ISIS Delay

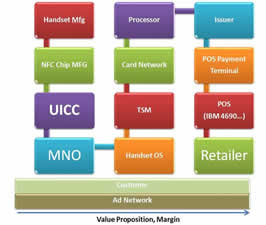

My last blog on this subject was only 2 months ago.. Headline was “ISIS has 12 months”. Rumor this week is that ISIS has 12 months to go TO PILOT (Dec 2012). The driver seems to be the UICC chip that supports the SWP SE (Gemalto’s fault??). Note that my previous nine party chart did not even consider the UICC.. so here is a revision.. (added UICC, MNO, and POS register)…

How would you like to run an industry consortium that had to coordinate a release and a new technology across 12 different companies!?? Oh.. a few other minor considerations as well: no compelling customer value proposition and against Google? My favorite question to ask anyone from ISIS is what will the application do for me that my Citi sticker won’t do now?

- Provision over the air? (Who cares)

- Turn on/off the card/element? (Who cares I don’t pay for fraudulent charges)

- Offers? (Who cares.. Citi can tie merchant offers directly to card use.. Clovr Media/Linkable)

There are MANY future functions like eReciepts and Item level coupons.. but these are VERY far off because they require retailer participation.

ISIS is proving that the NFC supply chain is not workable… at least not without a very substantial customer value proposition. A December 2012 delay to a PILOT may well be the death knell for ISIS… how can carriers invest $200M in a team that won’t see production until mid-late 2013? There is no shortage of parties complaining about Google’s approach.. but by taking control of the spec, the architecture, the handset and “TSM” they have eliminated the complexity and have been able to get something to market… and are improving from there based upon REAL customer feedback. So while ISIS will struggle to get a pilot running by late next year, Google is signing up new retailers every week, improving its applications and gaining market experience.

As I outlined previously, carriers started from a basis of control with the NFC Forum’s technical specification. Obviously, the handset has proven to be a platform of digital/physical convergence. We all see enormous opportunities to re-wire physical commerce with the handset at the core. But today the handset’s “commerce” success is driven by its open nature (apps and connectivity). It is a platform where anyone can build anything within a given set of loose rules (tighter in Apple’s case). In order to attract retailers, advertisers, issuers.. the MNOs had to continue this “open” approach.. but instead have taken one of control. This control approach may have been unintentional as not many organizations have successfully built business platforms (favorite book on topic is Platform Leadership). MNO’s control approach could have also been driven by the desire to securely maintain customer information. Whatever the reason, companies will likely develop approaches (See Square Card Case) that keep information out of the secure element and place it in the cloud. As I related in the Square article.. the success of NFC is far from given.. All that is really needed at the POS is a “key” that key could be a single number/identifier delivered by NFC, your voice or your IRIS. Keeping all customer information on the phone is rather stupid. One MNO told me this week.. its on the phone in case it doesn’t have connectivity. Well guess what.. stores have the connectivity.. that’s how Visa’s system works.. Stores are not dependent upon the Phone’s connectivity.. but rather their own.

It’s never easy for a Fortune 100 organization to admit that they made the wrong bet. Globally, there is also a very strong inter-carrier commitment to “carrier controlled NFC” work. All it will take is one major carrier to change course and join Google’s camp to bring down a global house of cards that is NFC. My guess is that carrier controlled NFC find long term traction in public transit and ticketing perhaps even in government identification. .. but this is 3+ years out before any substantial (>20%) adoption.

Customers.. you want ISIS mobile payments functionality? Go get a sticker.

MNOs.. do you want ANY part of mCommerce? You better move quickly to partner with someone that can get all of this done. Their dance card may fill up quickly. If you don’t move beyond the “control” approach.. you will be relegated to dump pipes.. as thousands of businesses work to get around your controls.. Given the Carrier IQ blow up this week, you have no ground for claiming you would manage privacy better than Facebook or Google.

There seem (at least) two main problems with the NFC/Card based approach to mobile payments 1) too many actors to synchronise and who all want a piece of a fairly small economic pie 2) nothing in it for the retailers apart from more cost.

The Square Card Case approach, which is similar in mechanism to the Paypal/PizzaExpress app would seem to me to offer a viable alternative if consumers can be driven to set up ACH/Bank transfers rather than using cards. This would immediately free up the interchange fee to either incentivise retailers directly or to fund promotions that would drive more business for the retailers. As I understand it, this would require Paypal at least to offer a new fee structure but it seems feasible. The other challenge I see in the Card Case / Paypal model as currently in the marketplace is that it requires the consumer to download an app specific to a particular retailer eg Pizza Express. However, even with this drawback the attraction to large retailers with regular repeat customers eg supermarkets are clear.

I would also recommend checking out Dwolla which is also ACH based.

Assume for a minute that the only players that have enough immediate heft to change the ecosystem are 1) PayPal, 2) Google and 3) Apple. All three have enough payment flow and installed user base to force their way into Visa/MC/Amex’s world and not be thwarted.

So how can a small company compete? ACH is crazy cheap, easy to implement, and connectivity is everywhere (as the author has pointed out – why didn’t stored value chips work? No need for them.) Effective interchange rates could get cut to a few basis points with a model like Dwolla. Not saying they will make it as this is a tough world, but if I were a merchant I would be all over it as a hedge to these big guys telling me what to do.

As adoption rises, ownership of data (consumer AND merchant) is being dramatically overlooked. When everyone realizes these three big guys are mining merchant customer lists and selling access to competitors then other solutions will become a whole lot more appealing.

Pingback: Nexus S – Verizon’s Plan B « FinVentures

Pingback: Apple and NFC? « FinVentures

Pingback: Carriers as dumb pipes? « FinVentures

Pingback: Google Wallet Thoughts « FinVentures

Pingback: Apple Passbook: No NFC Here… « FinVentures

Pingback: Apple and NFC « FinVentures

Pingback: Gemalto QR Codes.. One Giant Leap _________ ? « FinVentures

Pingback: Payment Hype and Delusions of Grandeur | FinVentures

Pingback: BIG Changes to NFC: Payments Part of the OS | FinVentures