compete in these categories is a sign of a good healthy market.. having multiple networks process the payment is NOT (only some of which are bank owned). As a side note, there is little reason to doubt that there will be SUBSTANTIAL consolidation surrounding the 6 major debit networks (Visa, Pulse, Star, NYCE…)

My top idea for CX to drive a little incremental revenue? 2 years ago, Metavante (now FIS) negotiated a PayPal deal that would provide for revenue sharing for eBay merchant payment.. PayPal collects 3%+fees and would share 30-50% with FIS. Why would the banks not want to do this? The original plan had more to do with this happening over bill pay.. but a transfer probably makes more sense. Either way, the banks should jump on this kind of opportunity. My #2 idea.. well I’m only telling my customer this one.. (my poor attempt at a tickler).

Happy Memorial Day

– Tom

Pingback: Google in Payments: Why Yesterday was BIG News | FinVentures

Pingback: Chess game.. another example | FinVentures

Pingback: US Payment Innovation and Regulation | FinVentures

Pingback: Facebook P2P - Starpoint Blog - Finventures